Is Sec 87A Tax Rebate Rs.50,000/- Available in both Tax Regimes? With Auto Calculate Income Tax Preparation Software All in One in Excel for the Government & Non-Government Employees for the F.Y.2023-24 as per Budget 2023

In India's tax world, knowing the rules is crucial. Section 87A is a hot topic—it offers a tax rebate of Rs. 50,000 to individual taxpayers. But does it work in both old and new tax systems? Let's dive in and find out. We'll also explore a handy income tax tool for government and non-government employees in the Financial Year 2023-24, following the 2023 Budget.

Table of Contents

- What's Section 87A?

- Old Tax Rules

- New Tax Rules

- Income Tax Tool

- Government Employees' Perks

- Benefits for Others

- How to Get the Rebate

- Who Qualifies

- Budget 2023 Impact

- FAQs

What's Section 87A?

Section 87A gives a tax rebate of up to Rs. 50,000 to lower-income individuals.

Old Tax Rules

In the old system, you can use deductions and exemptions. Section 87A applies here, letting eligible taxpayers get the Rs. 50,000 rebate if their income is below the limit.

New Tax Rules

The new tax system has lower tax rates but no deductions. Yet, Section 87A still applies. You can still get the Rs. 50,000 rebate if you meet the rules.

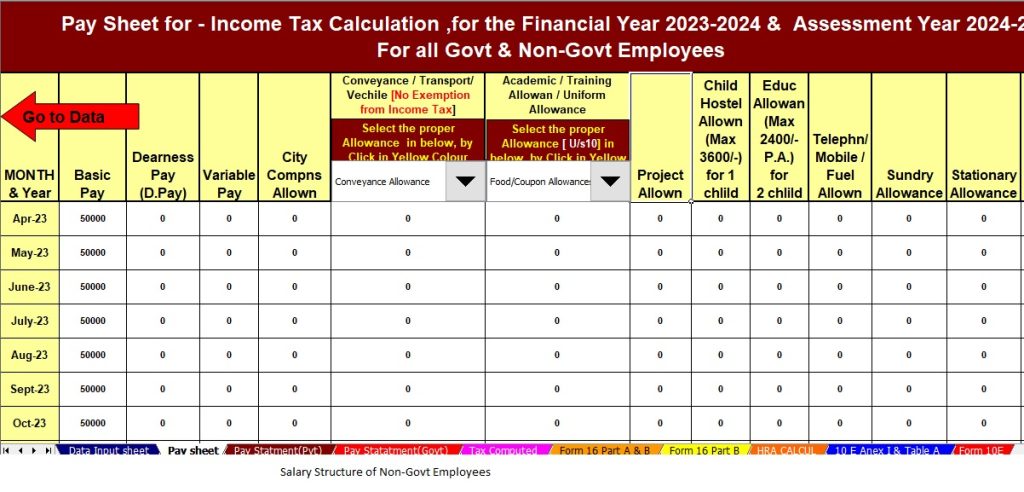

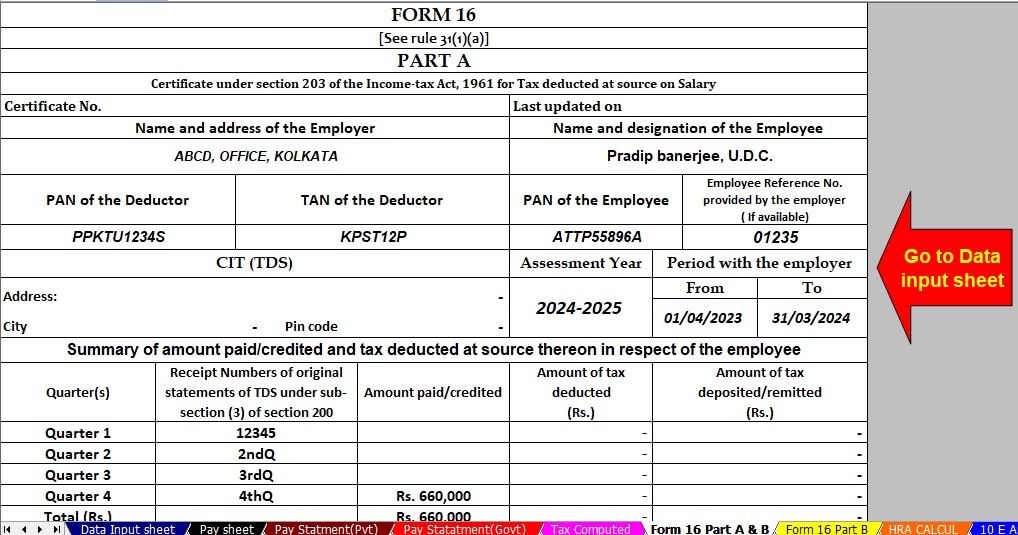

Income Tax Tool

For hassle-free tax returns, there's a new income tax tool. It suits government and non-government workers, making tax calculations easy.

Government Employees' Perks

Government employees have unique tax needs. This tool caters to them, helping them calculate income tax and claim Section 87A rebates.

Benefits for Others

Private sector employees can also benefit. This tool maximizes tax savings while following the new tax laws.

How to Get the Rebate

To get the Section 87A rebate:

- Be an individual taxpayer.

- Keep income below the limit.

- Don't use deductions that exceed the rebate.

Who Qualifies

You qualify for the Section 87A rebate if your total income is below the limit and you follow the rules.

Budget 2023 Impact

The 2023 Budget has some changes. Section 87A's Rs. 50,000 limit stays the same, but other rules may affect your taxes.

In Conclusion

In a nutshell, Section 87A gives a valuable Rs. 50,000 tax rebate, available in both old and new tax systems. To simplify tax preparation, an income tax tool suits government and non-government employees. Be aware of the rules and Budget 2023 changes for smart tax planning.

FAQs

- Does Section 87A work in both old and new tax systems?

- Yes, it works in both, allowing eligible taxpayers to get a Rs. 50,000 rebate.

- Who qualifies for the Section 87A rebate?

- Individuals with income below the limit qualify, as long as their deductions don't exceed the rebate.

- How can I calculate my income tax accurately?

- Use the handy income tax tool, designed to make tax calculations easy and maximize your savings.

- What does Budget 2023 change for Section 87A?

- The rebate limit stays at Rs. 50,000, but other tax rules may affect your overall tax situation.

- Where can I access the income tax tool?

- You can access it at the below given Link. It's designed for both government and non-government employees for the Financial Year 2023-24.

Download Auto Calculate Income Tax Preparation Software All in One in Excel for the Government and Non-Government Employees for the Financial Year 2023-24 as per Budget 2023