Introduction

Do you sometimes feel like filing income tax is as confusing as solving a giant puzzle? You’re not alone! Many taxpayers struggle to understand which regime—old or new—is more beneficial. While the new tax regime offers simplified slabs, the old tax regime still shines because of its deductions and exemptions. In fact, the Benefits of the Old Tax Regime, as per the Budget 2025, continue to attract both government and non-government employees who want to save more on their taxable income.

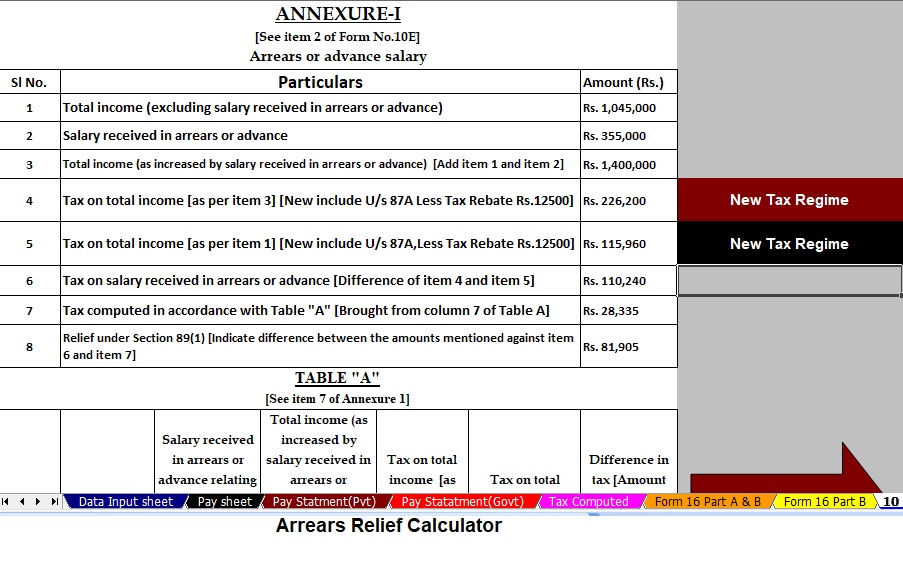

To make things even easier, there’s now an Automatic Income Tax Preparation Software All-in-One in Excel, designed for F.Y.2025-26. This tool helps you calculate your tax liabilities without the headache of manual calculations.

In this article, we will explore the deductions, exemptions, and advantages of the old tax regime in detail. You will also learn how Excel-based tax preparation software can simplify your life. So, let’s dive in!

Table of Contents

| Sr# | Headings |

| 1 | Understanding the Old Tax Regime |

| 2 | Benefits of the Old Tax Regime as per the Budget 2025 |

| 3 | Key Differences Between the Old and New Tax Regime |

| 4 | Standard Deduction under the Old Tax Regime |

| 5 | House Rent Allowance (HRA) Exemption |

| 6 | Leave Travel Allowance (LTA) Benefits |

| 7 | Deductions under Section 80C |

| 8 | Deductions under Section 80D for Health Insurance |

| 9 | Home Loan Interest Deduction under Section 24(b) |

| 10 | Education Loan Deduction under Section 80E |

| 11 | Other Important Deductions (80CCD, 80G, 80TTA) |

| 12 | Tax Planning for Government Employees |

| 13 | Tax Planning for Non-Government Employees |

| 14 | How Automatic Income Tax Preparation Software Helps |

| 15 | Conclusion and Final Thoughts |

Understanding the Old Tax Regime

The old tax regime allows taxpayers to reduce their taxable income by claiming various deductions and exemptions. Unlike the new tax regime, which offers lower tax rates but fewer benefits, the old system rewards those who plan their finances wisely. You can invest in savings schemes, pay insurance premiums, and claim house rent exemption to lower your taxable amount.

Benefits of the Old Tax Regime as per the Budget 2025

The Budget 2025 retained the flexibility of the old tax regime, making it a strong option for salaried individuals. Here are the major benefits:

- Multiple deductions and exemptions lower taxable income.

- Standard deduction increased to ₹75,000 for salaried individuals and pensioners.

- Freedom to plan investments as per personal needs.

- Suitable for individuals with high medical, housing, and education expenses.

In simple terms, the old regime works like a “buffet system” where you choose from a variety of tax-saving dishes, while the new regime is more like a fixed menu.

Key Differences Between the Old and New Tax Regime

- Old Regime: Higher tax rates but multiple deductions.

- New Regime: Lower tax rates but no major deductions.

- Who Benefits?: Taxpayers with significant investments and expenses find the old regime more rewarding.

Standard Deduction under the Old Tax Regime

The Budget 2025 increased the standard deduction to ₹75,000. This directly reduces taxable income for both government and non-government employees. For pensioners, this deduction brings much-needed relief by lowering tax liability automatically.

House Rent Allowance (HRA) Exemption

If you live in rented accommodation, an HRA exemption can save you a significant amount. Under the old regime, you can claim HRA based on:

- Actual HRA received.

- Rent paid minus 10% of salary.

- 50% of salary for metro cities and 40% for non-metro cities.

This exemption especially benefits salaried employees working in metropolitan areas.

Leave Travel Allowance (LTA) Benefits

Do you love travelling? The old tax regime allows you to claim the LTA exemption for travel expenses within India. You can claim this twice in a block of four years. Imagine saving tax while exploring new places—now that’s a win-win situation!

Deductions under Section 80C

One of the most popular sections, 80C, allows you to claim up to ₹1.5 lakh on investments like:

- Life Insurance Premiums

- Employees’ Provident Fund (EPF)

- Public Provident Fund (PPF)

- Tax-saving Fixed Deposits

- Tuition fees for children

This deduction helps individuals save significantly by promoting financial discipline.

Deductions under Section 80D for Health Insurance

Health is wealth, but medical expenses can drain finances. Section 80D provides deductions for health insurance premiums:

- Up to ₹25,000 for individuals and their families.

- An additional ₹50,000 for senior citizens.

This ensures financial protection while lowering taxable income.

Home Loan Interest Deduction under Section 24(b)

Homeowners benefit greatly from the old regime. You can claim up to ₹2 lakh on home loan interest paid annually. This makes buying a home more affordable while reducing tax liability.

Education Loan Deduction under Section 80E

Investing in education pays lifelong dividends. The old tax regime allows a deduction on interest paid for education loans for up to 8 years. This is a huge relief for families funding higher education.

Other Important Deductions (80CCD, 80G, 80TTA)

- 80CCD(1B): Extra ₹50,000 deduction for NPS contributions.

- 80G: Deduction for donations to charitable institutions.

- 80TTA/80TTB: Deduction on savings account interest.

These smaller deductions add up to make the old regime highly beneficial.

Tax Planning for Government Employees

Government employees usually receive structured salary packages with allowances like HRA, LTA, and transport allowance. By using the old regime effectively, they can claim these exemptions while also investing under 80C, making tax planning both easy and rewarding.

Tax Planning for Non-Government Employees

Private-sector employees often rely more on deductions like health insurance, NPS, and education loans. The old regime helps them maximise savings by customising deductions as per their lifestyle needs.

How Automatic Income Tax Preparation Software Helps

Manually calculating tax can be stressful and error-prone. The Automatic Income Tax Preparation Software All-in-One in Excel offers:

- Pre-built salary structures for both government and non-government employees.

- Automatic calculation of exemptions like HRA, LTA, and deductions under various sections.

- Instant tax computation as per the Budget 2025

- User-friendly interface that works even for people with limited Excel knowledge.

This software ensures that you never miss a deduction and always pay the right amount of tax.

Conclusion and Final Thoughts

The Benefits of the Old Tax Regime as per the Budget 2025, clearly outweigh the new regime for those who invest wisely and have eligible expenses. By claiming multiple deductions and exemptions, taxpayers can enjoy substantial savings. Whether you’re a government or non-government employee, planning under the old regime ensures maximum benefits. And with Automatic Income Tax Preparation Software in Excel, filing taxes has never been easier!

FAQs

- Who should choose the old tax regime in FY 2025-26?

Individuals with significant investments in 80C instruments, home loans, or health insurance should prefer the old regime. - Can pensioners claim the standard deduction under the old regime?

Yes, pensioners are eligible for the standard deduction of ₹75,000 introduced in Budget 2025. - Is the HRA exemption available under the new tax regime?

No, an HRA exemption is available only under the old tax regime. - What is the maximum deduction allowed under Section 80C?

Taxpayers can claim up to ₹1.5 lakh under Section 80C. - How does Excel-based tax preparation software help employees?

It automates calculations, reduces errors, and ensures all deductions and exemptions are applied correctly.

Download Automatic Income Tax Calculator All in One for Government and Non-Government Employees in Excel for the F.Y. 2025-26

Features of this Excel Utility:

- This Excel Calculator prepares your Tax Computation Sheet instantly as per Budget 2025.

- It includes a built-in Salary Structure for Non-Government Employees.

- It generates your Salary Sheet automatically.

- It calculates H.R.A. Exemption U/s 10(13A automatically.

- Automatic Calculate Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E

- It creates Form 16 Part A and Part B automatically.

- It prepares Income Tax Form 16 Part B automatically.

- It generates Income Tax Form 12BA automatically.