The central government introduced a new tax regime with concessional tax rates under the section

115BAC in the 2020 budget.

In the income tax regime of UnionBudget 2023, the government has made the following important

changes for the financial year (F.Y) 2023-24:

Complete exemption from income tax up to Rs. 7 lakhs has been provided under the new tax regime

under Section 87A of the Income-tax Act, 1961.

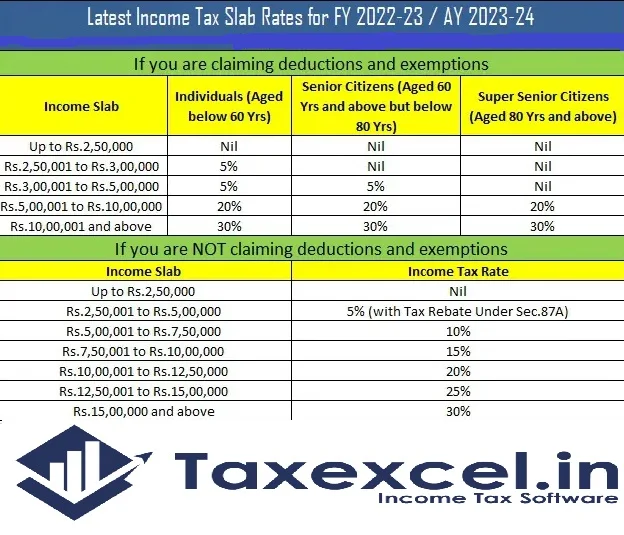

Limits on tax exemptions under the old tax system for the 2023-24 tax year Limits on tax exemptions under the new tax system for the 2023-24 tax year Rs..5 lakhs. 7 lakhs

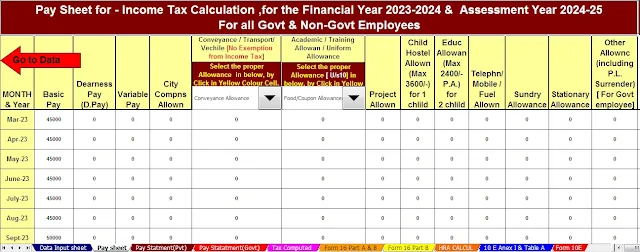

Features of this Excel utility:-

1) This Excel utility can prepare 50 employees at a time, Form 16, Part B, according to the 2022-23 budgets

2) This utility can be used by government and non-government concerned

3) Calculate your income tax automatically according to the New and Old Tax Regime

4) This Excel utility contains all the income tax sections according to the Income Tax Act.

5) This Excel utility can only be used as an Excel file

6) This Excel utility can be used by anyone and is easy to use.

If you claim the standard tax deduction of Rs 50.000, you should not pay tax. At an income cap of Rs 50,000. 7.5 lakhs.

Increase in basic tax exemption limit

The basic tax exemption limit of Rupees Two Lakh and Fifty Thousand under the old tax system increased to Rupees Three lacks under the new tax system.

Age categories Limit of basic tax exemption under old tax regime for 2023-24 tax year Limit of basic tax exemption under new tax regime for 2023-24 tax year

< 60 years of age Rs. 2.5 lakhs. 3 lakhs

60-80 years of age Rs. 3 lakhs

> Years Age Rs. 5 lakhs

If you opt for the new tax regime, the last exemption limit will take effect on April 1, 2023.

Salaried persons are eligible to claim the benefit of a standard deduction of Rs. 50,000 under the new tax regime.

Family pensioners can also claim the standard deduction of Rupees Fifteen thousand under the new tax regime.

Features of this Excel utility:-

1) This Excel utility can prepare 50 employees at a time, Form 16, Part A&B, according to the 2022-23 budgets

2) This utility can be used by government and non-government concerned

3) Calculate your income tax automatically according to the New and Old Tax Regime

4) This Excel utility contains all the income tax sections according to the Income Tax Act.

5) This Excel utility can only be used as an Excel file

6) This Excel utility can be used by anyone and is easy to use.

The new tax system is the default option

The new tax system is the default option for income tax deductions by an employer and the Internal Revenue Service.

Importance of exemptions and deductions in the new tax system

Let’s understand the keywords from the list below:

1. Deductions under the new tax system

• Refers to expenditures or investments made by the taxpayer that can be subtracted from his total gross income to arrive at taxable income

• Deductions can help reduce the tax liability of an individual or business

2. New tax system exemptions

• Refers to income or investments made by the taxpayer that are not included in the computation of his taxable income

Discounts and deductions are not available in the new tax system

Features of this Excel utility:-

1) This Excel utility can prepare 100 employees at a time, Form 16, Part B, according to the 2022-23 budget

2) This utility can be used by government and non-government concerned

3) Calculate your income tax automatically according to the New and Old Tax Regime

4) This Excel utility contains all the income tax sections according to the Income Tax Act.

5) This Excel utility can only be used as an Excel file

6) This Excel utility can be used by anyone and is easy to use.

From the table below, let’s find out the main exemptions and deductions in the new tax

Not required by a natural person:

Unclaimed tax deductions and exemptions in the new tax system

The standard deduction under Section 80TTA and Section 80TTB

Deductions Under Section 80C to 80CCD(1) and Chapter VI-A as per the Income Tax Act Act

Professional do

Entertainment subsidy on salary

House Rent Allowance (HRA)

License for Travel Allowance (LTA).

Pay helper allowance

Child Education Assistance

Income allowance for a minor child

Interest on occupied housing loans/vacant properties

Other Special Allowances A/ Section 10(14)

Employee contribution to the NPS account

Donations to political parties/foundations

Comparing cuts under the old regime versus. New regime for FY 2023-24

The table below shows a comparative analysis of the deductions available in the old versus. The new tax system:

Exemptions/ Deductions Available Old Tax System New Tax System

The standard deduction of Rs. 50,000 Yes, Yes

Employment/Business Tax Section 10(5) Yes No

Housing Rent Allowance (HRA) U/ S 10(13A) Yes No

Free meals through food vouchers/coupons Yes No

Deduction up to Rs. 1.5 lakh under

Chapter VIA U/ Sec for investments

like 80C, 80CCC, 80CCD, 80DD, 80DDB,

80E, 80EE, 80EEA, 80G, etc. Yes, No

Deduction for employer’s contribution to

Employee NPS accounts u/ Sec 80CCD(2) Yes Yes

Deduction u/sec 80CCD(1B) Up to Rs. 50,000 Yes No

Medical Insurance Premium U/Sec 80D Yes No

Interest on Housing Loan for Autonomous

Property / Vacancy Yes No

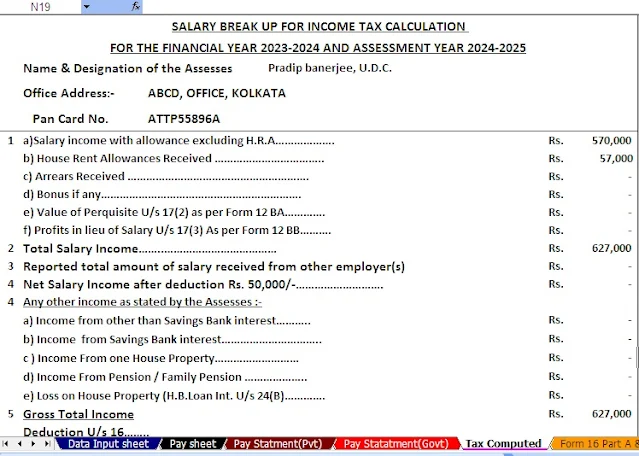

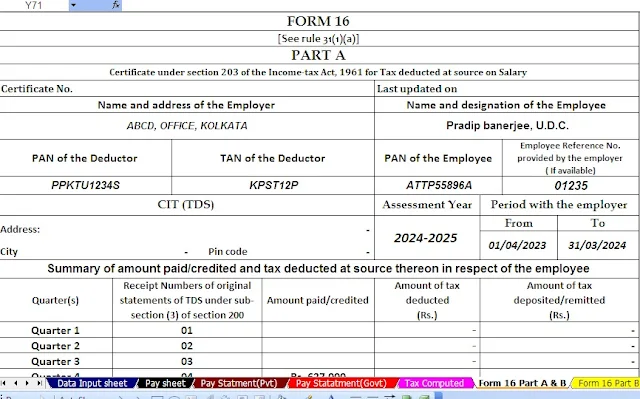

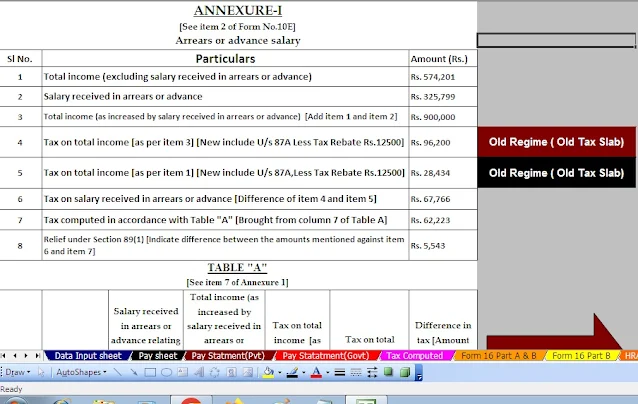

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24