In today's world, financial planning is crucial, and understanding your tax liability is a fundamental

aspect of it. As a non-government employee, it's essential to be aware of how income tax works,

especially with the ever-evolving tax laws and regulations. This article aims to provide you with a

comprehensive guide to an all-in-one income tax calculator tailored specifically for non-government

employees for the financial year 2023-24.

Table of Contents

• Introduction

• Understanding

Income Tax

• Components

of Income Tax Calculation

• Gross

Income

• Deductions

• Taxable

Income

• Tax

Slabs

• Rebates

and Credits

Using the Income Tax Calculator

• Step

1: Entering Your Gross Income

• Step

2: Deductions

• Step

3: Taxable Income

• Step

4: Calculating Tax Liability

• Step

5: Rebates and Credits

FAQs about Income Tax Calculation

• When

do I need to submit my income tax returns?

• Can I

claim deductions on home loan interest?

• How

can I legally lower the amount of income I have to pay taxes on?

• What

occurs if I don't submit my taxes by the deadline?

Let's dive into the nitty-gritty details of income tax

calculation for non-government employees.

Introduction

Before we delve into the intricacies of calculating

income tax, let's start with the basics. Income tax is a mandatory financial

contribution that individuals and businesses make to the government. This

revenue is used to fund various public services and infrastructure development.

Understanding Income Tax

Income tax is figured out by looking at how much money

you make in a year as non-government employees, this includes your salary,

business income, rental income, and other sources of income. To calculate your

income tax liability accurately, you need to consider several components.

Components of Income Tax Calculation

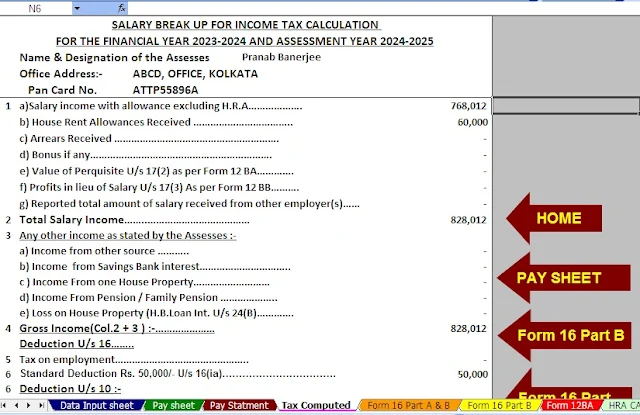

Gross Income

Your gross income is the total income you earn before

any deductions or exemptions. It includes your salary, rental income, business

income, and any other sources of income. To calculate your income tax, you'll

start with your gross income.

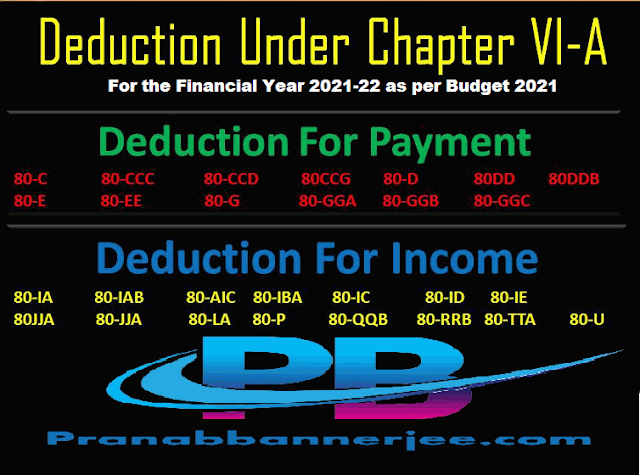

Deductions

Deductions are specific expenses or investments that

you can subtract from your gross income. These deductions reduce your taxable

income, ultimately lowering your tax liability. Common deductions include

contributions to provident funds, life insurance premiums, and investments in

tax-saving instruments.

Taxable Income

Once you've deducted eligible expenses from your gross income, you arrive at your taxable income. This is the amount on which you will calculate your income tax.

Tax Slabs

Income tax in most countries is progressive, meaning

the more you earn, the higher the tax rate you pay. Tax slabs are different

income ranges, each with its tax rate. As your income increases, you move into

a higher tax slab.

Rebates and Credits

Rebates and tax credits are incentives provided by the government to encourage specific behaviors, such as investments in certain sectors or savings in specified instruments. These actions can make your tax bill smaller.

Using the Income Tax Calculator

Now that you have a basic understanding of the components, let's explore how to use the all-in-one income tax calculator for non-government employees for the financial year 2023-24.

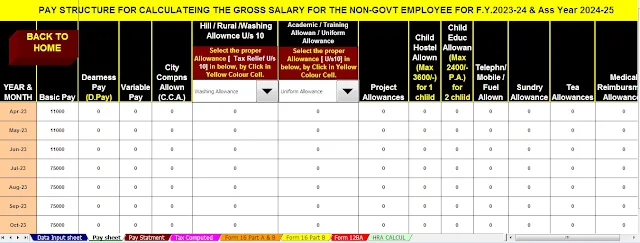

Step 1: Entering Your Gross Income

Begin by entering your gross income into the calculator. This should include your salary, rental income, business income, and any other income sources. Ensure accuracy in this step, as it forms the foundation of your tax calculation.

Step 2: Deductions

Next, you will need to enter the deductions you are eligible for. This could include contributions to provident funds, life insurance premiums, and any other applicable deductions. The calculator will subtract these deductions from your gross income to arrive at your taxable income.

Step 3: Taxable Income

Once you've entered your deductions, the calculator will automatically calculate your taxable income. This is the amount on which your income tax liability will be determined.

Step 4: Calculating Tax Liability

Now comes the crucial step—calculating your income tax liability. The calculator will use the tax slabs applicable to your taxable income to determine how much tax you owe to the government.

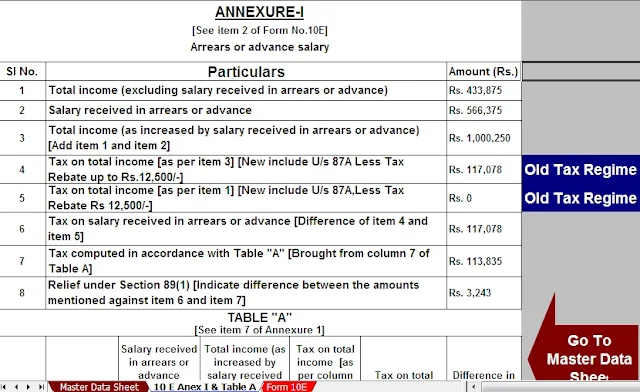

Step 5: Rebates and Credits

Finally, the calculator will factor in any rebates or

tax credits that you are eligible for. These can really help you pay less in

taxes

FAQs about Income Tax Calculation

Q: When do I need to submit my income tax?

A: The due date for filing income tax returns varies

from country to country. In most cases, it falls between July and September

after the end of the financial year. It's essential to check your country's tax

department website for the exact due date.

Q: Can I claim deductions on home loan interest?

A: Yes, you can claim deductions on the interest paid

on your home loan under certain conditions. However, the rules for this

deduction may vary, so it's advisable to consult a tax expert or refer to your

country's tax regulations for specific details.

Q: How can I reduce my taxable income legally?

A: You can reduce your taxable income legally by

taking advantage of deductions and exemptions provided by the government.

Contributing to provident funds, investing in tax-saving instruments, and

making charitable donations are some common ways to reduce your taxable income

.

Q: What occurs if I miss the tax filing deadline?

A: Missing the tax filing deadline can lead to

penalties and interest on the unpaid tax amount. It's crucial to file your tax

return on time to avoid these consequences. If you have missed the deadline,

it's advisable to file your return as soon as possible and pay any outstanding

taxes along with the penalties, if applicable.

In conclusion, understanding and calculating your

income tax as a non-government employee is vital for financial planning. The

all-in-one income tax calculator for the financial year 2023-24 simplifies the

process and helps you determine your tax liability accurately.

Features of this Excel Utility:-

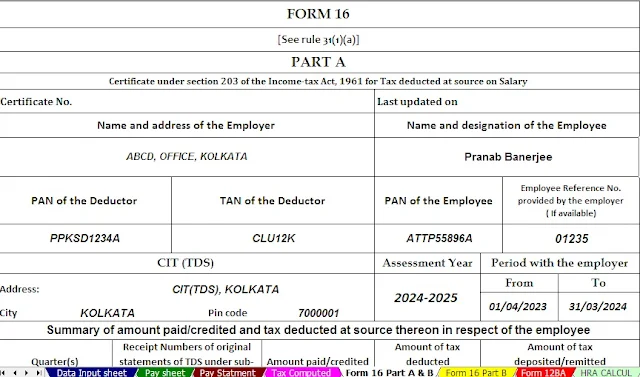

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Non-Government Employee’s

Salary Structure.

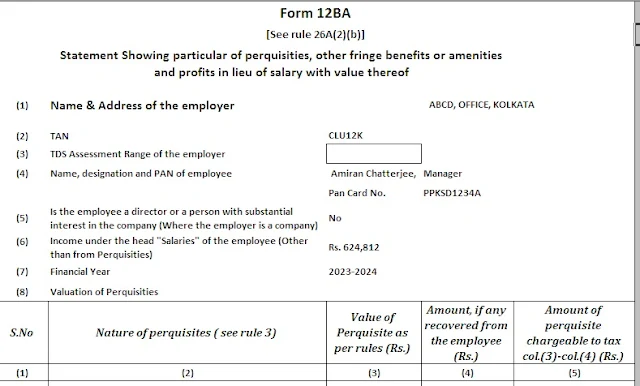

4) Automated

Income Tax Form 12 BA

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24