Salary exemption under Section 16 of the Income-tax Act, 1961 Section 16 of the Income Tax Act,

1961 deals with allowances and deductions on taxable wages. Under Article 16, salaried taxpayers and

pensioners*, regardless of their tax status, can claim deductions from their taxable income. The section

consists of three components - standard deduction under section 16 of the Income Tax Act,

entertainment allowance, and business tax deduction. The sole purpose of Section 16 is to provide tax

relief to wage earners. Let's understand the details in detail.

* Pensions received by participants from former employers are taxable. As the tax is levied, he is also entitled to deduction under Section 16 of the Income Tax Act.

You may also like- Master of Form 16 Part

A&B for the F.Y.2022-23, which can prepare at a time 50 Employees Form 16

Part A&B in Excel

Reduction of standard deduction under section

16 (ia)

The standard deduction is a flat tax deduction under section 16(ia) of salary income up to Rs.50,000. The main purpose of this discount is to replace transport allowances and medical bills up to Rs 19,200 and Rs 15,000 respectively.

The amount of relief available under section 16 is Rs 50,000 or full salary, whichever is less.

Assume that Joti earns a total salary of Rs 50,000 per financial year. In this case, he will get a standard deduction on his entire salary. On the other hand, Bibek earns 5.5 Lakh per financial year. Here he can claim a standard deduction of Rs 50,000. As a result, your taxable income will be 5 Lakh.

You may also like- Master of Form 16 Part

A&B for the F.Y.2022-23, which can prepare at a time 100 Employees Form 16

Part A&B in Excel

Entertainment Allowance under section 16

(ii)

Entertainment allowance is included in your salary. A separate subsidy is granted based on criteria to be implemented by the employer. Now let us understand Entertainment Allowance for Government Servants and Non-Government Servants.

Employees working in Central Government or State Government can claim any of the following exemptions, whichever is less:

20% of the basic salary

5000 thousand

The amount is given as an entertainment subsidy during the financial year.

However, certain criteria must be met in order to receive the subsidy:

The salary quoted shall be the gross price without any benefits

You can't view the entertainment subsidy amount

However, non-government employees are not eligible for entertainment subsidies under section 16(ii).

P. Tax under section 16(iii).

Under Section 16(iii) of the Income-tax Act, employees are entitled to a deduction from the p. tax they pay on their income. This deduction is available to all salaried individuals and is limited to the amount of business tax paid or Rs 2,500, whichever is less. Please note that professional tax rates and rules vary by state. To claim a business tax deduction under section 16(iii), an individual must have paid tax during the financial year. Another point worth noting is that the employer is also entitled to tax paid on behalf of the employee.

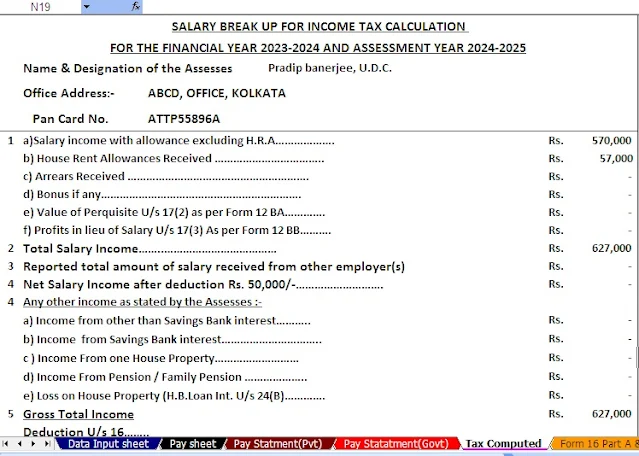

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24