Download Income Tax Preparation Software in Excel for F.Y 2023-24 and A.Y 2024-25 with Section

80GG: Deduction on payment of rent.

Features of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

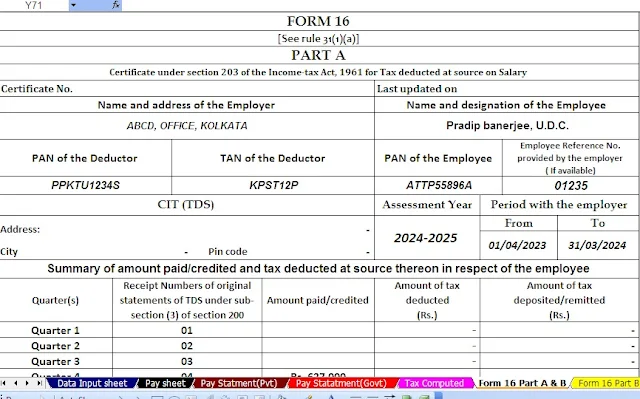

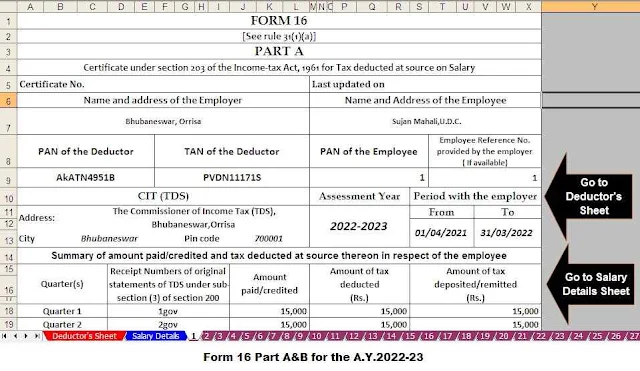

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24

Section 80GG: Exemptions in respect of rent paid - by whom and in what manner are granted hereunder with all essential conditions and particulars:

Section 80GG: Exemptions in respect of rent paid - by whom and in what manner are granted hereunder with all essential conditions and particulars:

The

main conditions for claiming deduction under this section are:

(1) The exemption is admissible for a person.

2) Rental fees must be paid for furnished or unfurnished accommodations.

(3) A self-employed person or person, or if an employee, is not entitled to rent or non-rent accommodation.

(4) The individual, his/her spouse or minor child, or the HUF of which he/she is a member, is not established in the place where the enumerator ordinarily resides or works or carries on business. in his business or profession.

If the payee i.e. has a domicile at a place other than the personal residence or place of business of the assessee, such property shall not be deemed to be personal property in the possession of such person.

(5) That person must comply with any other housing rules or restrictions, having regard to the dwelling or premises and other relevant circumstances. The assessee has to file a return in Form 10BA along with the return under section 80GG.

You may also like- Download and Prepare at a time 50 Employees Form 16 Part B in Excel for the Financial Year 2022-23and Assessment Year2023-24

The

separation must be smaller than the following values:

(i) Excess rent exceeds 10% of adjusted gross income”;

(ii) 25% of "adjusted gross income";

(iii) Rs.5000 per month.

Gross

amount adjusted:

Adjusted gross income, therefore, means “gross income”:

(i) Long-term capital gains included in the “comprehensive capital”;

(ii) Short-term capital gains of the type referred to in section 111A (ie short-term capital gains on investment of shares under-recognized stock exchange taxable @ 15%) ;

(iii) All deductions allowed under section 80C to 80U, except income under section 80GG.

(iv) An income referred to in sections 115A, 115AB, 115AC, or 115AD. These sections apply to the income of NRIs and foreign corporations, which are taxed at a special tax rate.