Are you ready to tackle the task of preparing Form 16 Part B for your employees efficiently and accurately? In this guide, we'll walk you through the process step by step, ensuring that you're equipped with all the knowledge you need to make this tax season a breeze.

Table of Contents

| Sr# | Headings |

| 1. | Understanding Form 16 |

| 2. | Importance of Form 16 Part B |

| 3. | Gathering Employee Information |

| 4. | Downloading Form 16 Part B |

| 5. | Organizing Data in Excel |

| 6. | Importing Data into Excel |

| 7. | Formatting and Calculations |

| 8. | Validating the Form 16 Part B |

| 9. | Saving and Distributing Form 16 Part B |

| 10. | Ensuring Compliance |

| 11. | Common Mistakes to Avoid |

| 12. | Additional Resources |

1. Understanding Form 16

Form 16 is a crucial document issued by employers to their employees, detailing the salary earned and taxes deducted during the financial year. It serves as a proof of TDS (Tax Deducted at Source) for employees.

2. Importance of Form 16 Part B

Form 16 Part B specifically provides a detailed breakup of the salary, allowances, deductions, and taxes paid by the employee. It is essential for filing income tax returns accurately.

3. Gathering Employee Information

Start by collecting all necessary details from your employees, including their PAN (Permanent Account Number), salary structure, deductions, and other relevant information.

4. Downloading Form 16 Part B

Access the TRACES (TDS Reconciliation Analysis and Correction Enabling System) website and download the Form 16 Part B zip file for all your employees.

5. Organizing Data in Excel

Create a structured Excel sheet with columns for employee details such as name, PAN, salary components, deductions, and tax calculations.

6. Importing Data into Excel

Extract the contents of the downloaded zip file and import the Form 16 Part B text files into your Excel sheet.

7. Formatting and Calculations

Format the Excel sheet to ensure clarity and accuracy. Use formulas to calculate taxable income, deductions, and tax liability for each employee.

8. Validating the Form 16 Part B

Double-check all calculations and ensure that the information matches the details provided by the employees and the downloaded Form 16 Part B files.

9. Saving and Distributing Form 16 Part B

Once validated, save the Excel sheet and convert it into PDF format for distribution to your employees.

10. Ensuring Compliance

Make sure that the Form 16 Part B complies with the latest income tax regulations and guidelines issued by the authorities.

11. Common Mistakes to Avoid

Avoid errors such as incorrect calculations, mismatched data, or missing information, as these can lead to discrepancies in tax filings.

12. Additional Resources

Refer to online tutorials, guides, and official documentation for further assistance in preparing Form 16 Part B effectively.

Conclusion

By following these comprehensive steps, you can effortlessly download and prepare Form 16 Part B for all your employees, ensuring compliance and accuracy in tax filings.

FAQs (Frequently Asked Questions)

1. What is Form 16 Part B?

Form 16 Part B provides a detailed breakup of an employee's salary, deductions, and taxes paid, essential for filing income tax returns.

2. How do I download Form 16 Part B for multiple employees?

You can download Form 16 Part B for multiple employees from the TRACES website by logging in with your credentials and selecting the relevant options.

3. Can I prepare Form 16 Part B manually?

While it's possible to prepare Form 16 Part B manually, using Excel ensures accuracy and efficiency, especially for a large number of employees.

4. What should I do if there are discrepancies in Form 16 Part B?

If you encounter any discrepancies in Form 16 Part B, reconcile the data with your employees and rectify the errors before distributing the document.

5. Is it mandatory to distribute Form 16 Part B to employees?

Yes, as per income tax regulations, employers are required to provide Form 16 Part B to their employees for each financial year.

Prepare yourself for tax season like a pro and simplify the process of generating Form 16 Part B for your employees with these expert tips and insights. Happy filing!

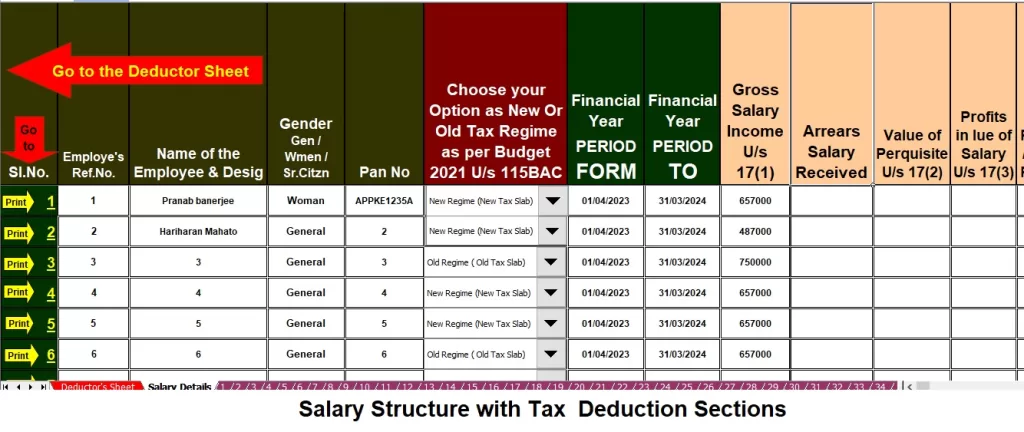

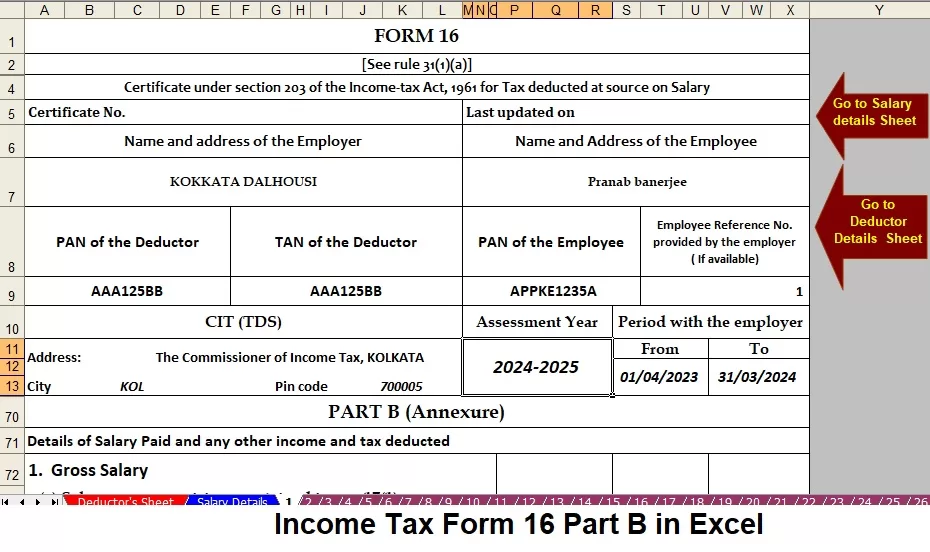

Download the Automated Income Tax Master for Form 16 Part B in Excel, capable of generating Form 16 Part B for 100 employees simultaneously for the Financial Year 2023-24

Feature of this Excel Utility:-

- . This Excel utility efficiently generates Form 16 Part B for 100 employees at once for FY 2023-24.

- It automatically calculates your Income Tax liabilities based on both the New and Old Tax regimes.

- The tool incorporates a unique Salary Structure tailored to individuals according to the Budget 2023.

- It includes all updated Income Tax Sections as per the Budget 2023-24 for both the New and Old Tax Regime.

- This utility prevents duplication of PAN numbers for each employee, ensuring no duplicate entries.

- You can easily print Form 16 Part B on A4-sized paper.

- It automatically converts amounts into words without the need for Excel formulas.

- Suitable for use by both Government and Non-Government entities.

- Simply download the Excel file, input the data into the sheet, and effortlessly generate Form 16 Part B for 100 employees simultaneously.

- This tool allows you to save employee data on your system and is compatible with Office versions 2003, 2007, 2010, and 2011.