Mastering Income Tax Preparation Using Excel Made Easy

Introduction:

In

the fast-paced world of finance and taxation, staying on top of your income tax

preparation is crucial. It's not just about filing your taxes; it's about

optimizing your financial strategy. In this comprehensive guide, we will walk

you through the process of using Excel as an all-in-one tool for income tax

preparation for private employees in the financial year 2023-24. With a focus

on clarity and simplicity, we'll break down the complex tax jargon into

easy-to-understand terms.

Understanding Income Tax Preparation

Before we dive into the nitty-gritty of Excel and income tax preparation, let's get a

clear understanding of what it entails. Income tax preparation is the process

of calculating and filing your taxes with the government. For private

employees, this includes declaring their income, deductions, and exemptions

accurately.

Why Excel is Your Ultimate Ally

Excel is a powerhouse when it comes to handling financial data. It's user-friendly

and offers a wide range of functions that make income tax preparation a breeze.

From organizing your income sources to calculating deductions and exemptions,

Excel can handle it all.

Getting Started with Excel

Now, let's start with the basics. If you're new to Excel, don't worry; it's simpler

than it looks. Begin by opening Excel and creating a new spreadsheet. Label

your columns for income sources, deductions, and exemptions. This step ensures

that you have a clean and organized template to work with.

Entering Your Income

In this section, we'll focus on entering your income sources into Excel. List all

your income streams, including your salary, bonuses, and any other additional

earnings. Excel's auto-calculate feature will sum up your income effortlessly.

Deductions Made Easy

Deductions play a vital role in reducing your taxable income. In Excel, you can create

formulas that automatically calculate deductions based on your inputs. This ensures

that you don't miss out on any eligible deductions.

Embracing Exemptions

Exemptions are another aspect of income tax preparation that can significantly impact your

tax liability. Use Excel to record and calculate your exemptions accurately.

This step will help you maximize your tax savings.

Excel's Built-in Formulas

Excel simplifies complex calculations with its built-in formulas. Whether you need to

calculate the tax liability or determine your refund, Excel has formulas for it

all. These formulas work in real time, giving you instant results.

Double-Check and File

Before you file your income tax return, it's essential to double-check your

calculations. Excel's error-checking features can help you spot any

discrepancies. Once you're confident in your numbers, you can easily export

your data into the official tax filing format.

Conclusion: Empowering Your Financial Journey

Incorporating Excel into your income tax preparation process for the financial year 2023-24

can save you time and money. It streamlines the entire process, making it

accessible to everyone, regardless of their financial background. With Excel as

your ally, you can confidently navigate the world of income tax preparation,

ensuring that you're making the most of your financial resources. So, start

today and take charge of your financial future!

Features of this Excel Utility

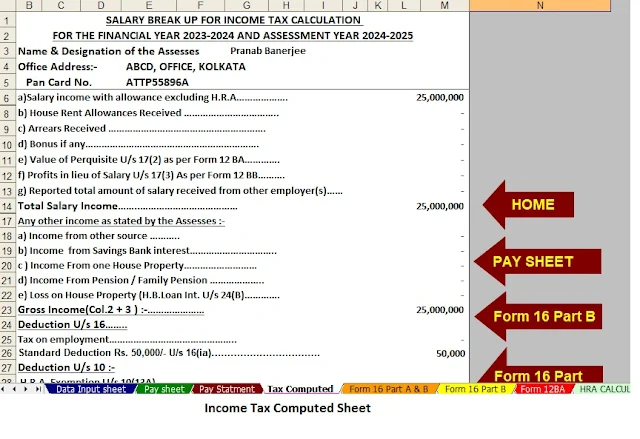

1) The Tax Calculation will be as per the Budget 2023 with New and Old Tax Regime U/s 115 BAC

2) This Excel Utility has its own Salary Structure as per the Non-Government (Private) Employees' Salary Structure

3) This Excel Utility can prepare automatically your Income tax Computed Sheet Just fill in the Data

4) This Excel Utility can Calculate your House Rent Exemption U/s 10(13A)

5) This Excel Utility have a separate Salary Sheet

6) This Excel Utility automatically your Arrears Relief Calculation U/s 89(1) with Form 10E

7) This Excel Utility can prepare at a time your Form 16 Part B automatically

8) This Excel Utility can prepare at a time Form 16 Part A and B