Download Income Tax Preparation Software in Excel for Non-Government Employees for the F.Y.2023-24. In the ever-evolving landscape of financial responsibilities, one task stands out for its complexity and importance – income tax preparation. For non-government employees, efficiently managing their tax obligations is crucial, and the use of dedicated software can significantly simplify this process. Therefore, This article explores the realm of income tax preparation software in Excel, offering insights into its benefits, features, and a step-by-step guide for the fiscal year 2023-24.

I. Introduction

Navigating the intricacies of income tax can be overwhelming, especially for non-government employees with diverse income sources. In other words, This is where the role of specialized software comes into play, providing a streamlined approach to tax preparation. In the following sections, we delve into the advantages of using Excel for this purpose and how it can revolutionize the way non-government employees approach their tax obligations.

II. Above all, Benefits of Using Excel for Income Tax Preparation

Accessibility and User-Friendly Interface

In addition, Excel, a widely used spreadsheet software, offers an accessible platform for users with varying levels of expertise. However, Its intuitive interface allows non-government employees to input their financial data effortlessly.

Customization Options for Various Financial Scenarios

For instance, One of Excel's standout features is its flexibility. Users can customize their spreadsheets to accommodate different income streams, investments, and deductions. After that, This adaptability ensures a tailored approach to tax preparation, addressing the unique financial situations of non-government employees.

III. Features of Income Tax Preparation Software in Excel

Calculation of Taxable Income

Similarly, Excel simplifies the often complex task of calculating taxable income. Therefore, By automating formulas and functions, users can accurately determine their taxable income, minimizing the risk of errors.

Deduction Tracking and Optimization

In other words, Tracking deductions is crucial for maximizing tax benefits. Excel's functionality allows users to organize and optimize their deductions efficiently, ensuring they take full advantage of available tax breaks.

Form Generation and E-Filing Capabilities

Effortlessly generate tax forms and seamlessly file your returns electronically using Excel. However, This feature eliminates the need for manual paperwork, reducing the likelihood of errors and expediting the filing process.

IV. Step-by-Step Guide for F.Y. 2023-24 Tax Preparation

Setting Up the Spreadsheet

Above all, Begin by creating a dedicated worksheet for your tax preparation. In addition, Designate sections for income, deductions, and other relevant categories.

Inputting Income Details

After that, Enter all income details accurately, including salary, bonuses, investments, and any additional income sources.

Maximizing Deductions

Utilize Excel's functions to track and optimize deductions. Similarly, Identify eligible expenses and ensure you claim all applicable deductions for the fiscal year.

Finalizing the Tax Return

Review your spreadsheet, verify calculations, and cross-check the information. Once satisfied, proceed to finalize and save your tax return.

V. Common Challenges and Solutions

Handling Complex Financial Situations

For individuals with intricate financial portfolios, Excel might present challenges. Seek assistance from financial advisors or online resources to navigate complex scenarios.

Troubleshooting Common Errors in Excel

Excel is not immune to errors. Be vigilant in reviewing your spreadsheet, double-check formulas, and use built-in tools for error detection and correction.

Tips for Efficient Tax Preparation

However, Maintain organized records, stay informed about tax law changes, and leverage Excel's features effectively to streamline your tax preparation process.

VI. Why Choose Excel Over Other Software Options

Cost-Effectiveness

Unlike some dedicated tax software, Excel comes at a lower cost, making it an attractive option for budget-conscious individuals.

Similarly, Familiarity and Widespread Usage

Therefore, Many individuals are already familiar with Excel, reducing the learning curve associated with adopting new software for tax preparation.

Flexibility for Personalization

In other words, Excel's adaptability allows users to personalize their tax preparation experience, catering to individual preferences and financial situations.

VII. However, Tips for Optimizing Your Tax Return

Staying Organized Throughout the Year

Maintain a system for organizing financial documents throughout the year. Above all, This practice eases the tax preparation process and minimizes stress.

Keeping Abreast of Tax Law Changes

In addition, Tax laws can change annually. Stay informed about any updates or modifications that may impact your tax situation.

Utilizing Excel Functions Effectively

After that, Invest time in learning and mastering Excel functions relevant to tax preparation. Similarly, This knowledge will enhance your efficiency and accuracy.

VIII. Real-Life Success Stories

Incorporating Excel into the tax preparation routine has yielded success for many individuals. Personal anecdotes showcase the positive impact of using Excel, inspiring others to adopt this approach.

IX. The Future of Income Tax Preparation

In other words, As technology continues to advance, the landscape of income tax preparation is expected to evolve. Above all, Predictions indicate a shift towards more user-friendly interfaces, automation, and increased integration with financial platforms.

X. In conclusion,

In conclusion, adopting income tax preparation software in Excel for non-government employees for the F.Y.2023-24 brings numerous advantages. From accessibility and user-friendliness to customization and e-filing capabilities, Therefore, Excel provides a comprehensive solution. By following the step-by-step guide and incorporating the provided tips, individuals can navigate tax season with confidence.

XI. Frequently Asked Questions

- Is Excel suitable for individuals with complex financial portfolios?

- Excel can handle complex scenarios, but seeking professional advice may be beneficial.

- How can I troubleshoot errors in my Excel tax preparation spreadsheet?

- Use Excel's built-in tools, review formulas, and consult online resources for guidance.

- Is Excel secure for storing sensitive tax information?

- Yes, Excel allows users to password-protect their files, adding an extra layer of security.

- Can I use Excel on multiple devices for collaborative tax preparation?

- Yes, Excel supports cloud storage and collaboration features for seamless teamwork.

- Are there any limitations to using Excel for tax preparation?

- While Excel is versatile, individuals with extremely complex financial situations might find dedicated software more suitable.

- How often should I update my Excel tax preparation spreadsheet?

- Regular updates are recommended, especially after significant financial changes or tax law updates.

Non-government (Private) Employees for the F.Y. 2023-24 and A.Y. 2024-25 can download All-in-One Automated Income Tax Preparation Excel-based software, equipped with the following features:

- The software calculates taxes by Budget 2023, considering both the New and Old Tax Regimes under U/s 115 BAC.

- For instance, It incorporates its Salary Structure tailored to match that of Non-Government (Private) Employees.

- For instance, The Excel Utility automatically generates your Income Tax Computed Sheet; simply input the required data.

- For instance, It calculates House Rent Exemption under U/s 10(13A) effortlessly.

- The utility includes a distinct Salary Sheet for comprehensive financial tracking.

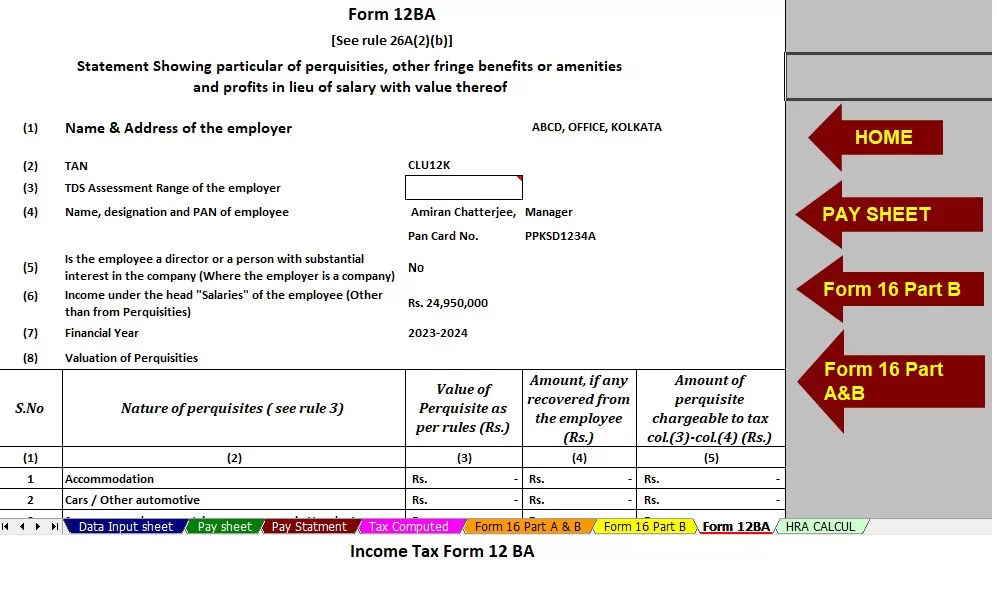

- For instance, It features the Value of Perquisite Form 12 BA within its functionalities.

- The Excel Utility concurrently prepares your Form 16 Part B automatically for FY 2023-24.

- Additionally, it can simultaneously generate Form 16 Part A and B for FY 2023-24."