Which is better, the new or the old tax regime for salaried employees? Remember the new 2020 tax

regime? If you missed it, now might be a good time to revisit it.

The Union Budget 2023 re-introduced the new tax regime, making it superior to the existing one. Even if the old tax regime is in place, the incentives for the new one seem to be satisfactory.

Trying to balance the new income tax regime with the old income tax regime? Let us help you understand the old and new tax regimes. Compare the best according to your income.

What is the Old and New Tax Regime?

Union Budget 2023 with an overhaul of the new tax regime has been a major choice for salaried employees. However, you can choose the old mode if it suits your purposes.

Let's understand the old and new tax regimes.

New tax regime

The new 2020 tax regime has lost support due to the coverage of exemptions and deductions. However, the 2023 budget was improvised to make changes to this regime.

Increase in tax rate: Previously, the taxable income margin started at Rupees 5 Lakh, and now it is 7. This means that employees earning less than Rs.7 Lakh can get tax-free income.

Simplified tax slab: An increase in slab rates means lower and simpler rates. Current tax slabs include:

|

Yearly Income |

Old rates |

New rates |

|

Up to Rs.3 lakhs |

nil |

0% |

|

Rs.3 – 6 lakhs |

5% |

5% |

|

Rs.6 – 9 lakhs |

20% |

10% |

|

Rs.9 – 12 lakhs |

30% |

15% |

|

Rs.12 – 15 lakhs |

30% |

20% |

|

Rs.15 lakhs and above |

30% |

30% |

Deduction of standard and family pension: The new scheme has a standard deduction of Rs 50,000 like the old scheme. In addition, it also offers discounts for family pensioners.

Previous tax system

The oldest scheme is at the top because of various exemptions beyond 70 years of age. Among these, 80C offers a reduction of Rs 1.5 lakh in taxable income, HRA and LTA are the most popular.

These are the discounts offered:

LTA (Leave Travel Allowances)

Personnel (Rental)

STRONG SMILE. 50,000 standard deduction

Savings account interest

Entertainment for civil servants

Deduction of INR 15,000 in family pension

Thus, this plan reduces the total amount of taxes paid on income.

Income Tax Old Regime or New Regime:

Which is suitable for salaried persons?

Now that you know what the old and new tax regimes are, it's time to compare the two. Below are the advantages and limitations of the new regime and the old income tax regime:

|

|

Old Tax Regime |

New Tax Regime |

|

Advantages |

Encourages a savings culture. Beats inflation over time through investments. Investments serve as passive income. |

Lower tax rates and compliances. Increased disposable income. Greater liquidity Offers flexibility to create an objective-based portfolio. |

|

Limitations |

The lock-in period of investments affects liquidity. Decreased disposable income. Limited tax-saving investment options. The plight of retaining proof of claimed deductions. |

Lack of tax exemptions and deductions. Reduced flexibility of choice for business owners. Diverts from a savings culture. |

So both the old and new tax regimes have their pros and cons. The best regimen for you depends solely on your personal qualifications for discounts and rebates. Rate, compare, and evaluate the best based on your income and financial preferences.

Briefly

With the old and new tax regimes in play, it's time for wage earners to evaluate their financial decisions. The two differ in terms of income tax rates, certain deductions, and exemptions.

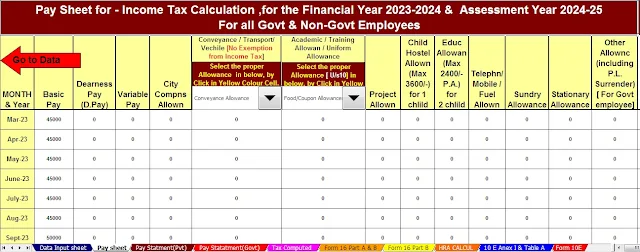

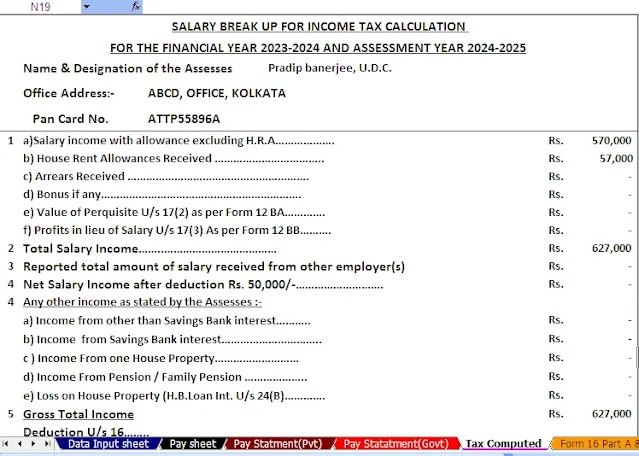

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime as per U/s 115 BAC

3) This Excel

Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

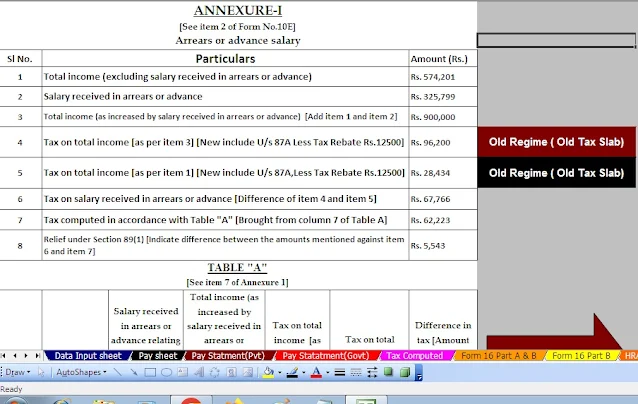

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

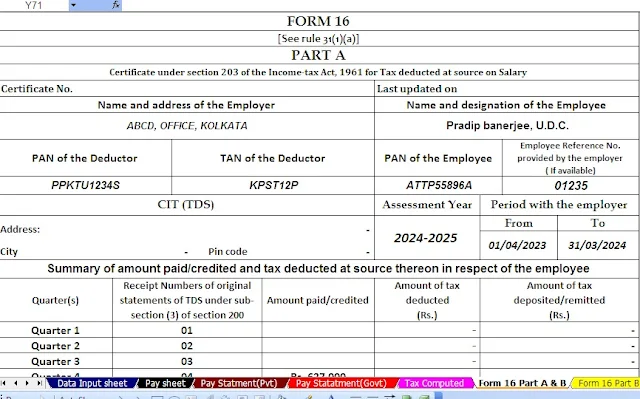

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24