Maximize Your Ta Savings with Section 87A Tax Rebate| If your taxable income is below Rs 5 lakh in

the financial year 2022-23 (the assessment year 2023-24), you may be eligible for a tax rebate under

Section 87A of the Income Tax Act, 1961. This rebate can provide you with a maximum benefit of Rs

12,500, regardless of whether you follow the old or new tax regime. However, there are certain types

of incomes that are not eligible for this tax rebate.

Maximize Your Savings with Section 87A Tax Rebate | Incomes not eligible for

tax rebates under Section 87A include long-term capital gains (LTCG) from equity

shares, equity mutual funds, and certain specified incomes. If your total

income includes any LTCG under Section 112A from the sale of listed equity

shares or equity mutual funds, you cannot claim the rebate under Section 87A

for the tax payable on such LTCG. LTCG from equity shares and equity mutual

funds is taxable at 10% if it exceeds Rs 1 lakh in a financial year, and the

rebate does not apply to this tax.

Additionally, certain special incomes are also excluded from the tax rebate.

Incomes from gambling, virtual digital assets (VDA), online gaming, lotteries,

game shows, or betting are not eligible for the tax rebate under Section 87A.

These incomes will be taxed at a flat rate of 30%, along with cess and

surcharge (if applicable).

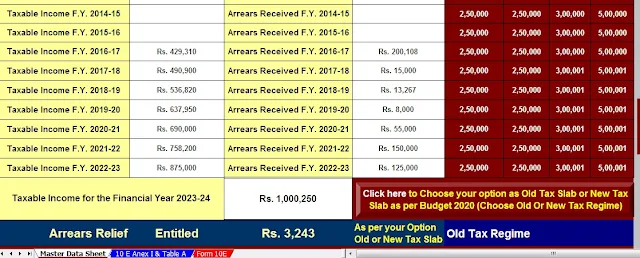

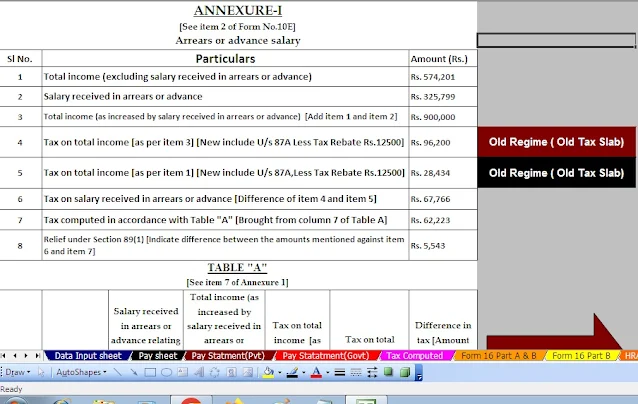

You may also like –Automatic Income Tax Arrears ReliefCalculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2023-24

To claim the tax rebate under Section 87A, you must be an Indian resident

individual, and your total income after claiming deductions (such as under

sections 80C and 80D) should not exceed Rs 5 lakh in FY 2022-23.

It's essential to file an income tax return (ITR) to claim the tax rebate under

Section 87A. The rebate is not automatically applied, and ITR filing is

mandatory if your total taxable income exceeds the basic exemption limit in a

financial year.

The basic exemption limit for FY 2022-23 (AY 2023-24) depends on your age and

the tax regime you choose. For individuals below 60 years, the basic exemption

limit is Rs 2.5 lakh in the old tax regime, and in the new tax regime, it's Rs

3 lakh. The new tax regime allows tax rebates under Section 87A for taxable

incomes up to Rs 7 lakh.

It's important to note that the tax rules may change from the current financial

year FY 2023-24, and the basic exemption limit and tax rebate under Section 87A

may be revised accordingly.

If you have capital gains from assets other than equity shares or equity mutual

funds, such as real estate or unlisted shares, you may still be eligible to

claim the tax rebate under Section 87A. The rebate can be claimed against LTCG

from real estate, unlisted shares, or any other assets, as well as STCG from

the sale of equity mutual funds or equity shares taxable under section 111A of

the Income Tax Act.

Features of this Excel utility:-

1) This Excel utility perfectly prepares your income tax according to your U/s 115BAC option.

2) This Excel utility has a completely revamped Income Tax section as per Budget 2023

3) Computerized Income Tax Form 12 BA

4) Automatic computation Income Tax Exemption rented house U/s 10(13A)

5) Individual salary structure according to government and private group salary model

6) Individual Pay Sheet

7) Individual tax datasheet

8) Automatic Income Tax Form 16 Part A&B revised for the financial year 2023-24

9) Automatic Income Tax Form 16 Part B revised for the financial year 2023-24