U/s 80GG - Tax benefits on paid house rent for self-employed persons. When it comes to tax

deductions for people living in rented properties, there is good news for both salaried and self-

employed people. While salaried taxpayers can claim a tax credit exemption (HRA), self-employed

individuals are also subject to the tax exemption provision. Let's explore the details of this rule and the

conditions that need to be met.

Who can get the

benefit of U/s 80GG?

Pursuant to Section 80GG of the Income Tax Act, persons who do not own residential premises where they carry on their office, profession, trade, or profession can claim tax exemption for the rent paid. This rule applies to a taxpayer, his or her spouse, a minor, or an Undivided Hindu Family (HUF) if the taxpayer is a member. To avail of the relief, the taxpayer must complete a Form 10BA, which contains details of rent payments.

Features of this Excel utility:-

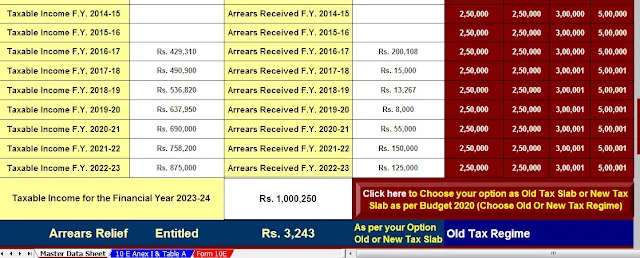

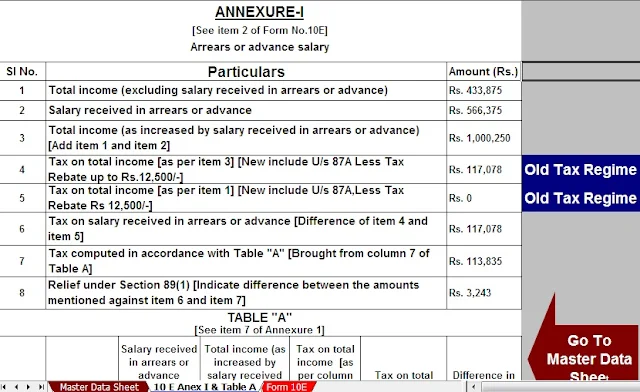

1) This Excel utility perfectly prepares your income tax according to your U/s 115BAC option.

2) This Excel utility has a completely revamped Income Tax section as per Budget 2023

3) Computerized Income Tax Form 12 BA

4) Automatic computation Income Tax Exemption rented house U/s 10(13A).

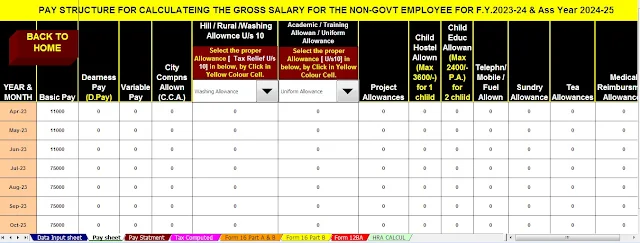

5) Individual salary structure according to government and private group salary model

6) Individual Pay Sheet

7) Individual tax datasheet

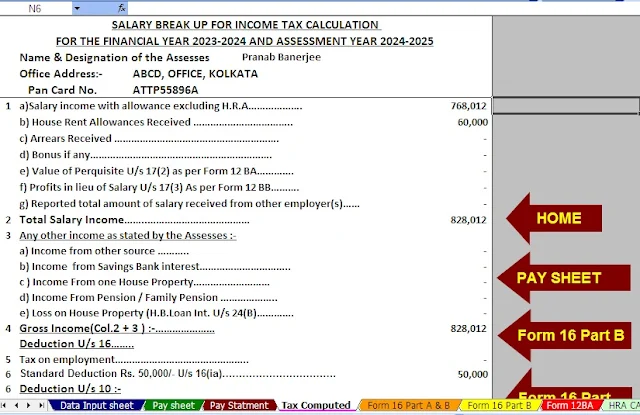

8) Automatic Income Tax Form 16 Part A&B revised for the financial year 2023-24

9) Automatic Income Tax Form 16 Part B revised for the financial year 2023-24

How much amount

exemption can be made by U/s 80GG?

The amount of deduction allowed depends on other factors. The deduction is limited to the lesser amount of Rs 5,000 per month, 25% of total rent, or actual rent paid in excess of 10% of total rent.

To be eligible for this subsidy, individuals must not own any residential property, and their spouse, minor child, or HUF must not own the residential property where the taxpayer normally resides. Taxpayers are required to file a declaration on Form 10BA to validate their eligibility.

It is important to note that the domestic rent allowance (HRA) deduction and the deduction under Section 80GG are not mutually exclusive.

Finally, HRA-ineligible individuals, including non-wage earners such as self-employed and salaried employees who do not receive an HRA, may receive an exemption from tax credits on this rent payable under Section 80GG. By meeting the specified conditions and submitting the required documents, eligible taxpayers can avail of the deduction, providing financial relief.