Which is better between the New and Old Tax Regime for F.Y.2023-24 and A.Y.2024-25? Now is the

time for many participants; Salaried individuals, in particular, have to choose between opting for the

New Tax Regime or continuing with the Old Tax Regime. Through this article, the author wants to help

them in their decision-making process.

There is no change in the slab rates for the old tax regime. No tax for income of 0 to 2.5 million, tax rate of 5% for income of 2.5 to 5 Lakh, tax rate of 20% for income of 5 to 10 Lakh, tax rate of tax for income of more than 10 Lakh is 30%.

For Sr. Citizens (from 60 years and above) – Rs. 3 lacks tax-free and income for super seniors (80 years+) is Rs. 5 Lakh tax-free.

The new slab for the new tax regime notified by Finance Act 2023 is 0 to 3 Lakhs income no tax 3 to 6 Lakh income tax rate 5% 6 to 9 Lakh income tax 10% Income 9 to 12 Lakh tax rate 15%, the Income tax rate of 12-15 lakhs is 20%, the tax rate is 30% for income above 15 lakhs.

You may also like- Automatic Income Tax Form 16 Part B in Excel for the Financial Year 2022-23 and Assessment Year 2023-24, which can prepare at a time 50 Employees Form 16 Part B

The standard deduction for salaried taxpayers. 50,000 continues for the Old Fiscal regime and the same has been introduced in the New Fiscal regime.

The new tax regime becomes the Default regime and the Taxpayer has to select the Old Tax regime if he wants to continue with the Old Rates.

Exemptions under the new tax regime are Rs. 7 Lakhs. In the old tax regime, it was Rs. 5 Lakhs. The new tax regime also has a Concept of Marginal Relief (Dependent on Rebate).

If the taxpayer opts for the new tax regime, Relocation Allowance (LTA), House Rent Subsidy (HRA), Child Education Subsidy, Professional Tax Deduction, Home Loan Interest, Investment Income, etc. are mentioned. allowed. However, it should be noted that under the new loan regime, the deduction for interest paid on home loans taken for home ownership is not available.

In the new tax regime, taxpayers can be entitled to claim the benefit of employer's contributions to the National Pension System (NPS) account U/s 80CCD(2) as per the Income Tax Act. This deduction is restricted to the employer's contribution to NPS up to a limit of 10% of salary (Basic + DA).

A taxpayer opting for a new tax period has to give up various exemptions under sections 80C, 80D, 80G, 80TTA/80TTB, and 80E. However, voluntary pension exemptions, gratuity exemptions, and holiday pay exemptions are available under the new tax regime.

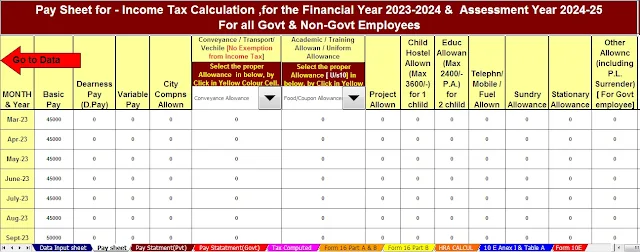

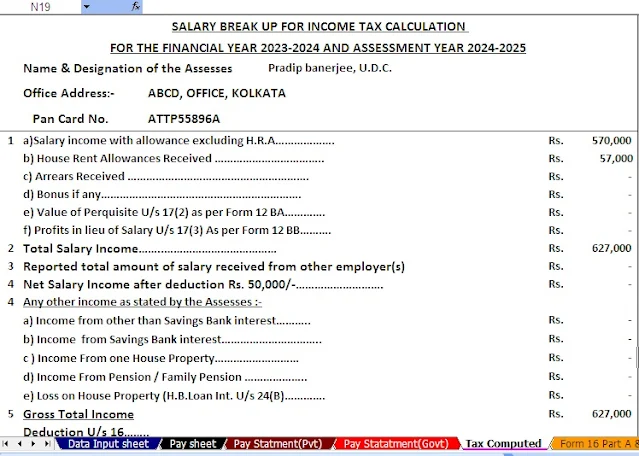

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

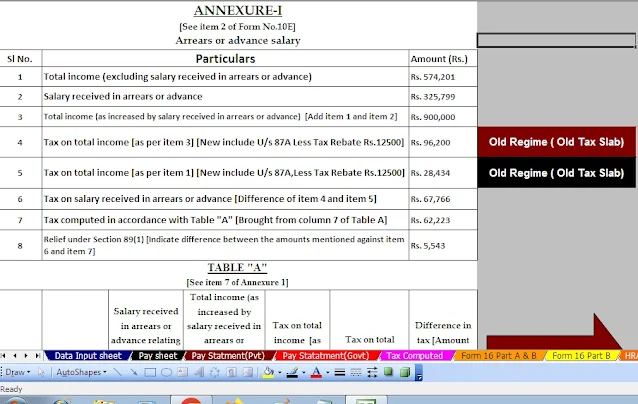

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24