Can you get tax deductions for HR and home loans at the same time? House Rent Allowance (HRA) is

an allowance provided by employers to cover the cost of rented accommodation. The Income Tax Act

allows exemption from HR if the employee lives in a rented house. In addition, the law allows an

individual taxpayer to deduct the interest paid on his home loan. This discount applies to home loans

for the purchase, construction, renovation, or reconstruction of residential property.

As per the Income Tax Act. Entitled taxpayers to get benefits both Home Rent Allowance (HRA) and interest paid on home loans in the same financial year. In some cases, taxpayers can live in a rented house while paying interest on a home loan.

If you own a home but rent, you may be able to claim a waiver from HR and reduce your home loan interest. However, these tax deductions are only available if the owner and the rented house are in different locations and the owner has a valid reason for not living in the house.

Valid reasons include working in another city or the long distance between the office and home. It should be noted that if the information is reviewed, a sufficient explanation should be given to the employer or the income tax authority.

The following situations are considered real, and inspectors may accept both:

1. Own house is rented

If you have rented a house with a home loan and live in another rented house, you can claim both. This scenario may arise if owning a home does not meet your requirements, such as being too small or too far from your workplace. In such cases, you can claim both the HR exemption and the mortgage interest. However, you must disclose the rental income from the rental property in your income tax return.

2. The house itself is located in another city

If you own a home in another city but live in a rented home in the city where you work, you can claim both.

For example, if an employee works

in Kolkata and lives in a rented flat but owns a property in

Employees who pay rent for housing must show proof of payment, such as rent receipts, to claim exemption from housing subsidy. If you are claiming an HRA deduction of more than Rs.1,000. 1 lakh per annum, you have to provide the PAN (permanent account number) of the property owner. To claim a home loan interest tax deduction, you need to show the interest certificate to your employer as proof of a home loan interest deduction.

The Income Tax Act does not restrict the claiming of deductions to one or the other part. Both deductions may be claimed. However, it is important to search only in real cases and not for tax avoidance.

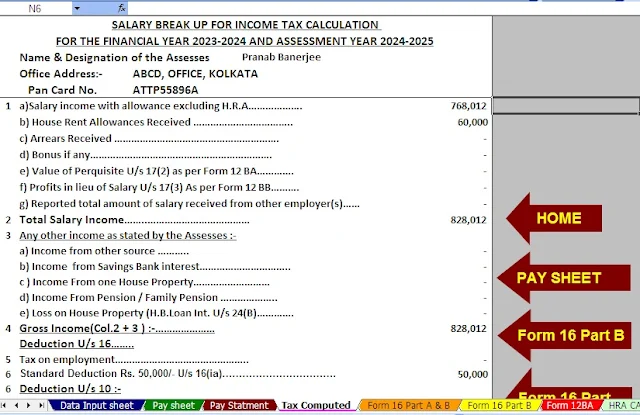

Features of this Excel utility:-

1) This Excel utility perfectly prepares your income tax according to your U/s 115BAC option.

2) This Excel utility has a completely revamped Income Tax section as per Budget 2023

3) Computerized Income Tax Form 12 BA

4) Automatic computation Income Tax Exemption rented house U/s 10(13A).

5) Individual salary structure according to government and private group salary model

6) Individual Pay Sheet

7) Individual tax datasheet

8) Automatic Income Tax Form 16 Part A&B revised for the financial year 2023-24

9) Automatic Income Tax Form 16 Part B revised for the financial year 2023-24