Introduction:

In the realm of income tax, understanding and accurately calculating arrears relief under section 89(1) is crucial for taxpayers. Therefore, this article provides a step-by-step guide on how to calculate arrears relief using the Automatic Form 10E in Excel for the Financial Year (F.Y.) 2023-24.

Section 89(1) Overview:

In other words, Section 89(1) of the Income Tax Act, of 1961, addresses the tax treatment of salary arrears or advances received by an employee. When an employee receives arrears in a particular financial year that relates to a different year, the tax liability is calculated considering the income for the respective years.

However, Utilizing Form 10E:

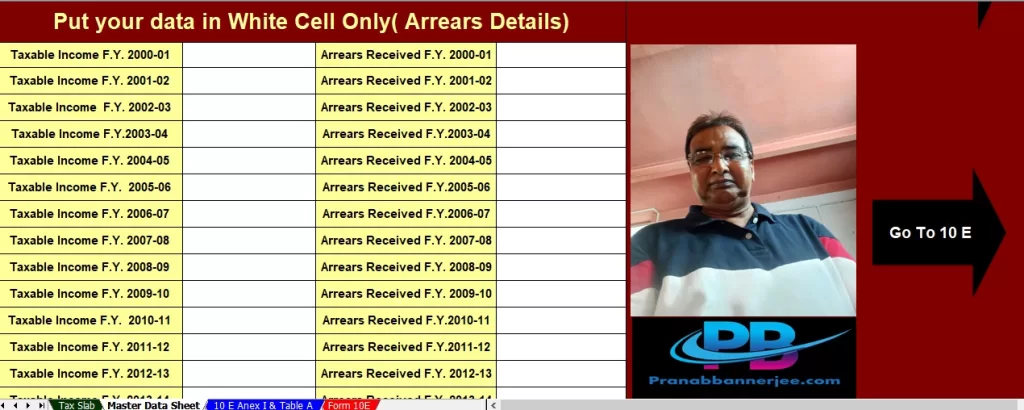

- Download and Open Form 10E: Begin by downloading Form 10E from the official Income Tax Department website. Open the form in Excel, which provides a user-friendly interface for calculations.

- Personal Information: Enter your details in the designated fields. Ensure accuracy in providing details such as name, PAN, and assessment year (2023-24 in this case).

- Financial Year Details: Specify the relevant financial year for which arrears are being calculated. Mention the assessment year for which the arrears relate.

- Employer Information: Fill in details regarding your employer, including the name, address, and PAN. Accurate information ensures seamless computation.

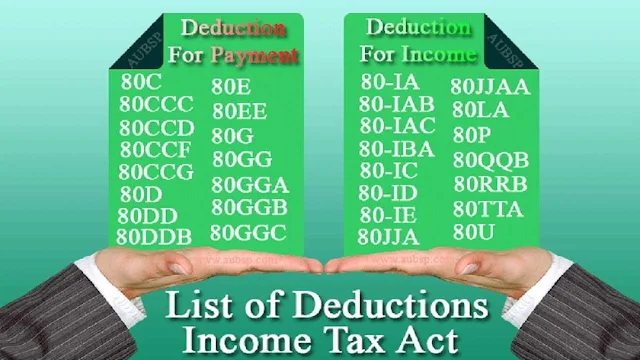

- Salary Details: Enter your salary details for the year of arrears receipt. This includes basic salary, allowances, bonuses, and any other components that contribute to your total income.

- Tax Computation: After that, Excel's formulas come into play here. Utilize the appropriate formulae to compute the tax liability for the current year without arrears and with arrears. The difference represents the additional tax liability due to the arrears.

- Relief Calculation: Section 89(1) relief is calculated by determining the average tax liability for the years without arrears and with arrears. The relief is the difference between the tax on the total income of the respective years.

- Enter Relief Details in Form 10E: Input the relief amount calculated in the appropriate field of Form 10E. The form will automatically adjust your tax liability, providing the relief you are entitled to.

- Verification and Submission: Carefully review the filled form for accuracy. Once satisfied, save the form and submit it along with your income tax return.

- Keep Records: Maintain a copy of Form 10E, as well as supporting documents, for future reference. This documentation is essential for any potential scrutiny by tax authorities.

In conclusion,

In addition, Mastering the art of calculating arrears relief under section 89(1) is crucial for every taxpayer. Above all, By using the Automatic Form 10E in Excel for the F.Y. 2023-24, individuals can streamline the process and ensure accurate computations. Staying informed and compliant with tax regulations not only avoids legal complications but also helps in optimizing financial planning.

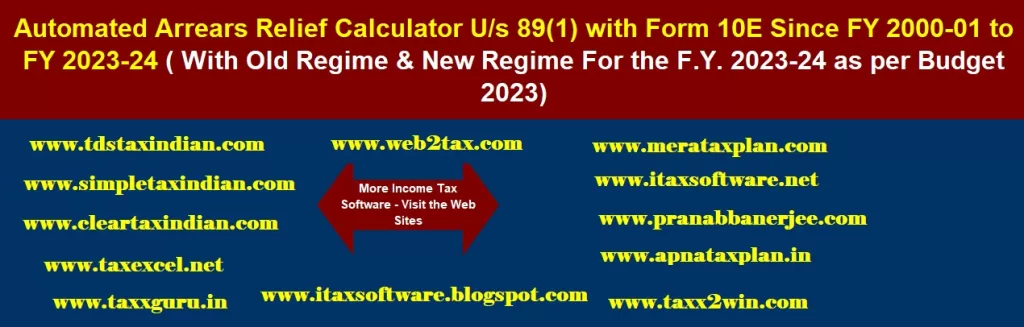

Download Automatic Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E in revised format for the F.Y.2023-24