Form 10E is an essential document for taxpayers, particularly for those seeking relief in income tax filing for the financial year 2023-24. Therefore, This article aims to provide a comprehensive guide on downloading and understanding Form 10E in Excel format.

Introduction to Form 10E

Form 10E, also known as "Form for relief under section 89(1)", is a document prescribed by the Income Tax Department of India. In other words, It is utilized by taxpayers to claim relief under section 89(1) of the Income Tax Act, of 1961.

Understanding the Purpose of Form 10E

However, The primary purpose of Form 10E is to provide relief to taxpayers who receive salary in arrears or advance. It ensures that taxpayers are not unfairly taxed in the year of receipt of such arrears or advances.

Eligibility Criteria for Filing Form 10E

Taxpayers who have received salary arrears or advance and wish to claim relief under section 89(1) are eligible to file Form 10E. However, it's crucial to meet certain criteria set by the Income Tax Department to qualify for this relief.

Importance of Form 10E in Income Tax Filing

Form 10E plays a crucial role in income tax filing as it allows taxpayers to reduce the tax burden arising from salary arrears or advances. By claiming relief under section 89(1), taxpayers can ensure fair taxation and avoid overpayment of taxes.

How to Download Form 10E in Excel Format

For instance, Downloading Form 10E in Excel format is a straightforward process. Taxpayers can use the link to download the form.

Above all, Step-by-Step Guide to Filling Out Form 10E

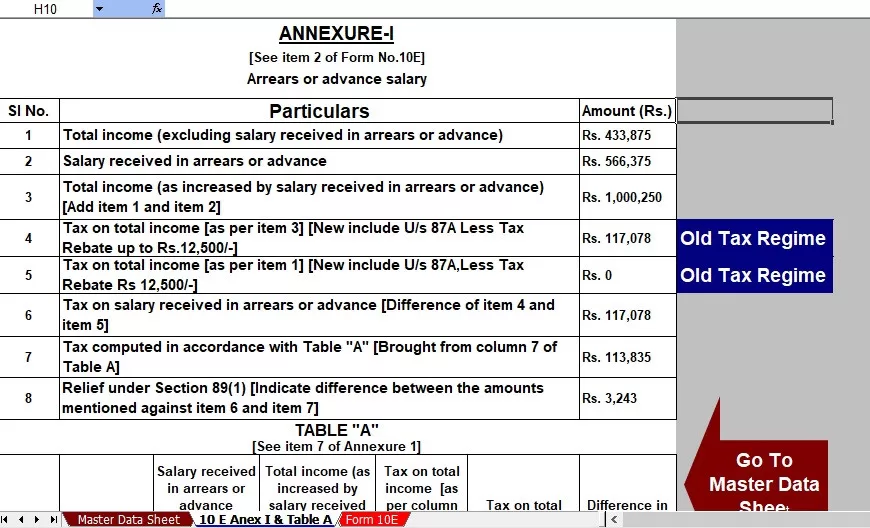

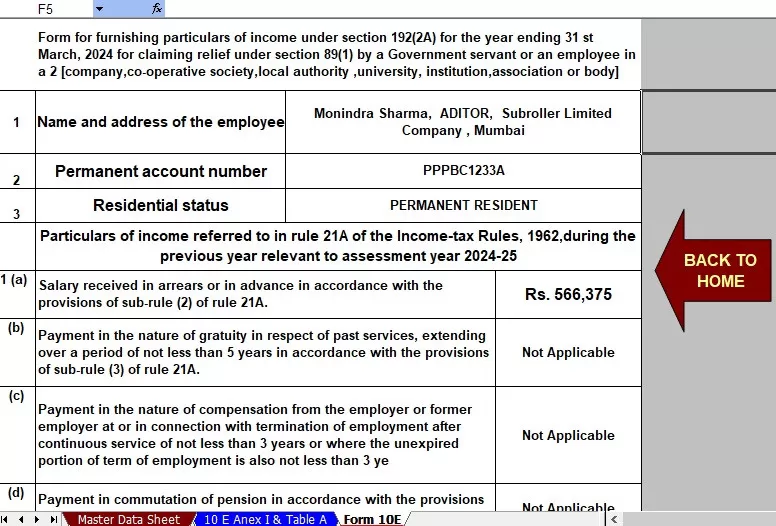

In addition, Filling out Form 10E requires careful attention to detail to ensure accuracy and compliance with tax regulations. Here's a step-by-step guide to completing the form:

- Start by entering personal details such as name, PAN, and assessment year.

- Provide details of the previous year's tax computation and tax deducted at source (TDS).

- Enter details of salary received in arrears or advance.

- Calculate relief under section 89(1) using the prescribed formula.

- Verify all information provided and ensure accuracy before submission.

After that, Tips for Error-Free Completion of Form 10E

To avoid errors while completing Form 10E, taxpayers should:

- Double-check all entered details for accuracy.

- Ensure compliance with the Income Tax Act and relevant regulations.

- Seek assistance from tax professionals if needed.

Frequently Asked Questions (FAQs) about Form 10E

What is Form 10E?

Form 10E is a document used by taxpayers to claim relief under section 89(1) of the Income Tax Act, 1961.

Who needs to fill out Form 10E?

Taxpayers who have received salary arrears or advance and wish to claim relief under section 89(1) need to fill out Form 10E.

How does Form 10E benefit taxpayers?

Form 10E allows taxpayers to reduce the tax burden arising from salary arrears or advances, ensuring fair taxation.

Is it mandatory to submit Form 10E?

While it's not mandatory, taxpayers are encouraged to submit Form 10E to claim relief under section 89(1) and avoid overpayment of taxes.

Where can I find assistance with Form 10E?

Taxpayers can seek assistance from tax professionals or refer to the official website of the Income Tax Department for guidance on Form 10E.

In conclusion, Form 10E serves as a vital tool for taxpayers seeking relief in income tax filing for the financial year 2023-24. By understanding its purpose, eligibility criteria, and the process of downloading and filling out the form, taxpayers can ensure compliance with tax regulations and minimize their tax liability.

Download the updated version of the Excel-based Income Tax Arrears Relief Calculator, including Form 10E under section 89(1), covering the financial years from 2000-01 to 2023-24.