Download Auto Calculate Income Tax Preparation Software in Excel All in One for the Non-

Government Employees for the F.Y.2023-24 and A.Y.2024-25 |Section 115BAC of the Income Tax Act

known as new tax regime| Those opting for the new tax regime should be aware of Section 115BAC of

the Income Tax Act, 1961. Section 115 BAC was introduced in Budget 2020 and came into effect from

the financial year 2020-21 (A.Y 2021-22). This section is a popular name to the taxpayers as a new tax

regime

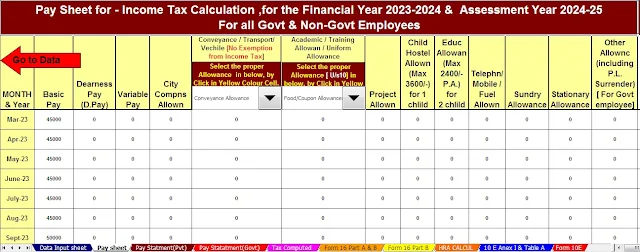

Features of this Excel utility:-

1) This Excel utility perfectly prepares your income tax according to your U/s 115BAC option.

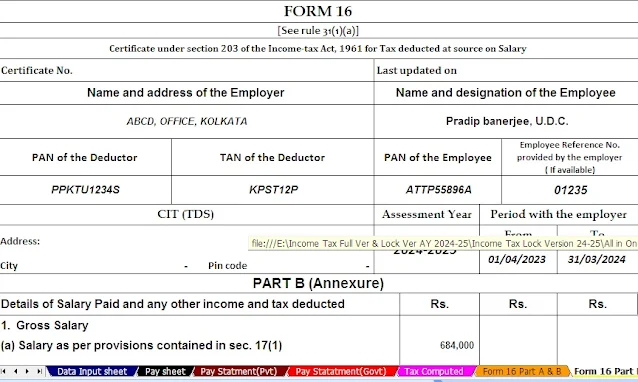

2) This Excel utility has a completely revamped Income Tax section as per Budget 2023

3) Computerized Income Tax Form 12BA

4) Automatic computation Income Tax Exemption rented house U/s 10(13A).

5) Individual salary structure according to government and private group salary model

6) Individual Pay Sheet

7) Individual tax datasheet

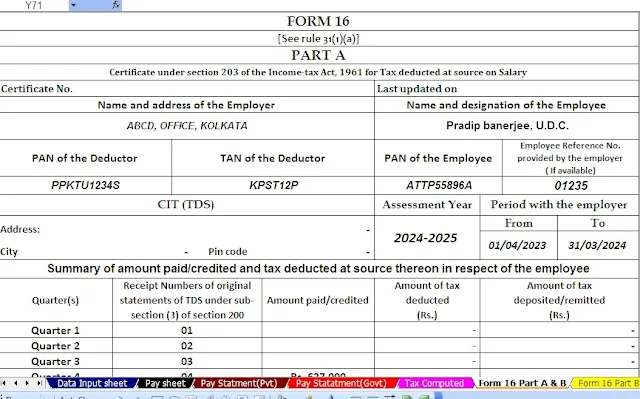

8) Automatic Income Tax Form 16 Part A&B revised for the financial year 2023-24

9) Automatic Income Tax Form 16 Part B revised for the financial year 2023-24

Section 115 BAC allows persons to pay income tax at a reduced rate. However, when people opt for the new tax regime or section 115BAC, they will have to give up around 70% of tax credits and exemptions.

Whether any taxpayers opt for a new tax regime U/s 115BAC, they can not avail of the 80C deduction in Chapter XI-A. , like Rs 1.5 lakh for U/s 80C, Rs 25,000 for U/s 80D, and U/s 80CCD (1b) additional deduction Rs. 50,000/- as NPS.

In addition, there are tax exemptions that cannot be used by an individual during the new tax regime. Some of the tax-deductible expenses include rent and travel expenses.

Till F.Y 2022-23, individuals salaried could not claim a deduction of Rs 50,000 from salary income. However, to make section 115BAC more attractive, the usual deduction is allowed on salary income under the new tax regime.

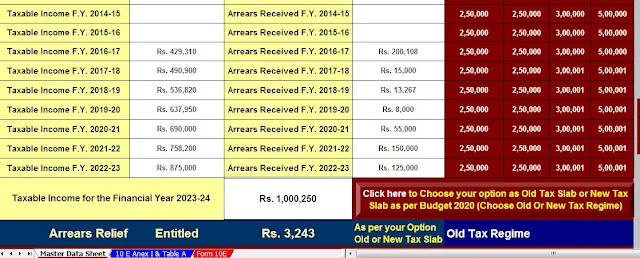

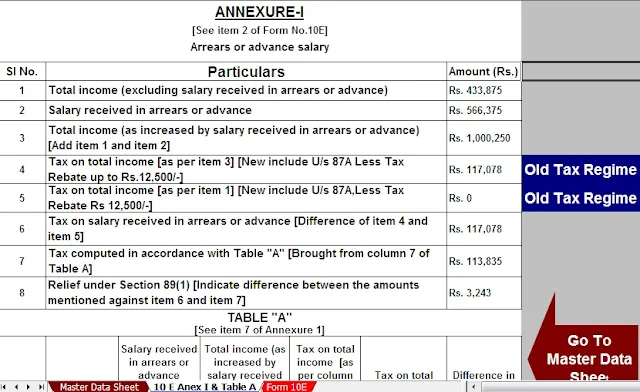

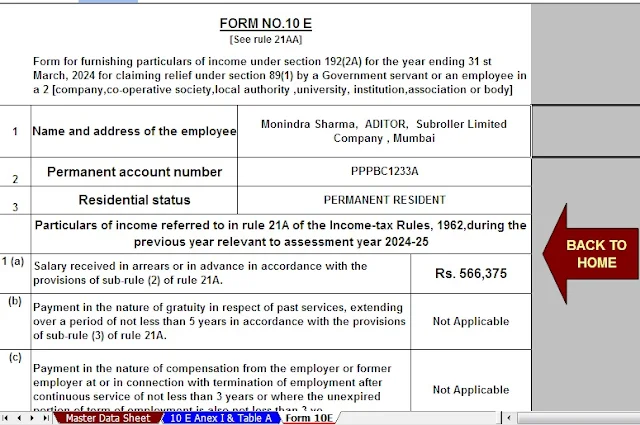

You may also like- Auto Calculate IncomeTax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 toF.Y.2023-24 in Excel

Please note that the normal deduction from salary income under section 115BAC will apply to salary income from 1st April 2023 to 31st March 2024 ie. F.Y 2023-2 Any person who opts for the new tax regime in the financial year 2022-23 or any other financial year cannot claim the normal exemption from salary income.

Who can choose a new tax regime under

section 115BAC?

The criteria for the new tax regime are broken down in section 115BAC. From April 1, 2023, associations of persons who are not co-operative society, body of persons, and artificial legal entities can also opt for the new tax regime - except for persons and HUFs.

What are the income tax slabs and rates

under Section 115 BAC?

Section 115BAC deals with the new tax regime. Accordingly, the income tax slabs and rates applicable at this stage will be a new tax regime.

Income

tax slabs under the new tax regime from April 1, 2023

Income tax slabs Income tax rate for the A.Y.2024-25

0% Interest up to Rs.3,00,000

Rs 3,00,001 to Rs 6,00,000 Income 5%

Rs 6,00,001 to Rs 9,00,000 Income 10%

Rs 9,00,001 to Rs 12,00,000 Income 15%

20% from Rs.12,00,001 to Rs.15,00,000

30% on income exceeding Rs 15,00,001