Income Tax Exemption from Income on Salary |Housing Allowance-HRA [Section 10(13A) and Rule

2A]. Prescribed special grants which are exempt to some extent - Section 10(14). Entertainment

exemption, Exemption in case of certain individuals

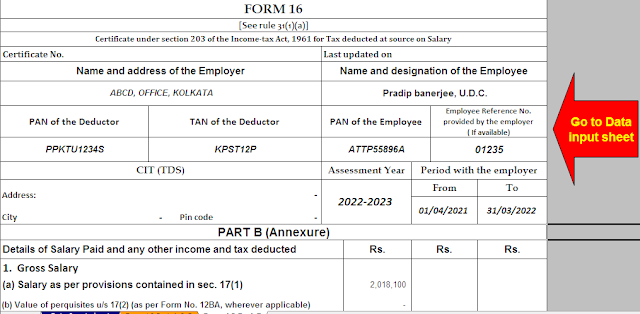

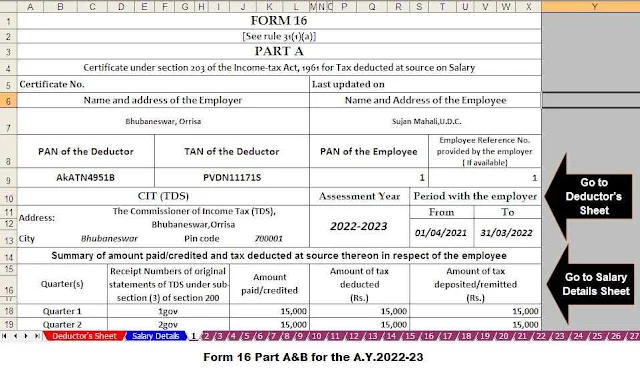

You may also like-Download and Prepare at a time 50 Employees Form 16 Part B for the Financial Year 2022-23

Grants that are fully taxable

An allowance is a fixed monetary amount paid by the employer to the employee to cover certain expenses, whether personal or for the performance of his duties. These allowances are generally taxable and should be included in gross pay unless a specific exemption is provided in respect of such allowances. Specific exemptions regarding subsidies are set out in the following sections:

(i) House Rent Allowance - Section10(13A).

(ii) Prescribed special allowances - Section 10(14)

The above allowances will be exempt in whole or to a limited amount and the balance, if any, will be taxable and therefore included in the gross salary.

Entertainment subsidy, however, does not fall under section 10 and is therefore not subject to any exemption. Any entertainment allowance is already included in the gross salary and thereafter under Section 16 (ii) only a Government official would be allowed a deduction from the gross salary on account of such entertainment allowance, which is already included

Some of the subsidies are treated as

follows:

1. HRA-House Rent Allowance [Section 10(13A) and Rule 2A].

Amount of discount: Less than the following three limits:

(i) Subsidy actually received Subsidy actually received

(ii) Rent paid in excess of 10% of salary Rent paid in excess of 10% of salary

(iii) 50% of salary 40% of salary

Download Automated Income Tax House Rent Exemption Calculator U/s 10(13A)in Excel

Comment:

The exemption from HRA is based on the following factors:

(1) Salary

(2) Place of residence

(3) Rent paid

(4) Got HRA.

Prescribed special grants which are

exempt to some extent - Section 10(14).

(i) Special allowances for the performance of official duties:

These allowances are not in the nature of a necessity within the meaning of section 17(2) and are specifically paid to cover such expenses wholly, necessary, and solely incurred in carrying out the functions of the beneficiary office or employment They go away. These grants shall be exempt to the extent that such expenditures are actually incurred for that purpose. [Section 10(14)(i)].

You may also like-Download and Prepare at

a time 50 Employees Form 16 Part A&B for the Financial Year 2022-23

These grants

are:

Traveling Allowance:

Any allowance paid to cover travel or duty transfer costs on tour. "Allowance paid to cover travel costs on relocation" includes any sums paid in connection with the relocation, packing, and transportation of personal effects on such relocation.

Daily allowance:

Any allowance, paid during travel or travel in connection with transfer, to meet the normal daily expenses of an employee due to his absence from his usual place of work;

Helper Allowance:

Any subsidy, no matter what the name, is given to cover expenses incurred for an assistant when that assistant is employed to perform certain functions;

Academic Grants:

Any subsidy provided for the encouragement of educational, research, and training activities in teaching and research institutions, irrespective of the name;

Uniform Allowance:

Any allowance, whatever the name, is paid to defray expenses incurred in purchasing or maintaining uniforms for use in the performance of the duties of a profitable office or employment.

Exemption for child hostel cost:

The actual amount received per child or Rs.300 p.m. for a maximum of two children per child, whichever is less.

3. Entertainment Allowances

This allowance is allowed only for a government official.

In the case of entertainment exemption, Sec is not entitled to any Exempt but is entitled to deduction under Section 16(ii) from gross wages. All entertainment allowances received by an employee are therefore added to the calculation of gross salary. The Government officer is then entitled to a deduction of the lesser of the following 3 limits on account of such entertainment allowance from the gross pay under Section 16(ii).

Actual recreational allowance received during the preceding year.

20% of your salary, excluding any allowances, benefits, or other privileges.

Rs.5,000 was given.

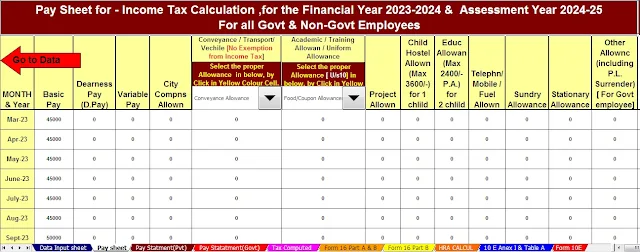

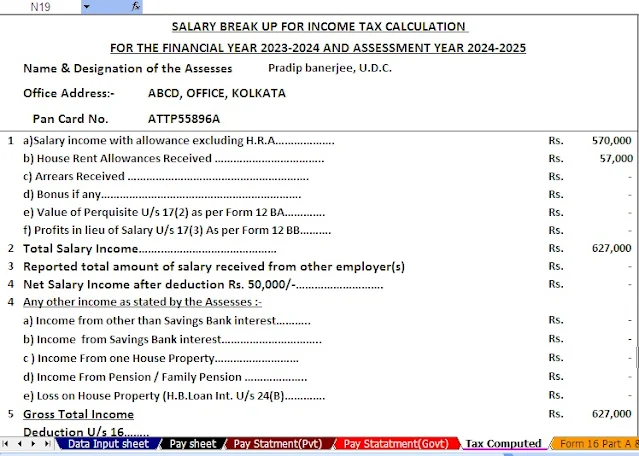

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

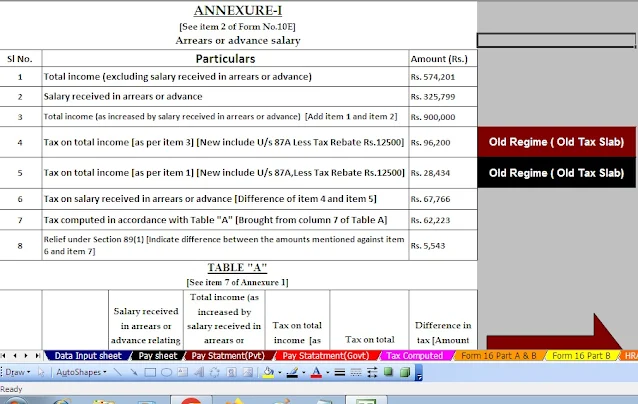

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24