In the constant alteration of income tax laws, staying informed is crucial for every taxpayer. The year 2023 has brought significant changes, particularly with the introduction of Section 115 BAC as part of the Budget. In this article, we will explore the intricacies of Section 115 BAC, its implications, and how it can impact your income tax filing.

Table of Contents

Understanding Section 115 BAC

What is Section 115 BAC?

Eligibility Criteria

Who can opt for Section 115 BAC?

Tax Computation

How is tax calculated under Section 115 BAC?

Key Highlights

Notable features of Section 115 BAC

Impact on Individual Taxpayers

Benefits of Choosing Section 115 BAC

Drawbacks and Considerations

Filing Process

How to file taxes under Section 115 BAC

Documentation and Records

What documents are required?

Frequently Asked Questions

Common queries about Section 115 BAC

Expert Opinions

Insights from tax professionals

Case Studies

Real-life scenarios

Tax Planning Tips

Maximizing benefits under Section 115 BAC

Comparing Section 115 BAC with Other Sections

Conclusion

1. Understanding Section 115 BAC

What is Section 115 BAC?

Section 115 BAC is a new provision introduced in the Income Tax Act of 1961, allowing individual taxpayers to choose between the existing tax regime and a new optional tax regime. This section aims to simplify the taxation process and reduce the tax burden on individuals.

2. Eligibility Criteria

Who can opt for Section 115 BAC?

Section 115 BAC is available to individual taxpayers, including resident and non-resident Indians, who have income from salaries, house property, business, or any other source. However, certain categories of taxpayers, such as partnerships and HUFs, are not eligible for this scheme.

3. Tax Computation

How is tax calculated under Section 115 BAC?

Under this section, taxpayers can choose a lower tax rate without claiming deductions and exemptions. The tax is calculated based on the taxpayer's age, income, and choice of regime.

4. Key Highlights

Section 115 BAC offers several key features, such as flexibility in choosing the tax regime, simplified tax calculations, and reduced tax rates for specific income slabs. Taxpayers can switch between the old and new regimes according to their financial situations.

5. Impact on Individual Taxpayers

The introduction of Section 115 BAC has a significant impact on individual taxpayers, offering them the freedom to optimize their tax liabilities. However, making the right choice requires a careful evaluation of their financial circumstances.

6. Benefits of Choosing Section 115 BAC

Opting for Section 115 BAC can lead to reduced tax liability and simplified tax planning. Taxpayers can enjoy higher take-home pay and better financial stability.

7. Drawbacks and Considerations

While Section 115 BAC offers benefits, it may not be suitable for everyone. Taxpayers need to consider the implications of forgoing deductions and exemptions before making a decision.

8. Filing Process

How to file taxes under Section 115 BAC

To file taxes under Section 115 BAC, taxpayers need to inform their employers about their choice of tax regime at the beginning of the financial year. Additionally, they must file their tax returns using the new regime while ensuring compliance with all relevant guidelines.

9. Documentation and Records

What documents are required?

Taxpayers must maintain records of their income, deductions, and exemptions. Adequate documentation is essential to avoid any discrepancies during tax assessments.

10. Frequently Asked Questions

Common queries about Section 115 BAC

Can I switch between the old and new tax regimes during the financial year?

No, you can only switch at the beginning of the financial year.

Is Section 115 BAC applicable to senior citizens?

Yes, it is applicable to taxpayers of all age groups.

Can I claim deductions for investments under Section 80C if I choose Section 115 BAC?

No, you cannot claim deductions under this section.

What is the maximum income limit for eligibility under Section 115 BAC?

There is no specific income limit; all eligible taxpayers can opt for it.

Are capital gains taxed differently under Section 115 BAC?

Capital gains are taxed at different rates under this section.

11. Expert Opinions

Insights from tax professionals

Tax experts recommend that individuals consult a financial advisor or tax consultant before choosing Section 115 BAC. Expert guidance can help taxpayers make informed decisions based on their unique financial situations.

12. Case Studies

Real-life scenarios

To better understand the practical implications of Section 115 BAC, let's explore a few case studies of individuals who have opted for this tax regime and the resulting impact on their tax liabilities.

13. Tax Planning Tips

Maximizing benefits under Section 115 BAC

Taxpayers can plan their finances strategically to make the most of Section 115 BAC. This includes optimizing their investments and understanding the nuances of the new tax regime.

14. Comparing Section 115 BAC with Other Sections

In this section, we will compare Section 115 BAC with other relevant sections of the Income Tax Act to help taxpayers make an informed choice that aligns with their financial goals.

15. Conclusion

In conclusion, Section 115 BAC introduces a transformative change in income tax regulations, giving taxpayers the freedom to choose a tax regime that suits their needs. However, it's crucial to assess individual financial circumstances and seek expert advice before making a decision.

FAQs

Can I switch between the old and new tax regimes during the financial year?

No, you can only switch at the beginning of the financial year.

Is Section 115 BAC applicable to senior citizens?

Yes, it is applicable to taxpayers of all age groups.

Can I claim deductions for investments under Section 80C if I choose Section 115 BAC?

No, you cannot claim deductions under this section.

What is the maximum income limit for eligibility under Section 115 BAC?

There is no specific income limit; all eligible taxpayers can opt for it.

Are capital gains taxed differently under Section 115 BAC?

Capital gains are taxed at different rates under this section.

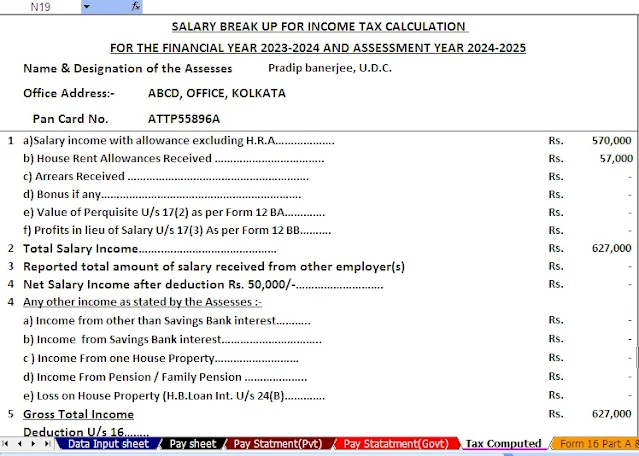

Features of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employee’s Salary Structure.

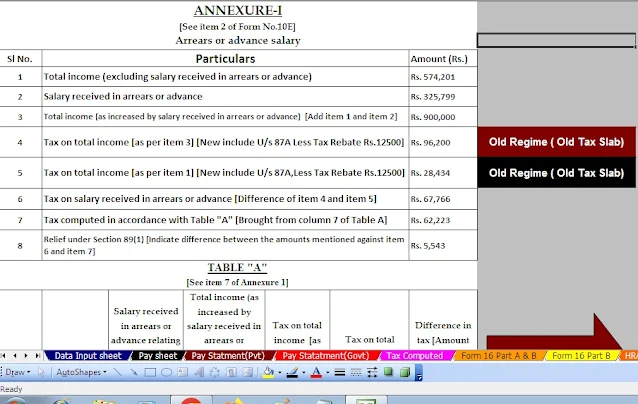

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24