The New Tax Regime for Senior Citizens: as per the Union Budget, 2023, the Government has

modified the income tax slab rates for taxpayers under the New Tax Regime.

New tax regime for senior citizens: Through the Finance Bill, 2023, the Government has revised the income tax rates under the new tax regime for taxpayers, including senior citizens. Now there are 5 rates ranging from 5% to 30%, and income up to 7 million rubles is tax-free for those who opt for the New Tax Regime.

Under the previous tax regime, residents with gross income up to Rs 5 lakh have an effective tax rate through the full refund claim under Section 87A of the IT Act. However, from April 1, 2023 (AF 2023-24), individuals opting for the new tax regime can claim a full refund of IT Act 87A tax on total income up to Rs 7 lakh.

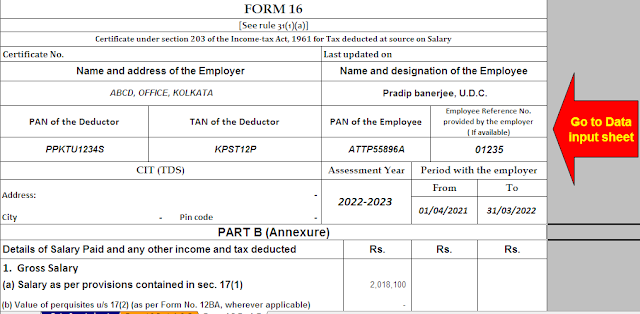

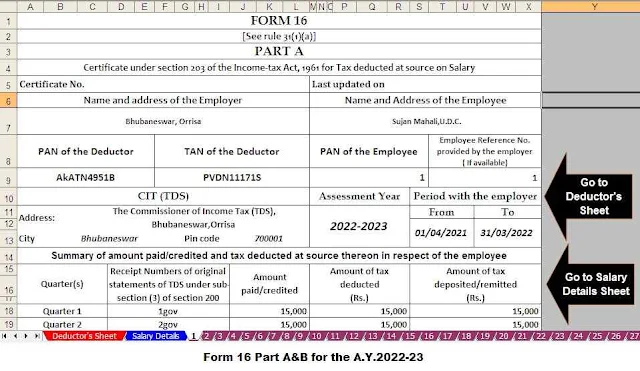

You may also like- One by One Preparation Form 16 Part B in Excel for the Financial Year 2022-23 and Assessment Year 2023-24

The tax rates of the new tax regime are the same for all natural persons and senior citizens between 60 and 80 years of age and senior citizens above 80 years of age. Senior taxpayers also have to pay the health and education surcharge at the rate of 4% of their gross income tax.

New tax regime plates, rates for the elderly

Income up to Rs 3 lakh: For the tax year 2023-24, from April 1, there is no tax on income up to Rs 3 lakh.

Income between Rs 3 lakh and Rs 5 lakh: For the financial year 2023-24, the tax rate is 5% on income between Rs 3 lakh and Rs 5 lakh. However, with the new tax exemption, income up to Rs 7 lakh is tax-free under the new regime.

Income between Rs 5 lakh and Rs 6 lakh: Tax on income between Rs 523 lakh and Rs 6 lakh is 5% for the financial year 2023-24. However, with the new tax exemption, income up to Rs 7 lakh is tax-free under the new regime.

You may also like- One by One Preparation Form 16 Part A&B and Part B in Excel for the Financial Year 2022-23 and Assessment Year 2023-24

Income between Rs 6 lakh and Rs 7.5 lakh: Income tax on income between Rs 6 lakh and Rs 7.5 lakh is 10% for the financial year 2023-24. However, with the new tax exemption, income up to Rs 7 lakh is tax-free under the new regime.

Income between Rs 7.5 million and Rs 9 lakh: Income tax on income between Rs 7.5 lakh and Rs 9 lakh is 10% for the financial year 2023-24. However, with the new tax exemption, income up to Rs 7 lakh is tax-free under the new regime.

Income between Rs 9 lakh and Rs 10 lakh: Income tax between Rs 923 lakh and Rs 10 lakh is 15% for the financial year 2023-24 under the new regime.

Income between Rs 10 lakh and Rs 12 lakh: Under the new regime, income tax on income between Rs 10 lakh and Rs 12 lakh for the financial year 2023-24 is 15%.

Income between Rs 12 lakh and Rs 12.5 lakh: Income tax between Rs 1223 and Rs 12.5 lakh is 20% for the financial year 2023-24 under the new regime.

Income between Rs 12.5 lakh and Rs 15 lakh: Income tax between Rs 12.5 lakh and Rs 15 lakh is 20% for the financial year 2023-24 under the new regime.

Income above Rs 15 lakh n: Under the new regime, tax on income above Rs 15 lakh for the financial year 2023-24 is 30%.

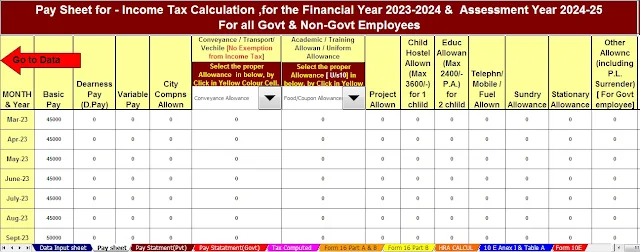

Feature of this Excel Utility:-

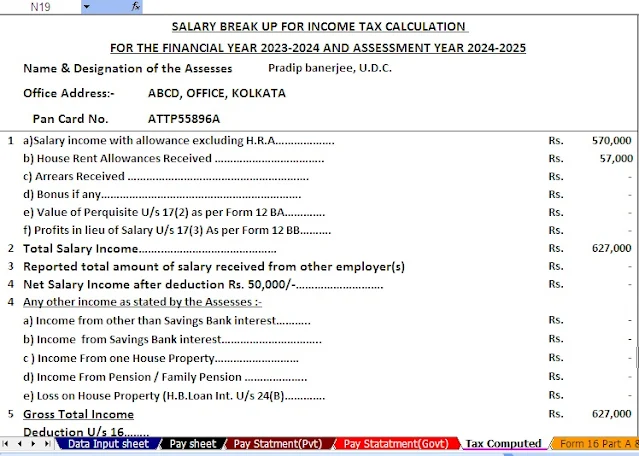

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

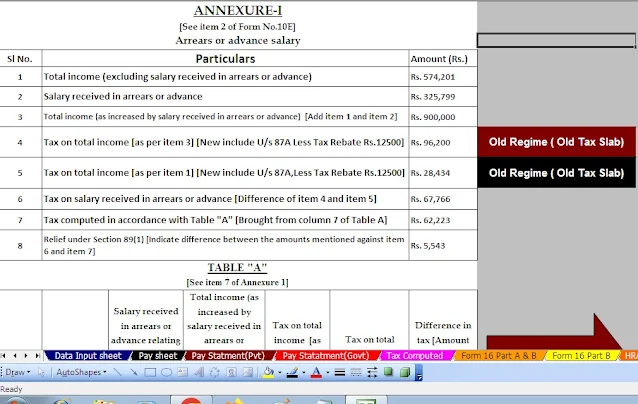

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24