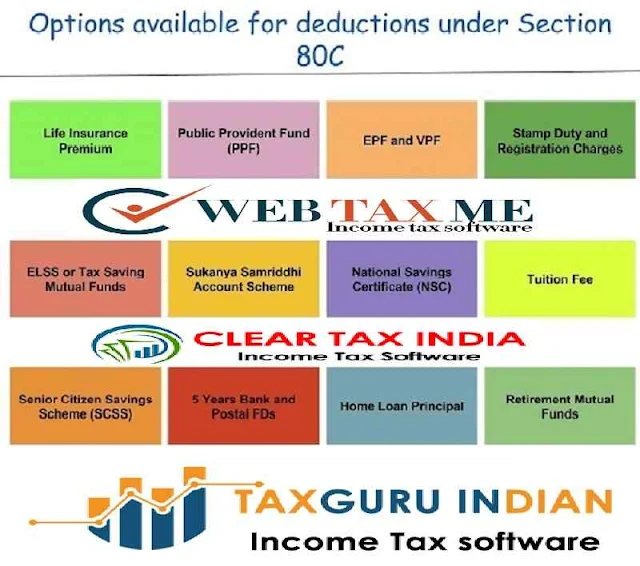

Download Auto-fill Income Tax Preparation Software All in One in Excel for the Govt and Private Employees .Section 80C is the most preferred category of all income tax payers because it allows the taxpayer to reduce tax liability by making tax saving investments and collecting eligible expenses. This allows a maximum of Rs 1,50,000 per year to be deducted from the total income.

This section can be beneficial for an individual and HUF. Companies, LLPs, firms and partnerships are not eligible to take advantage of this discount.

Section 80C also includes subsections like 80CCC, 80CCD (1), 80CCD (1B), 80CCD (2).

All these sections together allow deduction of Rs.1, 50,000, but section 80CCD (1B) allows additional deduction of Rs.50,000.

The benefits of this department are available only to one person and HUF, they can claim deduction of Rs.10,000 against interest income from the savings bank account, the account is in the bank, co-operative society or post office. This section does not apply to interest earned from a fixed deposit account or a recurring deposit account.

You may also, like- Automated Income Tax Preparation Excel Based Software for the Non-Government (Private)Employees for the Financial Year 2021-22[As per New and Old Tax Regime U/s 115BAC]

Section

80GG - House for Rent:

1. Consistent minus 10% of total income is rented;

2. 5,000 per month;

3. Consistent 25% of total income.

Section

80E - Interest on educational loans:

A deduction can be claimed under this section on the interest on loans taken for higher education. This loan can be taken for the taxpayer himself or for his wife or child or for the person on whose behalf the taxpayer is the guardian.

The deduction under this section can be claimed up to 8 years or up to the date of payment of interest, whichever is earlier.

A discount is available under this section in FY 2017-2018 only if the loan is taken in FY 2016-2017. The deduction is only available to homeowners who have only one home property on the date of the loan. The value of the property should be less than Rs 50 lakh and the loan amount should be less than Rs 35 lakh. They can claim a discount of up to Rs 50,000 per year under this category.

Section 80D - Medical Insurance:

A resident with a physical disability or mental disability is entitled to a rebate of Rs 75,000 under this section. A discount of Rs 1,25,000 can be claimed in case of severe disability.

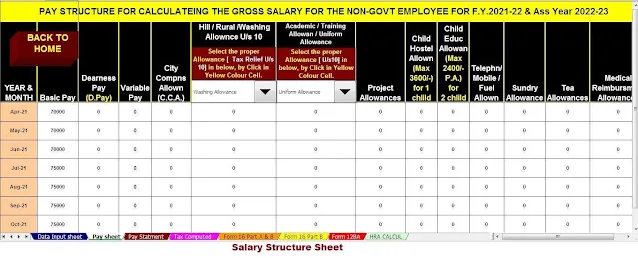

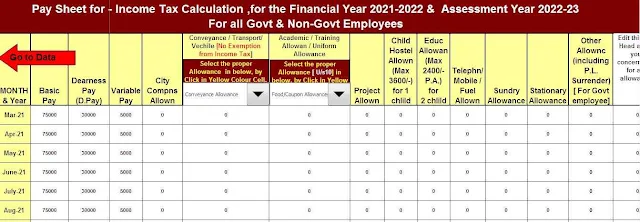

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employee’s Salary Structure.

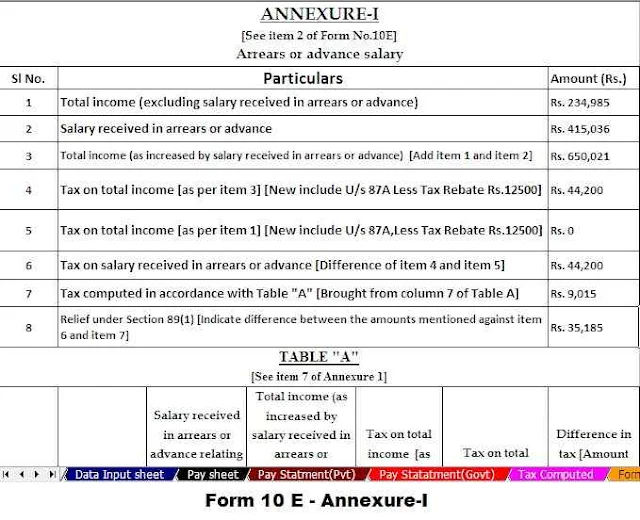

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2021-22