Introduction

The Union Budget 2025 brought significant tax changes that directly impact salaried individuals, government employees, and non-government employees alike. Many taxpayers are now asking: Which regime is better—the Old or the New Tax Regime?

As per the Budget 2025, the New Tax Regime is more beneficial than the Old Tax Regime for a majority of taxpayers. Why? Because under this new structure, income up to ₹12.5 lakh can be exempted effectively with rebates and deductions, while earlier the benefits were limited. Interestingly, the New Tax Regime allows full exemption up to ₹7 lakh without paying any tax, and after ₹7 lakh, the tax calculation begins with lower slab rates compared to the Old Regime.

Think of it like shopping in a supermarket. In the Old Regime, you had many discount coupons (deductions), but you had to keep track of them carefully. In the New Regime, you walk in, and most items are already at a lower price—simple, direct, and beneficial.

This article will explain the benefits of the Old and New Tax Regime as per Budget 2025, compare them, and show how you can simplify your tax filing with Automatic Income Tax Preparation Software All in One in Excel for F.Y. 2025-26.

Table of Contents

| Sr# | Headings |

| 1 | Understanding the Old Tax Regime |

| 2 | Understanding the New Tax Regime |

| 3 | Key Announcements in Budget 2025 |

| 4 | Benefits of the Old and New Tax Regime as per Budget 2025 |

| 5 | Why the New Tax Regime Is Considered More Beneficial |

| 6 | Tax Exemption Up to ₹7 Lakh Explained |

| 7 | Effective Exemption Up to ₹12.5 Lakh in the New Regime |

| 8 | Comparison of Tax Slabs: Old vs New |

| 9 | Impact on Government Employees |

| 10 | Impact on Non-Government Employees |

| 11 | Role of Standard Deduction in Both Regimes |

| 12 | Automatic Income Tax Preparation Software All-in-One in Excel |

| 13 | How Software Simplifies Tax Filing |

| 14 | Common Mistakes Taxpayers Make While Choosing a Regime |

| 15 | Final Verdict: Which Regime Should You Choose? |

| 16 | Conclusion |

| 17 | FAQs |

1. Understanding the Old Tax Regime

The Old Tax Regime was known for its multiple deductions and exemptions. Taxpayers could claim benefits under Section 80C, 80D, HRA, LTA, home loan interest deductions, and more. This regime rewarded those who invested in tax-saving instruments like PPF, ELSS, insurance policies, and NPS.

However, the downside was its complexity. Taxpayers had to plan investments carefully to save tax. Many found it overwhelming to keep track of different proofs, receipts, and deadlines.

2. Understanding the New Tax Regime

The New Tax Regime was introduced to simplify taxation. Instead of relying on deductions, it offers lower tax rates with fewer compliance requirements.

- Up to ₹7 lakh of income is tax-free.

- The effective benefit can go up to ₹12.5 lakh under the Budget 2025 provisions.

- Fewer deductions, but straightforward and transparent slab rates.

This makes it especially attractive to young professionals, freelancers, and salaried employees who do not want to lock their money in long-term tax-saving instruments.

3. Key Announcements in Budget 2025

The Budget 2025 highlighted a clear preference for the New Tax Regime:

- Standard Deduction of ₹75,000 is available.

- Tax rebate up to ₹7 lakh under Section 87A.

- Effective tax exemption up to ₹12.5 lakh with deductions like NPS and employer contributions.

- Focus on simplifying tax filing for both government and non-government employees.

4. Benefits of the Old and New Tax Regime as per Budget 2025

Both regimes have advantages depending on the taxpayer’s profile:

- Old Regime Benefits: High deductions if you invest in tax-saving instruments. Useful for those with home loans or large medical insurance premiums.

- New Regime Benefits: Simpler structure, less paperwork, and higher effective exemption. Great for people who prefer liquidity over locking funds.

5. Why the New Tax Regime Is Considered More Beneficial

The New Tax Regime wins because:

- Income up to ₹12.5 lakh can be non-taxable with rebates.

- You don’t need to chase multiple deductions.

- Salaried people with fewer investments save more.

In short, it saves both time and money while reducing stress.

6. Tax Exemption Up to ₹7 Lakh Explained

Under Section 87A, if your taxable income does not exceed ₹7 lakh, you pay zero tax under the New Regime. This makes it especially beneficial for middle-class taxpayers.

7. Effective Exemption Up to ₹12.5 Lakh in New Regime

With the standard deduction and employer contributions towards NPS, taxpayers can stretch their tax-free income limit up to ₹12.5 lakh. This is the biggest attraction of Budget 2025 for salaried individuals.

8. Comparison of Tax Slabs: Old vs New

- Old Regime: Higher slab rates but multiple deductions.

- New Regime: Lower slab rates, fewer deductions, more direct benefit.

This comparison shows why many are shifting toward the new system.

9. Impact on Government Employees

Government employees often enjoyed allowances under the Old Regime. However, Budget 2025 ensures that even government staff find better savings under the New Regime with standard deduction and NPS contributions.

10. Impact on Non-Government Employees

Private-sector employees benefit the most since many do not claim multiple deductions. The New Regime provides a clean, hassle-free approach with higher exemptions.

11. Role of Standard Deduction in Both Regimes

The standard deduction of ₹75,000 is available under both regimes. This levels the playing field and ensures every salaried person gets a direct benefit without extra paperwork.

12. Automatic Income Tax Preparation Software All-in-One in Excel

Manual calculations can be confusing. The Automatic Income Tax Preparation Software All-in-One simplifies everything. It allows both government and non-government employees to:

- Enter income details.

- Choose between the Old and New Regimes.

- Automatically calculate tax liability.

13. How Software Simplifies Tax Filing

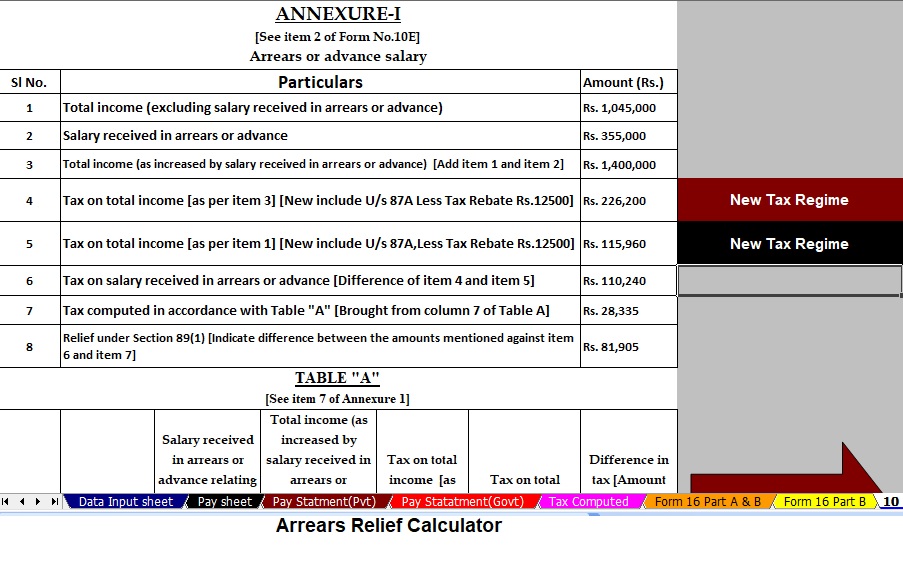

This Excel-based tool works like a personal tax assistant. It automatically generates tax sheets, Form 16, and even helps with Form 10E for arrears. Instead of worrying about mistakes, you can file your return with confidence.

14. Common Mistakes Taxpayers Make While Choosing a Regime

- Not comparing both regimes before filing.

- Overestimating deductions in the Old Regime.

- Forgetting that liquidity has value, money locked in tax-saving schemes reduces flexibility.

15. Final Verdict: Which Regime Should You Choose?

If you are someone who invests heavily in tax-saving schemes, the Old Regime may still suit you. But for most taxpayers, especially those earning up to ₹12.5 lakh, the New Tax Regime is more beneficial as per Budget 2025.

16. Conclusion

The Budget 2025 has tilted the scales in favour of the New Tax Regime. With simple slabs, higher exemptions, and reduced paperwork, it is truly a win for the general public.

Combine this with Automatic Income Tax Preparation Software All in One in Excel, and you have a stress-free way to calculate, plan, and file your taxes with confidence.

17. FAQs

Q1. What is the maximum tax-free income under the New Tax Regime in Budget 2025?

You can enjoy an effective exemption of up to ₹12.5 lakh under the New Regime.

Q2. Is the Old Tax Regime still available in F.Y. 2025-26?

Yes, taxpayers can still choose the Old Regime if it offers better benefits for them.

Q3. Who benefits most from the New Tax Regime?

Salaried individuals and non-government employees with fewer deductions benefit the most.

Q4. Do government employees gain under the New Tax Regime?

Yes, thanks to the standard deduction and NPS benefits, government employees also save more.

Q5. How does the Automatic Income Tax Preparation Software help taxpayers?

It simplifies tax filing by auto-calculating tax liability under both regimes and reducing errors.

Download the Automatic Income Tax Calculator All-in-One for Government and Non-Government Employees with Form 10E in Excel for F.Y. 2025-26

- This Excel-based calculator instantly prepares your Tax Computation Sheet as per the provisions of Budget 2025.

- Moreover, it includes an inbuilt salary structure for both Government and Non-Government employees, making it user-friendly.

- You can also rely on its Automatic Salary Sheet, which ensures accuracy without manual effort.

- In addition, it automatically calculates the HRA exemption under Section 10(13A) with just a few entries.

- It further simplifies your work by automatically computing Income Tax Arrears Relief under Section 89(1) along with Form 10E.

- As a bonus, the tool generates Form 16 Part A and Part B automatically, reducing paperwork.

- Finally, it provides an automatic Income Tax Form 16 Part B, making the filing process seamless and stress-free.