Are you paying your income tax only

at the end of the financial year ? If your answer is YES, then understand that

you are doing it in wrong manner. Today we will learn about Advance Tax which

is not widely understood and its quite important thing to know. I know that

majority of the people don’t follow this process and pay the income tax at the

end of the year only (in fact on the last minute many times), But today you

should understand if advance tax is applicable in case your case or not.

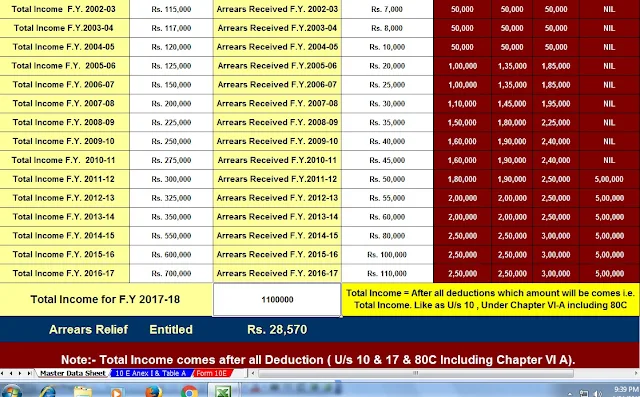

Download Automated Income Tax Preparation Excel Based Software for Govt & Non-Govt Employees for F.Y.2017-18.

Feature of this Excel Utility- Automatic Calculation of your Income tax liability as per new Budget 2017 with New Tax Slab

- Automatic Calculation House Rent Exemption Calculation U/s 10(13A)

- Automatic Calculation Arrears Relief Calculation U/s 89(1) with Form 10E up to F.Y.2017-18

- Individual Salary Sheet

- Individual Salary Structure as per Govt & Non-Govt Concerned Salary Pattern

- Automated Form 16 Part A& B for F.Y.2017-18

- Automated Form 16 Part B for F.Y. 2017-18

- Easy to install in any system, Just like an Excel File.

What is Advance Tax ?

As the name suggests, Advance Tax is part payment

of your income tax liability in advance. So instead of paying everything at the

end of the year, you pay it 3 times in a year in parts. The concept of Advance

tax exists because govt wants you to pay income tax as you earn month after

month and not at the end of the year. Advance tax is to be paid when your

annual tax liability exceeds Rs 10,000 overall .

However important point is that Advance tax is

applicable on your Income from sources other than your Salary like

- Interest on FDs or Savings bank deposits exceeding Rs. 10,000/-

- Rental income on House Property/properties

- Capital Gains on sale of Mutual Funds or Shares

- Income from any other sources not mentioned as above.

Which means that if you are a salaried employee who

does not have any other income source and if your employer deducts TDS regularly, then Advance Tax is

not applicable in your case. You don't need to worry about it.

On which date you have to pay Advance Tax ?

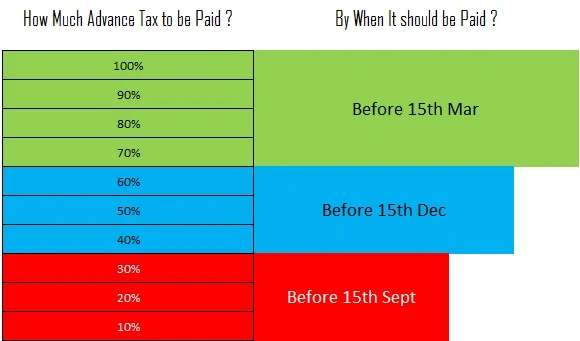

You have to pay advance tax 3 times in a year,

which is 15th Sept , 15th Dec and 15th Mar and you should be paying not less

than 30% , 60% and 100% of your income tax liability before these dates. Below

picture makes it clear for you.

Which means that if your income tax liability for a

year is Rs 1,00,000 , then you should pay advance tax of Rs 30,000 by 15th

Sept, another Rs 30,000 by 15th Dec and rest Rs 40,000 by the end of 15th Mar

What if I don’t pay Advance Tax on time ?

If Advance Tax is applicable in your case, then you

should be paying it on time, but if you don’t pay it on time, then you can pay

it on the next due date along with the interest. So those who have not paid the

first installment (i.e. September 15) of Advance Tax (if applicable to you),

then you can pay it together with second installment (on of before 15th Dec), but

with interest on the first installment for deferment of the same by three month

and if you are not paying it even on Dec 15th , then you can pay it by the end

of the year along with the interest.

You will be charged with penalty under Sec 234B and

234C in case you don’tpay your advance tax on time. Let me quickly share what

is sec 234C and sec 234B

Understanding Penalty under Section 234C

Lets first understand sec 234C. Under this section,

if you don’t pay your installments of advance tax on time, then you are charged

1% of simple interest for next 3 months on the amount of shortfall. So this is

the penalty to be paid because of DELAY!

Understanding Penalty under Section 234B

If your total advance tax paid by last due date

(15th Mar) is less than 90% of your advance tax liability, then you will have

to pay 1% interest on the balance amount each month until you complete the

payment. which means that suppose your income tax liability is Rs 1,00,000 in

total and if you have not paid anything upto 15th Mar, then you will be charged

1% on the outstanding balance (Rs 1 lac in this case) each month, unless you

pay it, so if you pay in June , then you will be charged for 3 months penalty

and it would be Rs 3,000 in total other than penalty under sec 234C.

Lets understand sec 234B and 234C with help of case

studies. Lets assume that your total Income Tax payment for the year would be

Rs 50,000, then as per rules of Advance tax, you should be paying

- Rs 15,000 by 15th Sept

- Another Rs 15,000 by 15th Dec

- And Rest 20,000 by 15th Mar

Now imagine you don’t pay any advance tax , then

how much penalty you will pay under sec 234B and 234C under various situations

? Below I have explained 4 situations where you pay your full income tax on

different dates. Check out how much penalty you will have to pay under these

situations !

How to pay Advance Tax ?

Now comes the final question, that how can you pay

your advance tax ? Most of the people are worried on this, as they feel that

paying advance tax would be very tough or involves lots of hassles, but thats

not correct. You can make payment of your advance tax in less than 5 min.

There are mainly two ways of payment advance tax.

1. Offline option

Almost all the banks have tie up with govt for

accepting the advance tax from the taxpayers, you can go to the banks which

have the tie up and fill up the challan number 280 and pay your advance tax to

them.

1. Online Payment of Advance Tax

The other faster way to make payment online. Here

is how it works

2. Choose Advance Tax option and other

details and make payment

When come to the next page, you will have to choose

various details here. Make sure you choose your

- PAN Number (of utmost importance)

- Advance Tax (under Type of Payment)

- Email, Phone and Address details

- Assessment year

Once you choose these details, you can then click

on “proceed” and it will connect you to the Bank which you had selected, It

will show you your NAME on the next page, so that you can confirm there was no

mistake from you end, then you can make the payment online, and you will be

able to print the receipt online (you will also get it on email)

Are you paying your Advance Tax

I guess, you are now clear about the advance tax

and how its calculated . Its a good practice to pay your advance tax on time

and do not delay it because it can mean a penalty of few thousand rupees in

most of the cases. I know its tempting to delay the headache and complete the

payment once in a year, a lot of people might be ok with paying some penalty,

but then you also invite related problems with it. Pick your choice.