In the realm of financial responsibilities, few things can be as daunting as income tax preparation.

Whether you're a government employee navigating through complex allowances or a private-sector

worker juggling various sources of income, filing your taxes correctly and efficiently is crucial.

Fortunately, there's a solution that can make this process remarkably straightforward – All-in-One

Excel Software for FY 2023-24. In this in-depth guide, we'll explore how this innovative software can

simplify income tax preparation for both government and private employees.

Understanding the Tax Filing Challenge

Income tax preparation can be a labyrinth of forms, calculations, and regulations. The fear of making errors and missing out on deductions often leads individuals to seek professional assistance. However, with the advancement of technology, there's a more accessible and cost-effective way to tackle your income tax preparation.

Introduction to All-in-One Excel Software for FY

2023-24

What Is All-in-One Excel Software?

All-in-One Excel Software for FY 2023-24 is a versatile and user-friendly tool designed to streamline the income tax preparation process. Whether you're a government employee dealing with specific allowances or a private sector worker with diverse income sources, this software is tailor-made to meet your needs. Let's delve into the key features and benefits that set this software apart.

1. Intuitive User Interface

Bid farewell to the days of perplexing tax forms and jargon-laden instructions. This software boasts an intuitive user interface that guides you through the process step by step. Even if you have limited tax knowledge, you can confidently prepare your taxes using this tool.

2. Real-time Calculations

No more second-guessing your calculations or fretting about errors. All-in-One Excel Software conducts real-time calculations as you input your financial data, ensuring that your tax liability remains accurate and up-to-date.

3. Comprehensive Tax Forms

Whether you need to file Form 1040, various schedules, or additional attachments, this software generates all the required forms, saving you the hassle of searching for and completing each one separately.

4. Error Detection and Correction

Worried about errors creeping into your tax return? The software includes an error-detection feature that scans your data for common mistakes and prompts you to rectify them before submission, significantly reducing the risk of costly errors.

5. Electronic Filing

Say goodbye to paper forms and long waiting times for refunds. All-in-One Excel Software allows you to e-file your tax return directly with the relevant tax authorities. It's not only convenient but also quicker and more secure.

Benefits for Government Employees

1. Simplified Allowance Calculation

Government employees often contend with intricate allowances and deductions. This software simplifies the process of calculating these allowances, ensuring that you maximize your tax benefits.

2. Easy Access to Tax Regulations

With the software's built-in access to the latest tax regulations and updates, government employees can stay informed and make informed decisions about their tax filings.

Benefits for Private Sector Employees

1. Streamlined Income Reporting

For private sector employees and self-employed individuals, tracking income and expenses can be a challenge. This software streamlines income reporting and expense tracking, making tax preparation more straightforward than ever.

2. Maximizing Deductions

The software guides private sector employees through the process of maximizing deductions and credits, helping them legally reduce their tax liability.

How to Get Started

Now that you're acquainted with the benefits and features of All-in-One Excel Software, here's how you can initiate your tax preparation:

Step 1: Purchase and Installation

Visit the official website and purchase the software. After the purchase, download and install it on your computer.

Step 2: Data Entry

Open the software and commence entering your financial information. The software will lead you through each step, ensuring that you don't overlook any vital details.

Step 3: Review and Verification

Take a moment to scrutinize your tax return for accuracy. The software's error-detection feature will help you identify and rectify any errors.

Step 4: E-File Your Return

Once you're content with your tax return, use the software to electronically file it with the relevant tax authorities. You'll receive confirmation once your return is successfully submitted.

Conclusion

To conclude, All-in-One Excel Software for FY 2023-24 is a formidable tool that simplifies income tax preparation for both government and private employees. With its user-friendly interface, real-time calculations, comprehensive forms, error detection, and electronic filing capabilities, it offers a hassle-free and efficient approach to managing your taxes. Say farewell to the complexities of tax season and embrace a smoother, more convenient way to prepare your income tax return. Try All-in-One Excel Software today and experience the transformative power it can bring to your financial life.

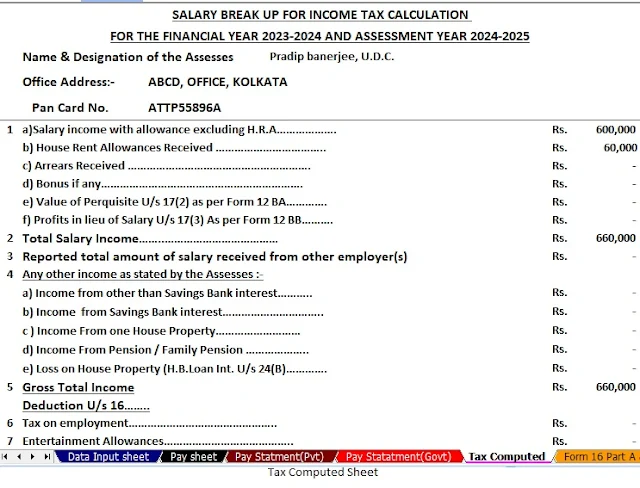

Feature of this Excel

Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as a New or Old Tax Regime

3) For instance, This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

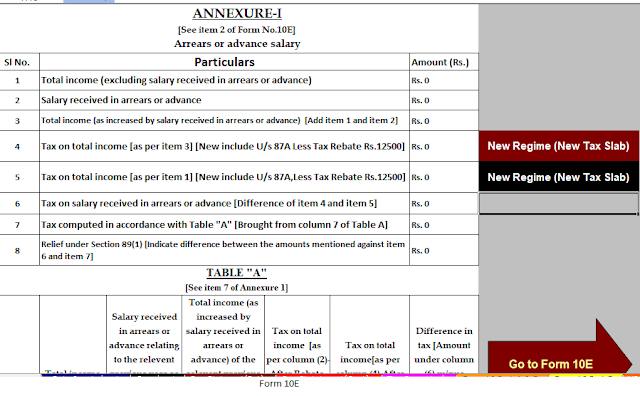

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2023-24 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2023-24