Budget 2018 Highlights – some changes you must know

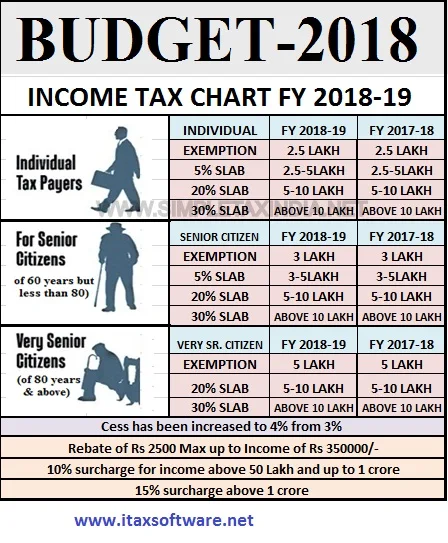

1) No Change in Income Tax Slab Rates for FY 2018-19 or AY 2019-20

There is no change in IT Slab Rates for individuals. Hence, the applicable tax slab will be as below.

2) EPF Contribution by Government for new employees and women

The government will contribute 8.33% of Employee Provident Fund (EPF) for new employees by the Government for three years.

Women employees contribution to EPF now reduced to 8% from the earlier 12%. This reduced contribution will be for the first 3 years of employment.

Both these moves will bring in more take home for both new employees and women.

Along with this, Government will contribute 12% to EPF for new employees for three years by the Government in sectors employing the large number of people like textile, leather, and footwear.

Also, paid maternity leave is now increased from 12 weeks to 26 weeks, along with the provision of crèches.

3) Rs.40,000 Standard Deduction for Salaried individuals and pensioners

Rs.40,000 standard deduction is available for all salaried individuals in lieu of the present exemption in respect of transport allowance and reimbursement of miscellaneous medical expenses.

This is I think a big relief many as it will rejoice the salaried individuals.

4) TDS limit raised for Senior Citizens

Exemption of interest income on deposits with banks and post offices to be increased from Rs.10,000/- to Rs.50,000/- and TDS will not be required to be deducted on such income, under section 194A. This benefit shall be available also for interest from all fixed deposits schemes and recurring deposit schemes.

But do remember one thing that AVOIDING TDS DOES NOT MEAN AVOIDING TAX.

5) Sec.80D limit raised to Rs.50,000 for Senior Citizens

limit of deduction for health insurance premium and or medical expenditure from Rs.30,000/- to Rs.50,000/-, under section 80D. All senior citizens will now be able to claim the benefit of the deduction up to Rs.50,000/- per annum in respect of any health insurance premium and/or any general medical expenditure incurred.

This I think a much-awaited relief to many senior citizens. Because the premium of health insurance will increase as you grow older. Hence, by increasing Sec.80D limit, Government really helped this class.

6) Limit of deduction on medical expenditure critical illness for senior citizens raised

The limit of deduction for medical expenditure in respect of certain critical illness from, Rs.60,000/- in case of senior citizens and from Rs.80,000/- in case of very senior citizens, to Rs.1 lakh in respect of all senior citizens, under section 80DDB.

7) Pradhan Mantri Vaya Vandana Yojana extended to March 2020

Pradhan Mantri Vaya Vandana Yojana is the 10 years 8% guaranteed pension scheme meant for senior citizens. The earlier deadline for the closure of this scheme was 3rd May 2018. Now, this is extended to until March 2020.

Also, the good news is that the earlier limit under this scheme was Rs.7,50,000, which is now increased to Rs.15,00,000.

8) Education and Health Cess increased to 4%

Currently, there is 3% cess on personal income tax consisting of 2% for primary education and 1% for secondary and higher education.

Now this 3% existing educational and higher education cess is replaced to 4% HEALTH AND EDUCATION CESS.

Other important proposals of Budget 2018 Highlights are as below.

a) National Health Protection Scheme

The government will launch the National Health Protection Scheme. In this scheme, each family will be covered for Rs.5 lakh of health insurance per year. This will be for secondary and tertiary care hospitalization.

This will be the world’s largest government-funded health care programmed. This is mainly to the poor and vulnerable families.

Along with this, Government will provide nutritional support to all TB patients at the rate of Rs.500 per month for

the duration of their treatment.

b) E-Assessment is made mandatory

Now no more paper filling IT return allowed. From now onward you have to file IT Returns only through online mode. This will actually reduce the time taken to process your IT returns.