Download Automatic Income Tax Calculation Software based on Excel all in |

The following are some of the major deductions and exemptions you can’t claim under the new tax system:

- The standard deduction under Section 80TTA/80TTB

- Professional tax and entertainment allowance on wages

- Travel Authorization (LTA).

- Housing Rent Assistance (HRA).

- Income allowance for a minor

- Compensation of assistant

- Children's school allowance

- Other special duties [Section 10(14)].

- Interest on a home loan on a private dwelling or vacant dwelling (Section 24).

- Chapter VI-A exemptions (Sections 80C, 80D, 80E, etc., except Section 80CCD(2) and Section 80JJAA)

- Withdrawal or withdrawal of any other incentive or allowance, including meal allowance of Rs 50/meal based on 2 meals per day

- Contribution of employee (self) to NPS

- Donation to political party/trust, etc.

- 2023 budget update: Family pension deduction only for years through FY 2022-23 (from FY 2023-24, this is allowed as a deduction)

- Budget 2023 update: Standard deduction of Rupees Fifty Thousand only for years up to F.Y 2022-23 (From F.Y 2023-24, this is entitled as a deduction in the New Tax Regime)

Exemptions and deductions are available under the new regime for the Financial Year 2023-24 as per the Budget 2023

In the new tax regime U/s 115 BAC you can entitle to tax exemption as follows:

- Transportation allowances in case of a specially trained person.

- Transportation allowance received to cover transportation expenses incurred as part of the project.

- Any compensation received to cover travel and tour or relocation expenses.

- Perceived daily allowance to meet ordinary charges or expenses incurred due to absence from his usual place of work.

- Prebends for official purposes

- Dismissal for voluntary dismissal 10(10C), gratuity u/s 10(10) and leave pay u/s 10(10AA)

- Interest on the mortgage loan on rental property (Section 24).

- Donations up to Rs 5,000

- Additional deduction as an employer contribution to NPS account [Section 80CCD(2)].

- Exemption of cost of additional workers (Section 80JJA).

- The 2023 Budget has introduced a standard deduction of Rs 50,000 in the new tax regime to be implemented from the financial year 2023-24

- The 2023 Budget also included the repeal of section 57(iia) of the family pension scheme

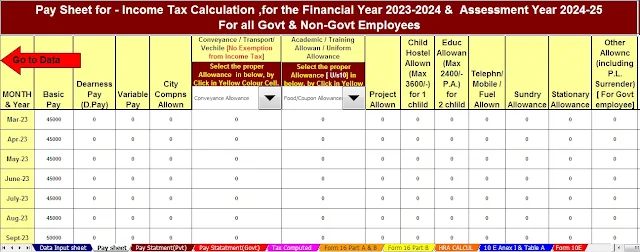

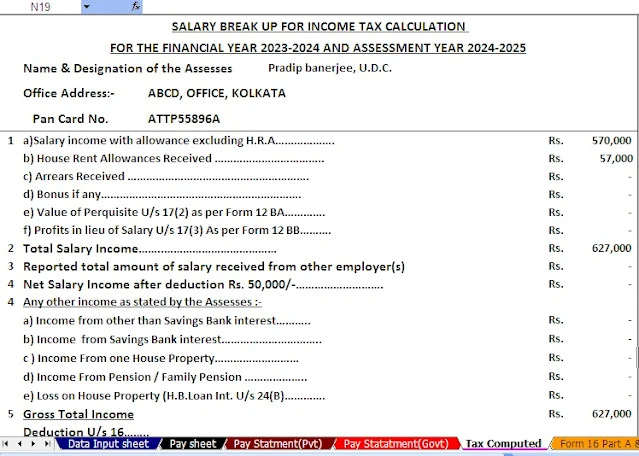

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

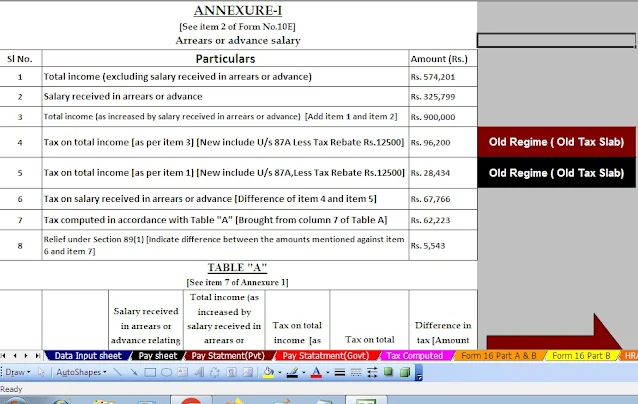

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

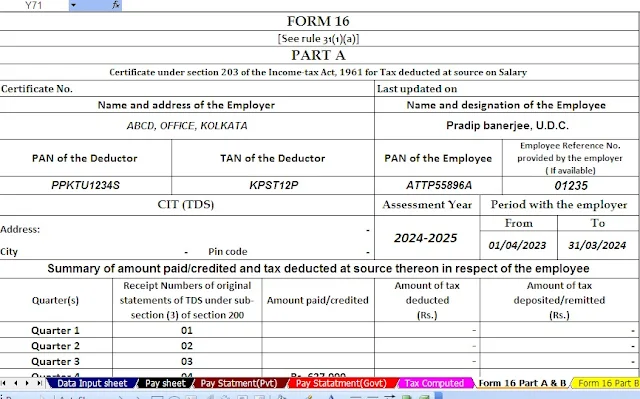

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24