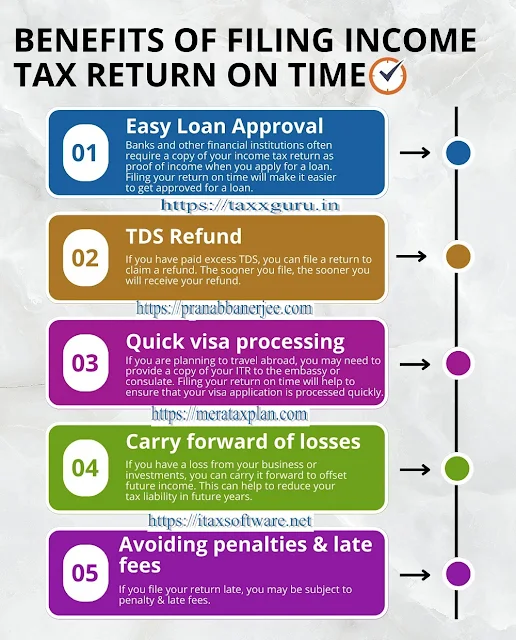

Advantages of filing Income Tax Return in due time | Below are some of the benefits of filing income

tax on time:

(1) Easy loan approval

Banks and other financial institutions often require a copy of your tax return when applying for a loan. Filing your return on time will make it easier to get loan approval.

(2) Refund of TDS

If you have overpaid TDS, you can claim a refund. If you register early, you will be refunded.

3) Proof of income and address

Your income tax return can be used to prove and address income for a variety of purposes, such as applying for a job, renting a property, or receiving government benefits.

(4) Expedited Visa Processing

If you plan to travel abroad, you may need to submit a copy of your tax return to the embassy or consulate. Completing your return on time will ensure your visa application is processed quickly.

(5) Indemnification and Indemnification

of Losses

If you have a loss in your trading or investment, you can carry it forward to cover future earnings.

6) Avoid fines and late fees

If you file your return late, you may be subject to penalties and late fees. In addition to these benefits, paying taxes on time is the right thing to do. By paying your taxes on time, you are supporting the government and the services it provides.

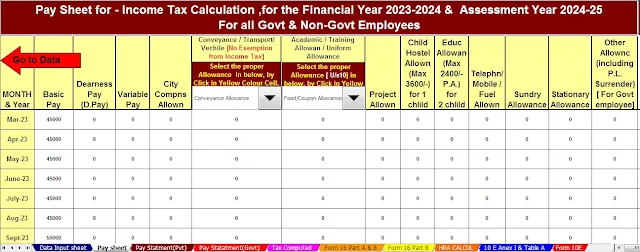

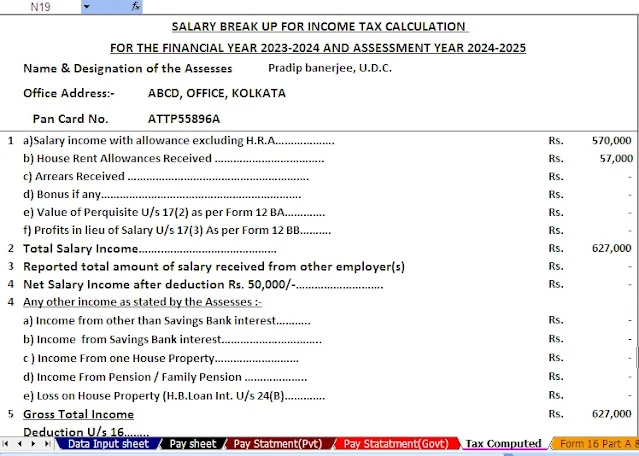

Features of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24