Introduction:

Income tax is an integral part of our financial responsibilities, and understanding how to effectively manage it can make a significant impact on our financial well-being. Income Tax Section 80C offers individuals the opportunity to save taxes while simultaneously building a strong foundation for their financial future. In this comprehensive guide, we'll delve into the various aspects of Income Tax Section 80C, including its benefits, eligible investments, and strategies to make the most out of this provision.

Income Tax Section 80C: Explained

Income Tax Section 80C is a provision in the Income Tax Act that allows individuals to claim deductions up to a specified limit on certain investments and expenses, resulting in a reduction of their taxable income. The primary aim of this provision is to encourage individuals to invest in avenues that promote long-term savings and financial security. Under Section 80C, individuals can avail a maximum deduction of Rs. 1.5 lakh, rendering it a favored option among taxpayers seeking to enhance their tax efficiency.

Eligible Investments under Section 80C

To avail of the benefits of Section 80C, individuals can invest in a variety of financial instruments that range from traditional to market-linked options. Some of the most popular eligible investments include:

1. Employee Provident Fund (EPF):

The EPF is a government-backed scheme that enables salaried individuals to build a substantial retirement corpus. Contribution towards EPF qualifies for deduction under Section 80C.

2. Public Provident Fund (PPF):

PPF stands as a long-term savings scheme that entails a lock-in duration of 15 years. It offers tax benefits on both contributions and withdrawals, making it an attractive option for risk-averse investors.

Features of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as a New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for West Bengal Government Employee’s Salary Structure.

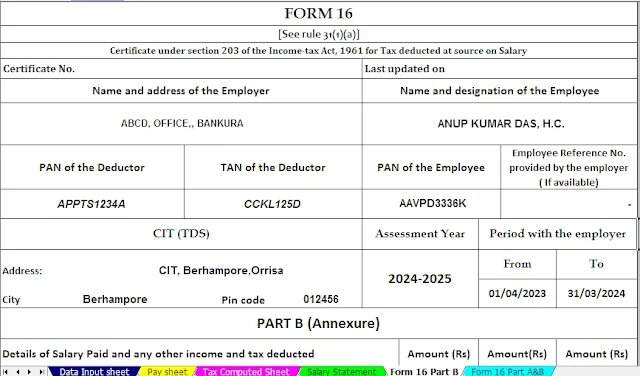

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2023-24

3. Equity-Linked Saving Schemes (ELSS):

ELSS are mutual funds that invest primarily in equities. They offer the dual benefit of potential capital appreciation and tax savings, making them a preferred choice for individuals with a higher risk appetite.

4. National Savings Certificate (NSC):

NSC is a fixed-income investment with a fixed maturity period. The interest earned is reinvested and eligible for deduction under Section 80C.

5. Tax-Saver Fixed Deposits:

Certain fixed deposits with a lock-in period of 5 years qualify for tax benefits under Section 80C. They provide stability along with tax-saving advantages.

6. Repayment of Home Loan Principal:

The repayment of the principal amount of a home loan is eligible for deduction under this section, encouraging individuals to invest in real estate and own a home.

Strategies to Maximize Section 80C Benefits

To make the most of Income Tax Section 80C, consider these strategies:

1. Diversify Your Portfolio:

Instead of putting all your eggs in one basket, distribute your investments across different eligible avenues. This diminishes risk while amplifying potential returns.

2. Systematic Investment Planning (SIP):

Investing in ELSS through SIPs allows you to benefit from rupee cost averaging, reducing the impact of market volatility.

3. Align Investments with Goals:

Choose investments that align with your financial goals. For instance, PPF can be ideal for long-term goals like retirement planning, while NSC might suit short-term goals.

4. Stay Informed:

Regularly review the performance of your investments and stay informed about changes in tax laws to ensure your portfolio remains optimized.

FAQs:

Is there an age

restriction to avail of Section 80C benefits?

There is no age restriction to avail of Section 80C benefits. Any individual, regardless of age, can invest in eligible instruments to claim deductions.

Can I invest more than Rs. 1.5 lakh under Section 80C?

While you can certainly invest more than Rs. 1.5 lakh, the maximum deduction allowed under Section 80C remains limited to Rs. 1.5 lakh.

Are the returns from ELSS guaranteed?

No, ELSS returns are market-linked and subject to market fluctuations. While they offer the potential for higher returns, there is no guarantee.

Can I withdraw funds from PPF before the maturity

period?

Certainly, partial withdrawals are permissible starting from the seventh year onwards. However, complete withdrawal is only permissible at the end of the 15-year maturity period.

What happens if I miss the due date for PPF

contributions?

If you miss contributing to your PPF account by the due date, a penalty is charged, and the account becomes inactive. You can reactivate it by paying the penalty and contributing for the missed years.

Is the interest earned on NSC taxable?

Yes, the interest earned on NSC is taxable. However, it is deemed to be reinvested and eligible for deduction under Section 80C.

Conclusion:

Income Tax Section 80C offers a golden opportunity to simultaneously save on taxes and grow wealth. By investing wisely in eligible avenues, individuals can secure their financial future while optimizing their tax liability. From traditional options like PPF and NSC to market-linked choices like ELSS, there are various avenues to choose from based on your risk appetite and financial goals. Remember to stay updated with the latest tax laws and periodically review your investment portfolio to ensure continued financial well-being.

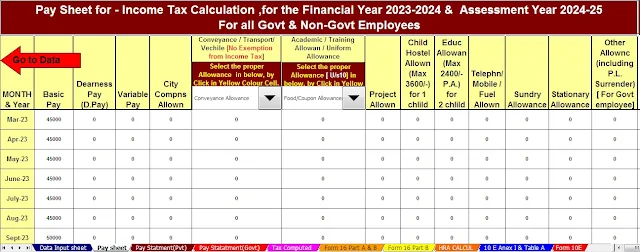

Features of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employee’s Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24