Introduction to Income Tax Form 10E

Income tax filing is an annual ritual for individuals, and it often comes with its fair share of complexities. Therefore, One crucial aspect of the process is Form 10E, which plays a significant role in adjusting tax liabilities. Therefore, In this article, we will delve into the intricacies of Form 10E and shed light on the updated Excel-based automatic revised version for the financial year 2023-24.

In other words, The Significance of Revised Income Tax Forms

As financial landscapes evolve, so do tax regulations. In other words, Revised income tax forms, like Form 10E, ensure that taxpayers can accurately reflect their financial status, deductions, and exemptions. This not only streamlines the filing process but also ensures compliance with the latest tax laws.

However, Understanding Excel-Based Automatic Revised Forms

In an era dominated by technology, the government has embraced the digital wave, offering taxpayers more convenient ways to fulfil their obligations. For instance, The Excel-based automatic revised Form 10E is a testament to this evolution. This user-friendly form simplifies the entire process, making it accessible to individuals with varying degrees of financial expertise.

Above all, the Advantages of Using Excel-Based Forms

However, The transition to Excel-based forms brings several advantages to the table. Firstly, it eliminates the need for manual calculations, reducing the chances of errors. Additionally, the interactive nature of the Excel format allows for a smoother and more intuitive user experience. In addition, Taxpayers can navigate through the form effortlessly, ensuring accuracy and completeness.

After that, Step-by-Step Guide to Downloading Form 10E for F.Y.2023-24

Above all, Let’s break down the process of obtaining the Excel-based Form 10E for the financial year 2023-24. Follow these steps to ensure a hassle-free experience:

1. Visit the Official Income Tax Website

Navigate to the official website of the income tax department.

2. Locate the ‘Forms’ Section

Look for the ‘Forms’ section on the website. This is typically found in the ‘Downloads’ or ‘Resources’ tab.

3. Select the Appropriate Financial Year

Identify the financial year 2023-24 and find Form 10E in the list of available forms.

4. Download the Excel Version

Click on the download link for the Excel-based version of Form 10E.

5. Therefore, Save the Form to Your Device

Once downloaded, save the form to your computer or device for easy access.

How to Fill Out the Excel-Based Form

Now that you have the form, the next crucial step is to fill it out accurately. Similarly, The Excel-based format simplifies this process, allowing you to input information in designated cells. Ensure you have all necessary documents, such as salary slips and investment proofs, before you begin.

In addition, Common Mistakes to Avoid

Despite the user-friendly nature of the Excel-based Form 10E, some common mistakes can still occur. Avoid errors by double-checking all entered information. Common pitfalls include incorrect PAN details, mismatched income figures, and overlooking eligible deductions.

After that, Tips for Efficiently Completing Form 10E

To streamline the process further, consider these tips:

- Keep all supporting documents organized.

- Take advantage of available online resources for guidance.

- Seek professional assistance if needed.

Benefits of Timely Submission

Submitting Form 10E within the stipulated timeframe comes with its own set of advantages. Timely submissions ensure that your revised income details are processed promptly, preventing any delays or complications in your tax assessments.

Changes in Form 10E for the Financial Year 2023-24

Stay informed about the specific changes introduced in Form 10E for the financial year 2023-24. Be aware of any new sections, revised calculations, or additional requirements to avoid any discrepancies in your filing.

Frequently Asked Questions (FAQs) about Form 10E

- Q: Can I submit Form 10E manually?

- A: No, the Excel-based version must be filled out digitally and submitted online.

- Q: What happens if I miss the deadline for Form 10E submission?

- A: Late submissions may incur penalties, and the revised details might not be considered for the current assessment year.

- Q: Are there any eligibility criteria for using Form 10E?

- A: Yes, individuals claiming relief under Section 89(1) need to fill out Form 10E.

- Q: Can I revise Form 10E after submission?

- A: No, once submitted, revisions are not allowed, so ensure accuracy before finalizing.

- Q: How can I track the status of my Form 10E submission?

- A: Visit the official income tax portal and use the provided tracking tools for real-time updates.

In conclusion,

Navigating the intricacies of income tax forms can be daunting, but the transition to Excel-based automatic revised Form 10E for the financial year 2023-24 marks a positive step toward simplicity and accuracy. By staying informed, adhering to guidelines, and utilizing technology, taxpayers can ensure a seamless filing experience.

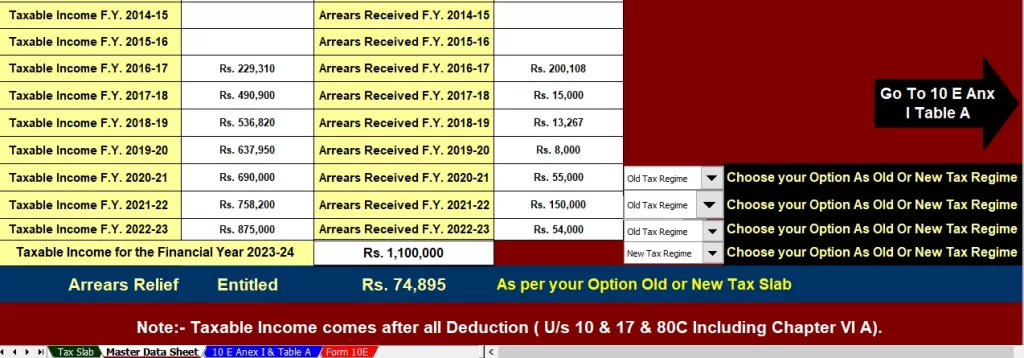

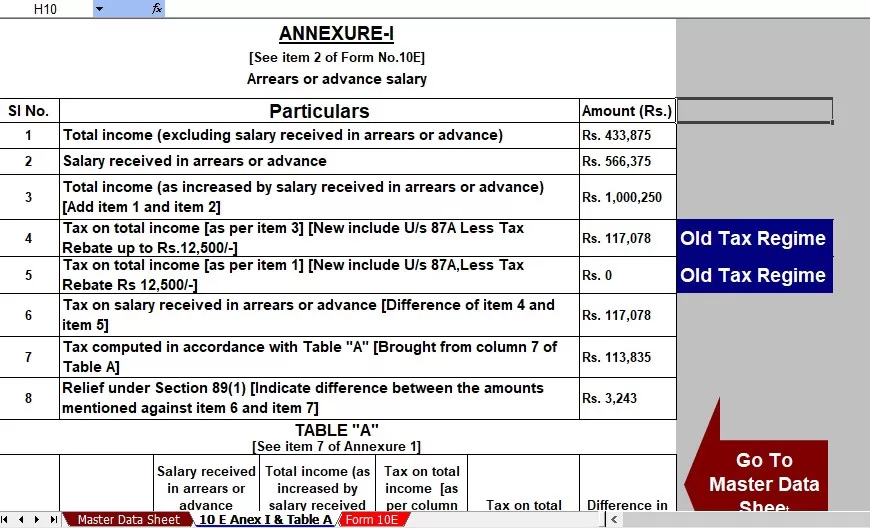

Download the Excel-based Automatic Income Tax Arrears Relief Calculator under Section 89(1) with the updated Form 10E for the Financial Year 2023-24.

Key features of this Excel Utility include:

- The Excel Utility prepares the Arrears Relief Calculator.

- It calculates the Arrears Relief Calculator U/s 89(1) from the Financial Year 2000-01 to the Financial Year 2023-24 (Updated).

- The Excel Utility can calculate under both the New and Old Tax Regimes from the F.Y.2020-21 onward U/s 115 BAC.

- Both Government and Non-Government Employees can use this Excel Utility.

- It is easy to generate, and anyone can utilize this Utility.”