Form 16 Part B plays a pivotal role in the financial landscape, especially for employers responsible for a large workforce. Therefore, As the financial year 2023-24 begins, the need to efficiently prepare Form 16 Part B for 100 employees becomes paramount. This article guides you through the process, ensuring accuracy, efficiency, and compliance.

Understanding Form 16 Part B for F.Y.2023-24

Form 16 Part B is a comprehensive document that outlines the salary details and tax deductions for employees. In other words, In the current financial year, there have been noteworthy changes, making it crucial for employers to stay informed.

Excel as a Tool for Form 16 Part B Preparation

However, Excel emerges as a powerful tool for preparing Form 16 Part B. Its versatility and user-friendly features make it an ideal choice for managing the intricate details of employee finances.

Setting Up Your Excel Workbook

Above all, Creating individual sheets for each employee streamlines the preparation process. Inputting details like income, deductions, and exemptions into the workbook ensures accuracy in the final Form 16 Part B.

Importance of Accuracy in Form 16 Part B

Errors in Form 16 Part B can lead to complications for both employers and employees. This section addresses common mistakes and emphasizes the importance of adherence to tax regulations.

Time-Saving Tips for Efficient Form 16 Part B Preparation

Optimizing the use of Excel shortcuts and efficient data entry techniques can significantly reduce the time spent on preparing Form 16 Part B.

Bulk Processing for 100 Employees

In addition, Managing a large dataset requires strategic planning. This section provides insights into avoiding bottlenecks and ensuring a smooth preparation process for all 100 employees.

Ensuring Security and Confidentiality

Implementing password protection and other security measures safeguards sensitive employee information, instilling trust in the preparation process.

Common Challenges and Solutions

Addressing challenges such as data consistency issues and Excel errors ensures a seamless preparation process for Form 16 Part B.

Automation Tools for Form 16 Part B Preparation

Explore the benefits of incorporating automation tools to streamline the preparation process and reduce the likelihood of errors.

Staying Updated with Taxation Regulations

Regularly checking for updates in tax laws and adapting your preparation process accordingly ensures compliance with the latest regulations.

Employee Communication and Distribution

Crafting informative messages and adopting secure methods for distributing Form 16 Part B enhances the communication process with employees.

Feedback and Continuous Improvement

Gathering feedback from employees and making iterative improvements in the preparation process contributes to ongoing efficiency.

Conclusion

In conclusion, the preparation of Form 16 Part B for 100 employees is a task that demands attention to detail and efficiency. By following the outlined strategies, employers can navigate this process seamlessly, ensuring compliance, accuracy, and employee satisfaction.

FAQs

- Q: Can I prepare Form 16 Part B manually without using Excel?

- A: While possible, using Excel streamlines the process and reduces the likelihood of errors.

- Q: Are there any specific changes in Form 16 Part B for the F.Y.2023-24?

- A: Yes, be sure to stay updated on the latest changes in tax regulations for the current financial year.

- Q: How often should I update the Excel workbook for Form 16 Part B?

- A: Regular updates are recommended, especially when there are changes in employee details or tax laws.

- Q: Is it necessary to password-protect the Excel workbook?

- A: Yes, password protection adds an extra layer of security to sensitive employee information.

- Q: Are there any recommended automation tools for Form 16 Part B preparation?

- A: Explore available tools and choose one that aligns with your organization's needs.

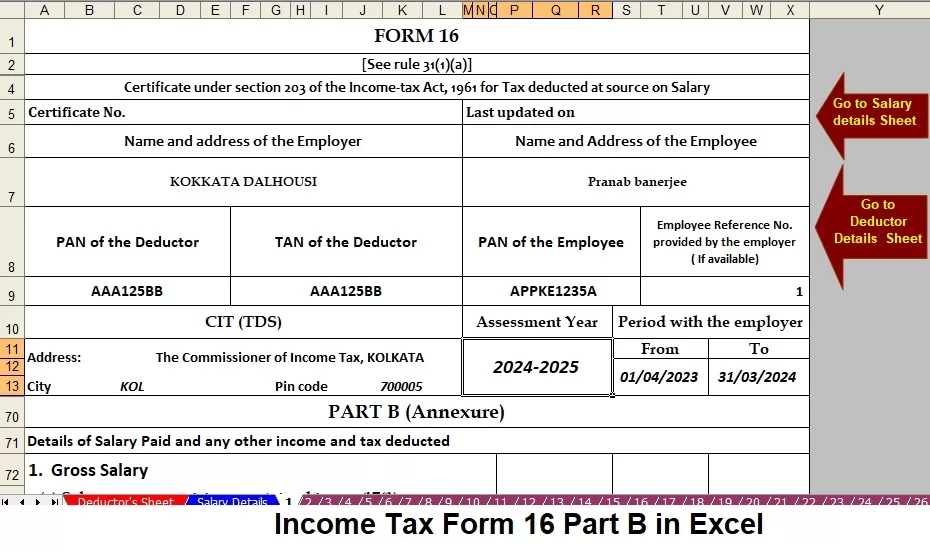

Download the Automatic Income Tax Master of Form 16 Part B in Excel, enabling it to simultaneously prepare Form 16 Part B for 100 employees during the financial year 2023-24.

This Excel Utility boasts the following features:

- It prepares Form 16 for 100 employees in Part B simultaneously for FY 2023-24.

- It automatically calculates your Income Tax liabilities based on the Income Tax Slab in both the New and Old Tax Regimes.

- For instance, The Excel Utility showcases a unique Salary Structure for individuals in alignment with the Budget 2023.

- It incorporates all amended Income Tax Sections as modified in the Budget 2023-24 for both the New and Old Tax Regime.

- The Excel Utility eliminates the risk of double or duplicate names and Pan Entries by preventing the duplication of Pan Numbers for each employee.

- For instance, It formats Form 16 Part B to fit A-4 paper size for easy printing.

- The utility automatically converts amounts into words without requiring any Excel Formula.

- It is suitable for use by both Government and Non-Government entities.

- This simple Excel file, known as the Excel Utility, allows you to download and start filling in data on the input sheet, magically preparing Form 16 Part B for 100 employees simultaneously.

- You can prepare and save employee data on your system. It is compatible with Office 2003, 2007, 2010, and 2011 MS Office versions.