Introduction

About Income Tax Standard Deduction Rs. 50000/- U/s 115BASC in the new tax regime| Income Tax

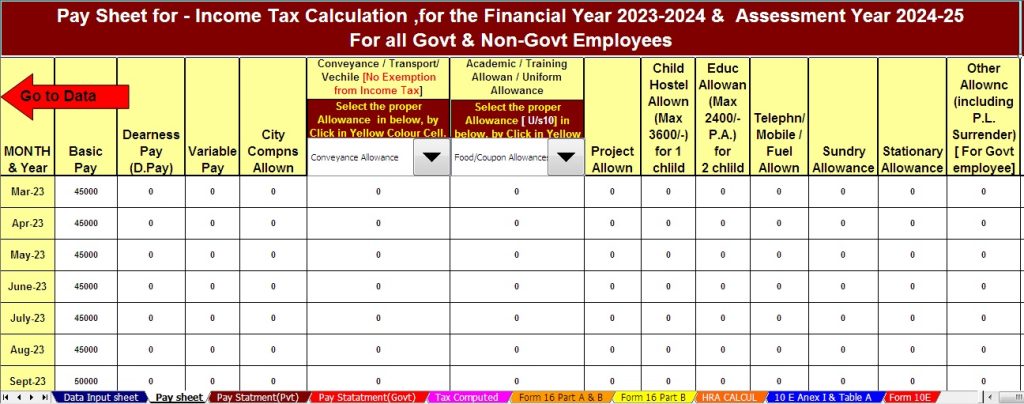

Calculator in Excel All in One with Simplifying Tax| Navigating the complexities of income tax

calculations can be daunting, especially for employees from both government and non-government

sectors. Therefore, Fortunately, Excel comes to the rescue with its user-friendly tools that streamline

this process. In this article, we'll explore how to use an Income Tax Calculator in Excel, focusing on

the Income Tax Standard Deduction of Rs. 50000/- U/s 115BASC in the new tax regime.

Understanding Income Tax Calculation

about Income Tax Standard Deduction Rs. 50000/- U/s 115BASC in the new tax regime.| When it

comes to income tax calculation, accuracy and efficiency are key. Similarly, the Income Tax Calculator in

Excel All in One with Simplifying Tax| Government and non-government employees alike need to

understand how their income tax is determined. In other words, By utilizing Excel, you can easily

organize your financial data and calculate taxes without the hassle of manual computations.

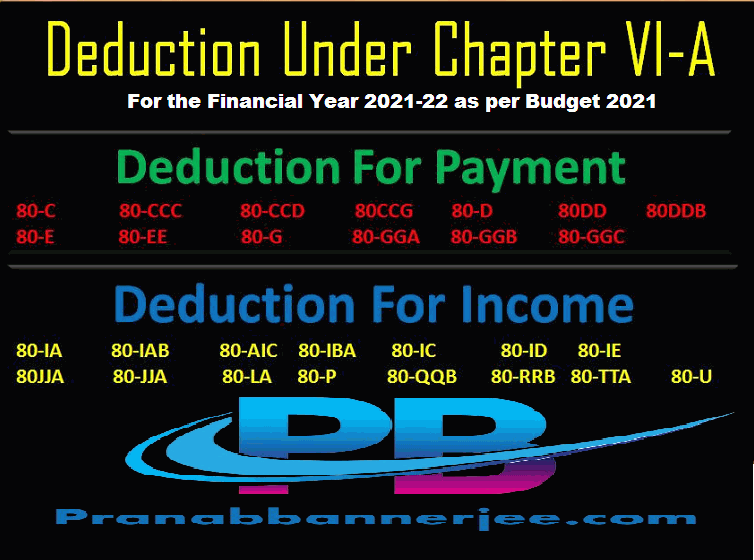

Income Tax Standard Deduction Rs. 50000/- U/s 115BASC plays a significant role in the new tax

regime. Above all, It allows taxpayers to reduce their taxable income by a flat Rs. 50000, resulting in

lower overall tax liability. This deduction is available to all salaried individuals and pensioners, making

tax calculations more favorable and manageable.

The Power of Excel in Tax Calculation

In addition, Excel provides a versatile platform to create a personalized Income Tax Calculator. With

its functions and formulas, you can input your income sources, allowances, and deductions. After that,

The spreadsheet will automatically perform the necessary calculations, providing you with an accurate

estimate of your taxable income and the subsequent tax amount.

In other words, Income Tax Standard Deduction Rs. 50000/- U/s 115BASC Explained

However, Demystifying Income Tax Standard Deduction Rs. 50000/- U/s 115BASC in the New Tax Regime

Similarly, The Income Tax Standard Deduction, introduced under section 115BASC, is a boon for

taxpayers. Therefore, It allows for a deduction of Rs. 50000 from the total income before calculating

taxes. This deduction is applicable whether you opt for the new tax regime or the old one, providing

flexibility to taxpayers based on their financial situation.

Above all, Frequently Asked Questions (FAQs)

Q1: Who is eligible for Income Tax Standard Deduction?

Answer: Both salaried individuals and pensioners are eligible for the Income Tax Standard Deduction

of Rs. 50000/- U/s 115BASC, regardless of the tax regime they choose.

Q2: Can self-employed individuals avail of this deduction?

Answer: No, the standard deduction is currently applicable only to salaried individuals and pensioners.

Q3: Is it better to choose the new tax regime or the old one with deductions?

Answer: The choice depends on various factors, including your income sources and financial goals. It's

recommended to consult a financial advisor to make an informed decision.

Conclusion

In conclusion, the Income Tax Calculator in Excel simplifies the intricate process of tax estimation for

both government and non-government employees. After that, The Income Tax Standard Deduction

Rs. 50000/- U/s 115BASC provides a sigh of relief to taxpayers, allowing them to substantially reduce

their taxable income. Whether you're a salaried individual or a pensioner, Excel's dynamic features

empower you to take control of your tax calculations efficiently. To make the best choice between the

tax regimes, seek guidance from financial experts who can align your decisions with your financial

aspirations. In addition, Embrace the power of Excel and navigate the realm of income tax

calculations with confidence.

Download Automated Income Tax Preparation Excel-Based Software All in One for the Government & Non-Government (Private) Employees for the F.Y.2023-24 and A.Y.2024-25