In the dynamic realm of business and finance, maintaining a competitive edge is essential. One area where this is particularly true is tax compliance, and more specifically, in the preparation of Form 16 Part B. Therefore, This essential document holds significant weight in the realm of income tax filing, making its accurate and timely preparation a priority for businesses and employees alike.

Understanding Form 16 Part B

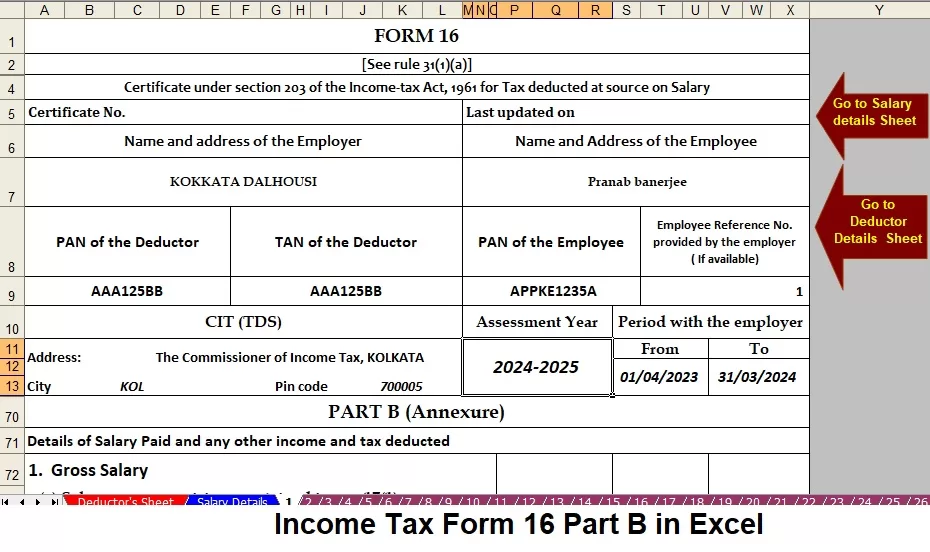

Above all, Form 16 Part B is a critical document that provides a detailed overview of an employee’s income and the taxes deducted by the employer. In other words, It serves as a comprehensive record that aids individuals in filing their income tax returns. The meticulous preparation of this form ensures compliance with tax regulations and smoothens the tax filing process for employees.

However, the Key Features of the Automated System

Embracing technological solutions has become a hallmark of modern business practices, and the preparation of Form 16 Part B is no exception. Automated systems designed to handle this task come with a host of features that make the process efficient and error-free.

Preparing Form 16 Part B for 50 Employees at Once

One of the standout advantages of using an automated system is its ability to handle bulk data effortlessly. For businesses with 50 employees or more, this translates to substantial time savings and increased efficiency in HR processes.

Adaptability to Old and New Tax Regime

As tax regulations evolve, businesses must adapt. The automated system for Form 16 Part B ensures compatibility with both the Old and New Tax Regime, offering flexibility and peace of mind for employers and employees alike.

User-Friendly Excel Interface

Navigating through complex tax forms can be daunting, but the automated system’s user-friendly Excel interface simplifies the process. Even individuals with basic Excel skills can use the system with ease, fostering accessibility for all users.

Ensuring Accuracy and Compliance

Accuracy in tax documentation is non-negotiable. The automated system minimizes errors and ensures compliance with the latest tax regulations, providing a reliable and secure platform for Form 16 Part B preparation.

Security Measures in Place

Safeguarding sensitive employee data is a top priority. The automated system incorporates robust security measures, ensuring that confidential information remains protected throughout the preparation process.

Benefits for Employers

For employers, adopting automated Form 16 Part B preparation translates to streamlined HR processes and reduced workload. The efficiency gained in this aspect allows businesses to focus on strategic initiatives rather than getting bogged down by administrative tasks.

Employee Perspective: Convenience and Clarity

From the employee’s perspective, automated Form 16 Part B brings convenience and clarity to the often complex world of taxation. Accessing and understanding tax-related information becomes a straightforward process, enhancing the overall experience.

Cost-Effectiveness of Automated Form 16 Part B Preparation

Comparing the costs associated with manual and automated processes reveals a clear advantage for the latter. The initial investment in adopting automation pays off in the long run through reduced operational costs and increased efficiency.

Adopting Technology for Tax Compliance

In a world driven by technological advancements, businesses are encouraged to embrace automation for tax compliance. Staying technologically updated is not just a trend but a necessity for ensuring efficiency and accuracy in financial processes.

Future Trends in Tax Form Preparation

Looking ahead, the future of tax form preparation is likely to witness further advancements in technology. Businesses and individuals who stay informed and embrace these changes will be better positioned to navigate the complexities of tax compliance.

Testimonials and Success Stories

Real-life examples of businesses benefiting from automated Form 16 Part B preparation serve as a testament to the system’s effectiveness. Positive feedback from users underscores the advantages in terms of time savings, accuracy, and overall convenience.

Conclusion

In conclusion, the download of Automatic Income Tax Form 16 Part B in Excel proves to be a game-changer for businesses and employees alike. The article has explored the various facets of this automated system, highlighting its efficiency, adaptability, and user-friendly features. As businesses continue to evolve, staying ahead in tax compliance through technological solutions becomes imperative.

Frequently Asked Questions (FAQs)

- Is the automated system compatible with both Old and New Tax Regime?

- Yes, the system is designed to cater to both Old and New Tax Regime, ensuring flexibility for users.

- How secure is the automated system in handling sensitive employee data?

- The system incorporates robust security measures to safeguard confidential information during the preparation process.

- Can businesses with a large number of employees benefit from this automated solution?

- The system is designed to handle bulk data

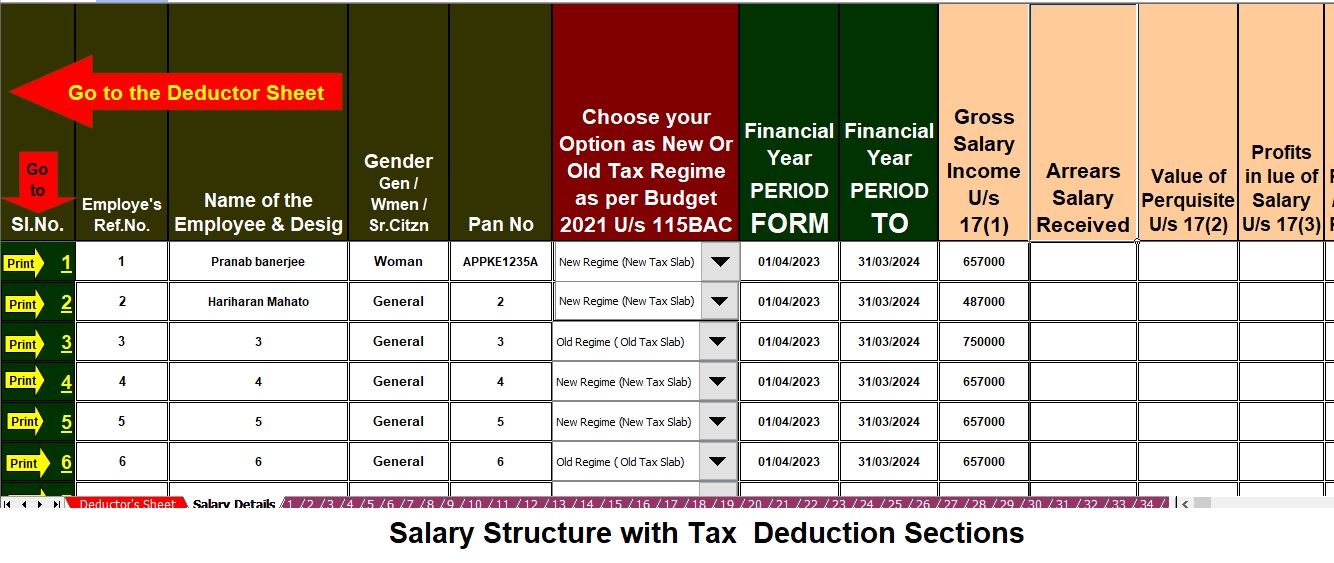

Download the Automatic Income Tax Master of Form 10 Part B in Excel, a versatile tool capable of preparing Form 16 Part B for 50 employees simultaneously for the FY 2023-24.

Features of this Excel Utility:

- Prepare both Form 16 Part B for 50 employees at once for FY 2023-24.

- Automatically calculate your Income Tax Liabilities based on the Income Tax Slab in both the New and Old Tax Regimes.

- Incorporates a unique Salary Structure for individuals aligned with the Budget 2023.

- Includes all amended Income Tax Sections as per the modifications outlined in the Budget 2023-04, covering both New and Old Tax Regimes.

- Prevents duplication of Pan Numbers for each employee, eliminating the risk of double entries.

- Enables printing of Form 16 Part B on A-4 size papers.

- For instance, Automatically converts amounts into words without the need for complex Excel formulas.

- Suitable for use by both Government and Non-Government entities.

- A simple Excel file that, upon download, allows you to start inputting data on the provided sheet, magically preparing Form 16 Part B for 50 employees simultaneously.

- Compatible with Office 2003, 2007, 2010, and 2011 MS Office versions.