Are you ready to simplify your tax filing process? If you're looking for an easy way to manage your income tax documents, you're in luck! In this guide, Therefore, we'll walk you through how to download the Automatic Income Tax Form 16 Part B in Excel for the Financial Year 2023-24. Whether you're a seasoned taxpayer or new to the process, we've got you covered with step-by-step instructions and helpful tips.

Table of Contents

| Sr# | Headings |

| 1. | Understanding Income Tax Form 16 Part B |

| 2. | Importance of Form 16 in Excel |

| 3. | Benefits of Using Automatic Form 16 |

| 4. | How to Download Automatic Form 16 in Excel? |

| 5. | Step-by-Step Guide |

| 6. | Common Mistakes to Avoid |

| 7. | Tips for Using Form 16 Effectively |

| 8. | Frequently Asked Questions (FAQs) |

| 9. | Conclusion |

Understanding Income Tax Form 16 Part B

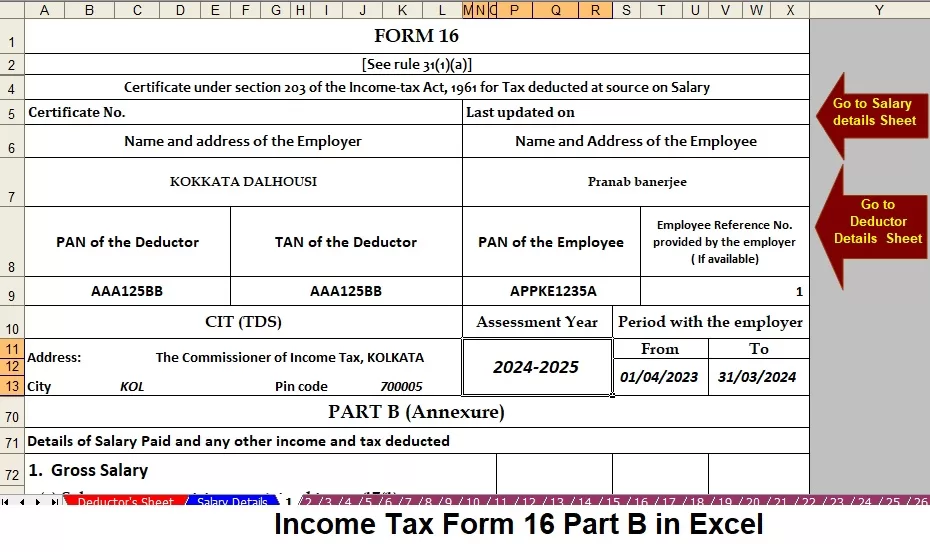

Income Tax Form 16 Part B is a crucial document issued by employers to their employees. It provides a comprehensive summary of the income earned by an individual during a particular financial year and the taxes deducted at source (TDS) by the employer. Part B specifically contains details of salary income, tax deductions, and any other income sources.

In other words, the Importance of Form 16 in Excel

However, Form 16 in Excel format offers several advantages over traditional paper formats. It allows for easy editing, customization, and calculations. Moreover, it simplifies the process of tax filing by providing a structured layout for income details and deductions, reducing the chances of errors.

For instance, the Benefits of Using Automatic Form 16

Automatic Form 16 generation streamlines the entire process of tax documentation. It eliminates manual errors, saves time, and ensures accuracy in calculations. Additionally, it provides a digital record of income and taxes, making it easier to maintain and access when needed.

Above all, How to Download Automatic Form 16 in Excel?

Downloading Automatic Form 16 in Excel is a straightforward process. Follow these steps to get started:

In addition, Step-by-Step Guide

- Download the Form 16 Part B from the below-given link

- Download the Excel format: Click on the download option next to the Excel format to initiate the download.

- Verify the details: Once downloaded, verify that all the details in the form are accurate and complete.

- Save the file: Save the downloaded file in a secure location on your device for future reference.

Common Mistakes to Avoid

When downloading Form 16 in Excel, be mindful of the following common mistakes:

- Entering incorrect financial year: Ensure that you select the correct financial year to download the relevant Form 16.

- Ignoring updates: Check for any updates or revisions to the form before downloading to ensure compliance with current regulations.

- Not verifying details: Always double-check the details provided in the form to avoid discrepancies later during tax filing.

Tips for Using Form 16 Effectively

To make the most of Form 16 in Excel, consider the following tips:

- Keep backups: Maintain backup copies of Form 16 in multiple locations to prevent loss of data.

- Organize your documents: Create a systematic folder structure to store all your tax-related documents for easy access.

- Seek professional assistance if needed: If you're unsure about any aspect of tax filing, don't hesitate to seek guidance from a tax consultant or financial advisor.

Frequently Asked Questions (FAQs)

- Can I use Form 16 for filing my income tax returns? Yes, Form 16 provides essential details required for filing income tax returns and serves as a supporting document.

- What should I do if I notice errors in Form 16? If you identify any errors in Form 16, promptly notify your employer for corrections and obtain a revised copy.

- Is Form 16 mandatory for all taxpayers? Form 16 is primarily issued to salaried individuals by their employers. However, it may not be applicable to taxpayers with income from other sources.

- Can I request a duplicate Form 16 if I lose the original? Yes, you can request a duplicate Form 16 from your employer if you lose the original copy.

- Is it necessary to file Form 16 physically or digitally? You can file Form 16 electronically by uploading it along with your income tax returns on the Income Tax Department's portal.

Conclusion

In conclusion, downloading Automatic Income Tax Form 16 Part B in Excel for the F.Y. 2023-24 offers numerous benefits, including convenience, accuracy, and efficiency in tax filing. By following the step-by-step guide and implementing the provided tips, taxpayers can simplify their tax documentation process and ensure compliance with regulatory requirements. Make the most of this digital tool to streamline your tax-related tasks and stay organized throughout the year.

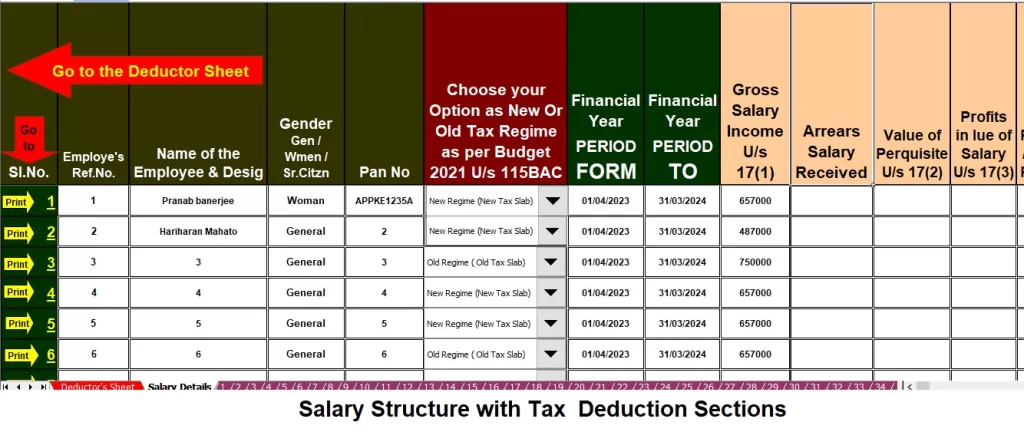

Download the Automatic Income Tax Master of Form 16 Part B in Excel, capable of preparing Form 16 Part B for 50 employees simultaneously for the Financial Year 2023-24.

- This Excel Utility can efficiently generate Form 16 Part B for 50 employees at once for FY 2023-24.

- Automatically calculates your Income Tax liabilities based on both the New and Old Tax Regimes.

- Incorporates a unique Salary Structure tailored to individuals according to the Budget 2023.

- Includes all updated Income Tax Sections as per the Budget 2023-04 for both the New and Old Tax Regime.

- Prevents duplication of PAN numbers for each employee, ensuring no duplicate entries.

- Print Form 16 Part B on A4-sized paper.

- Automatically converts amounts into words without the need for Excel formulas.

- Suitable for use by both Government and Non-Government entities.

- Simply download the Excel file, input the data into the sheet, and effortlessly generate Form 16 Part A&B for 50 employees simultaneously.

- Allows you to save employee data on your system and is compatible with Office versions 2003, 2007, 2010, and 2011.