Section 87A allowed the New Tax Regime up to Rs.25000/- whose taxable Income is not above 7

Lakh as per Budget2023| If your taxable income is less than Rs 5 lakh in tax year 2022-23 (accounting

year 2023-24), you may be eligible for a tax rebate under Section 87A of the Tax Act of Income of

1961. This reduction can give you a maximum benefit of Rs 12,500 irrespective of whether you follow

the old and new tax regime rebate of Rs.25000/- whose taxable income mot above 7 Lakh. However,

there are certain types of income that do not qualify for this tax break.

Income not eligible for tax relief under section 87A includes long-term capital gains (LTCG) arising from mutual funds, mutual funds, and other specified income. If your combined income includes any LTCG under Section 112A from the sale of stock or listed stock mutual funds, you will not be eligible to claim a rebate under Section 87A for tax payable on LTCG in such a way. The LTCG of stocks and equity mutual funds is taxed at 10% if it exceeds Rs 1 lakh in a financial year, and the rebate does not apply to this tax.

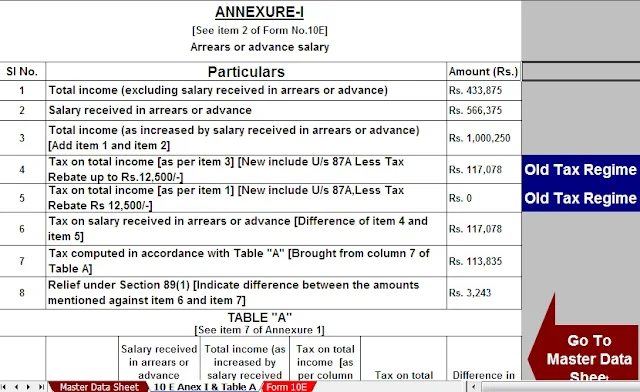

You may also download- Auto Calculate IncomeTax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2023-24

To claim tax rebate as per Section

87A, you must be a resident of

It is important to file an income tax return (ITR) to claim tax relief under Section 87A. The deduction does not apply automatically, and ITR reporting is mandatory if your total taxable income exceeds the basic exemption limit in the financial year.

The basic exemption limit for the 2022-23 tax year (2023-24 tax year) depends on your age and the tax regime you choose. For persons below 60 years of age, the basic exemption limit is Rs 2.5 lakh under the old tax regime, and under the new tax regime is Rs 3 lakh.

The new tax regime allows Rs. 25000/- tax relief as per Section 87A for taxable income up to Rs 7 lakh as per Budget 2023.

It is important to note that the tax rules may change for the current tax year 2023-24, and the basic exemption threshold and tax break under Section 87A may be revised accordingly.

In conclusion, the tax relief provided under Section 87A can be a valuable benefit to eligible individuals, helping to reduce their tax liability. To claim a refund, file your income tax return and make sure your taxable income does not exceed the threshold. Be sure to be aware of any changes in tax laws and regulations for each fiscal year.

Features of this Excel utility:-

1) This Excel utility perfectly prepares your income tax according to your U/s 115BAC option.

2) This Excel utility has a completely revamped Income Tax section as per Budget 2023

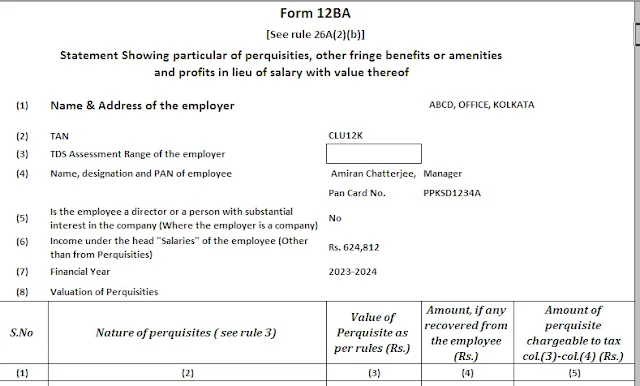

3) Computerized Income Tax Form 12 BA

4) Automatic computation Income Tax Exemption rented house U/s 10(13A).

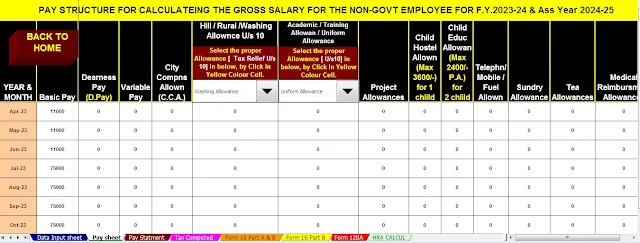

5) Individual salary structure according to government and private group salary model

6) Individual Pay Sheet

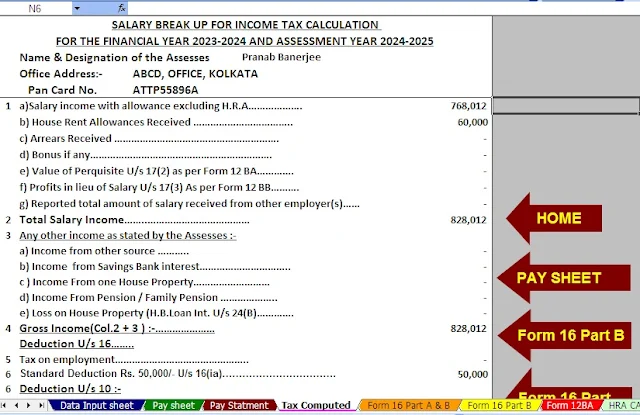

7) Individual tax datasheet

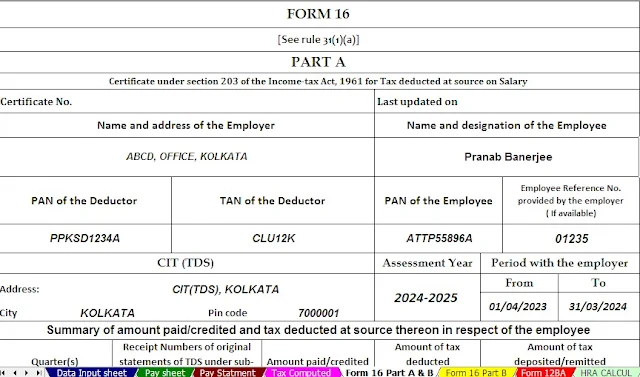

8) Automatic Income Tax Form 16 Part A&B revised for the financial year 2023-24

9) Automatic Income Tax Form 16 Part B revised for the financial year 2023-24