Download Auto Calculate and Automatic Income Tax Preparation in Excel for the Govt and Non-Govt

Employees for the F.Y.2023-24 with Benefits to New Tax Regime U/s 115 BAC for the F.Y.2023-24 as

per Budget 2023 |The Finance Bill 2023, presented by Mr. FM on February 1, 2023,

proposes changes in the area of Personal Taxation to make the new 115BAC personal tax regime more

palatable to taxpayers.

The mandatory forfeiture of several deductions to taxpayers who opt for the new u/s 115BAC tax regime introduced in the 2020 Finance Act has made the new regime less popular with taxpayers.

The Government wants more individual taxpayers to adopt the new regime to facilitate the filing and verification of tax returns and, to achieve this goal, significant changes to the 115BAC personal tax regime have been proposed by the Finance Bill 2023 as follows:

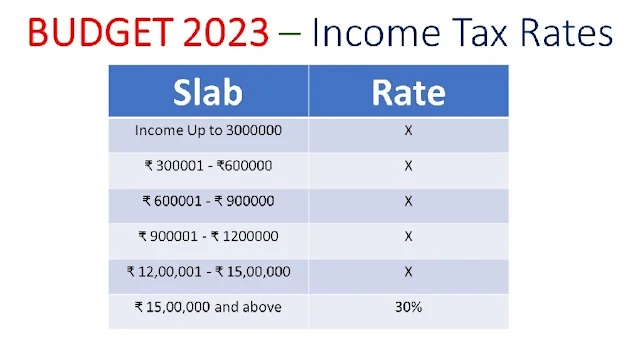

1. Pay less, save more: Basic exemption threshold increased to 3 Lakhs (first 3,00,000 tax-free) thanks to 5 simplified tax rates

The new tax regime under section 115BAC has increased the basic exemption threshold from Rs 2.5 lakhs to Rs 3 lakhs. As of the 2024-25 assessment year, the proposed tax rates for this new regime will apply to individuals, undivided Hindu families, partnerships (except cooperative societies), private entities (with or without legal personality), and legal entities artificial as follows:

2. Increase in the Discount Limi tu/s 87A

Deduction U/s 87A has been raised from Rs 5 lakhs to Rs 7 lakhs in the new tax regime under Section 115BAC. The new discount threshold of Rs 25,000 on an exempt income of Rs 7 lakh is an improvement over the previous discount threshold of Rs 12,500 on an exempt income of Rs 5 lakh.

Q If there is no income tax of up to Rs. 7 lakhs, why are the tax rates prescribed by the new tax regime?

In the 2023 Budget, the increase comes in the form of a section 87A rebate rather than an increase in the base exemption threshold within the tax bands. Thus, taxpayers who opt for the new regime from the 2024-25 tax year and have incomes up to Rs. 7 lakhs will not have to pay any income tax. However, if your income exceeds Rs. 7 lakhs, even slightly, the section 87A discount will not apply and the new tax rates will come into effect.

3. Normal Deduction Subsidy and Family Pension Deduction in the new Tax Regime

The Finance Bill 2023 provides important changes by allowing the normal exemption under Section 16(ia) and the family pension exemption under Section 57(ia) for persons receiving wages under the new tax regime under section 115BAC of the Tax Act of Income.

The only exemptions or deductions available under the new Tax Regime (as of the 2024-25 assessment year) are:

I. Ordinary exemption under section 16(ia) (Rs. 50,000).

ii. Deduction for family pension as per clause (ia) of section 57 (Rs.15,000 or 1/3 of the amount received, whichever is less)

iii. Deduction made according to Amount paid/deposited Agniveer Corpus Fund by assessee and contribution made by Central Government to such fund

4. Deduction under Section 80CCD(2) for an employer's contribution to an employee's National Pension System (NPS) account

5. New tax regime will be an Option by default

The biggest change is envisioned in section 115BAC of the Finance Act of 2023, making the new tax regime the default option. This is different from the current setup, where the old regime is automatically selected and people must choose the new regime by filling out an online declaration.

As of AY 2024-25, Individuals or HUFs wishing to remain under the former regime will have to deliberately choose to file a return online in the prescribed form or before the due date for filing their tax return from Section 139 (1) of the Law.

For those with income from a trade or occupation, their prior regime election under section 115BAC will be required for subsequent assessment years, as applicable.

6. Maximum surcharge rate reduced from 37% to 25%.

As per the new personal tax regime as per section 115BAC, the maximum tax rate of 37% on income above Rs. 5 crores is reduced by 25%. This reduction resulted in the reduction of the maximum rate from 42.74% to 39%.

However, for those who choose to remain in the old regime, there is no change in the amount of the surcharge.

Important Note: There are no changes to the Old Tax Regime.

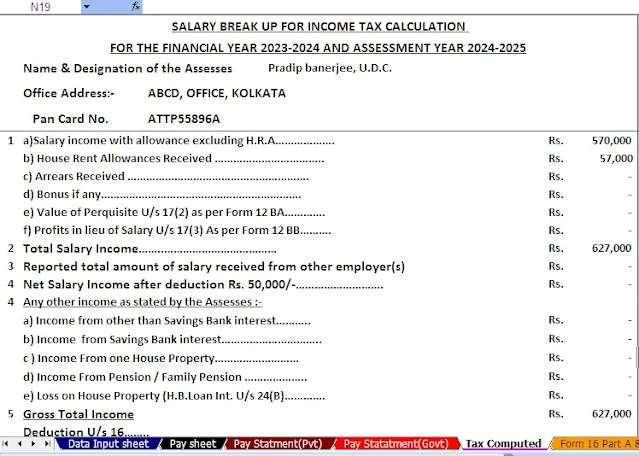

Features of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01

to F.Y.2023-24 (Update Version)

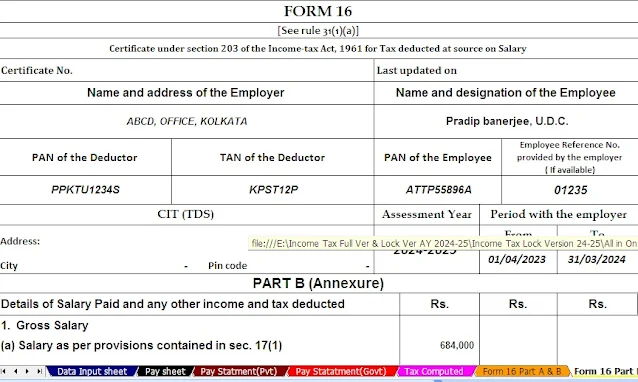

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24