Tax Exemption in different sections of Income Tax for the F.Y.2023-24 for the Old Tax Regime | A tax

exemption is a benefit granted by the government to individuals or organizations to exempt some or all

of their income from taxation. As per the Income Tax Act exemptions are provided under different

sections in

credits and deductions for certain types of investments and expenses, such as provident fund

contributions, health insurance payments, interest payments on education loans, donations to charities,

and rent paid by non-employees.

You may also like- Auto Prepare IncomeTax Master of Form 16 Part B which can prepare at a time 50 Employees in Excel for the F.Y.2022-23 and A.Y.2023-24

A tax exemption is a benefit granted by the government that allows individuals or organizations to exclude some or all of their income from taxation. It is designed to encourage certain behavior or provide financial assistance to specific groups of taxpayers. Sectional tax credits come in many forms, including credits, credits, and exclusions from gross income, and can significantly reduce a taxpayer's tax liability. For example, personal allowances allow individuals to claim certain amounts for themselves, their spouses, and their dependents, reducing their taxable income.

Charitable contributions to qualified organizations may be taxable, reducing taxable income. Other common tax deductions include mortgage interest, state and local taxes, education expenses, and contributions to retirement accounts. Tax credits can change and vary by country, so it's important to seek professional advice or consult the relevant government authorities for the most up-to-date information. In general, tax credits play an important role in economic and social policy-making and are a valuable tool for managing personal and organizational finances.

You may also like- Auto Prepare Income

Tax Master of Form 16 Part A&B which can prepare at a time 50 Employees in

Excel for the F.Y.2022-23 and A.Y.2023-24

TDS 2023 deductions

TDS stands for withholding tax, and

TDS exemptions refer to cases where a person or organization is exempted from

paying TDS on their income. In

Tax exemptions in

Section 80C: This section provides special deductions for investment and expenditure and tax deductions for investment. Some common deductions under Section 80C include Public Pension Fund (PPF), Employees Provident Fund (EPF), National Savings Certificate (NSC), and life insurance contributions. The maximum amount that can be claimed as a deduction under section 80C is Rs 1.5 lakh per tax year.

You may also like- Auto Prepare IncomeTax Master of Form 16 Part B which can prepare at a time 100 Employees in Excel for the F.Y.2022-23 and A.Y.2023-24

Section 80D: This section provides tax deductions for health insurance premiums. Claim a deduction Maximum of Rs 25,000 per financial year on health insurance premiums for themselves, their spouses, and dependent children and an additional deduction of up to Rs 25,000 per tax year for senior citizen health insurance premiums.

Section 80E: This section provides tax deductions for interest payments on education loans. Taxpayers can claim all interest paid on education loans, unlimited, for up to 8 financial years.

Section 80G: This section provides tax deductions for donations made to specific charities and relief funds. Donors can claim a reduction of up to 100% or 50% of the donation amount, depending on the organization.

You may also like- Auto Prepare Income

Tax Master of Form 16 Part A&B which can prepare at a time 100 Employees in

Excel for the F.Y.2022-23 and A.Y.2023-24

Section 80GG: This section provides tax relief on rent paid by individuals who do not receive HRA (House Rent) from their employer. Taxpayers can claim a deduction of up to Rs 60,000 per tax year for rent paid under certain conditions.

It should be noted that the tax

deductions under these sections may vary and may vary depending on the

individual circumstances of the taxpayer. It is best to consult a tax

professional or the Indian Income Tax Department for the most up-to-date

information on tax exemptions in

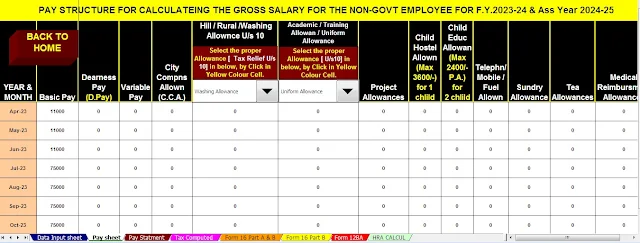

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Non-Government Employees

Salary Structure.

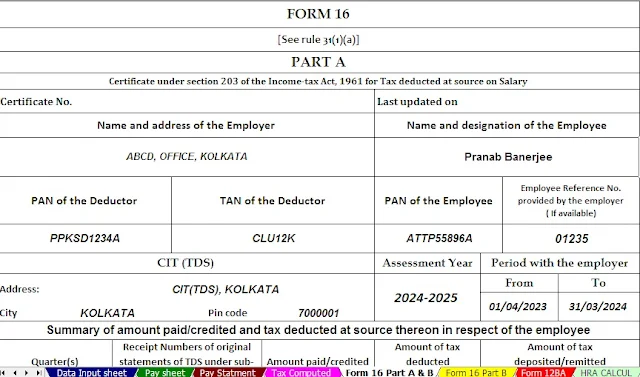

4) Automated

Income Tax Form 12 BA

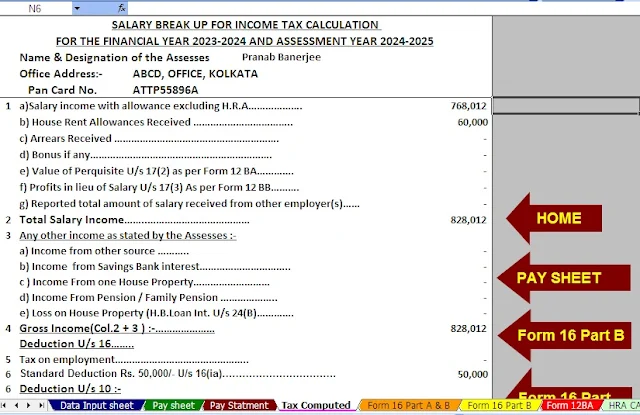

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24