Auto-Fill Income Tax Preparation Software in Excel for the Govt and Non-Govt Employees for F.Y.2021-22 .Under section 80DD, deduction is defined as: provision for expenses or similar for dependent relatives (depending on dependent expenses / contributions) and under section 80U: for the assessee's own or his own disability (not dependent on expenses incurred / grant). .

1. Section 80DD: Cost for dependent relative or provision for the same (dependent cost / contribution)

This discount is only available to residents and HUFs.

• It is a beneficial discount available in exchange for payment for medical treatment (including nursing), training and rehabilitation of a dependent, being a disabled person or depositing money under a scheme made for this by a life insurance corporation or any other insurer. Or subject to conditions specified and approved by the Board for the maintenance of a dependent person as the administrator or the specified company is a disabled person.

You may also, like- Automated Income Tax Preparation Software in Excel for the Andhra Pradesh State Employees for the F.Y.2021-22

This discount is limited to money. 75,000 for general disability and Rs. 125,000 / - for severe disability. Severe disability means eighty percent or more of one or more persons with disabilities referred to in sub-section (4) of section 56 of the Persons with Disabilities (Equal Opportunity, Protection of Rights and Full Participation) Act, 1995. 1 of 1996); Or a person with a serious disability referred to in section (o) of section 2 of the National Trust. For the welfare of individuals including autism, cerebral palsy, mental retardation and multiple disability laws, 1999 (44 of 1999). These details are usually referred to by the medical authority who issued the certificate.

• If the dependent person, being a disabled person, before the person referred to in sub-section (2) or a member of the Hindu Undivided Family, the amount equal to the amount paid or deposited under sub-section (b) (1) is treated as the previous year's income of the assessee In which case this amount will be accepted by the assessee and accordingly the previous year's income will be taxed

A certificate issued by a medical authority is required as a documentary proof. This exemption is only available up to the validity of such certificate after which the same renewal is required.

You may also, like- Automated Income Tax Preparation Software in Excel for the Assam State Employees for the

(Section 2 (i) of section 2 of the Persons with Disabilities (Equal Opportunity, Protection of Rights and Full Participation) Act, 1995 (1 of 1996) shall define disability [4] [and include autism, cerebral autism, cerebral palsy, mental Sections (a), (c) and (h) of the National Trust for the Welfare of Persons with Persons with Disabilities and Sections (a), (c) and (h) of the Disability and Multiple Disabilities Act, 1999 (44 of 1999) refer to palsy and multiple disabilities. . Eligible persons with a minimum of 40% disability or 80% or more will be classified as severely disabled.

2. Section 80U: for the assessor's own or his own disability (not dependent on contribution / expense)

This deduction is only allowed for one resident.

It is a standard deduction which is limited to money. 75,000 / - as specified in case of general disability and Rs. 125,000 / - in case of severe disability. Severe disability means eighty percent or more of one or more persons with disabilities referred to in sub-section (4) of section 56 of the Persons with Disabilities (Equal Opportunity, Protection of Rights and Full Participation) Act, 1995. 1 of 1996); Or a person with a serious disability referred to in section (o) of section 2 of the National Trust. For the welfare of individuals including autism, cerebral palsy, mental retardation and multiple disability laws, 1999 (44 of 1999). These details are usually referred to by the medical authority who issued the certificate.

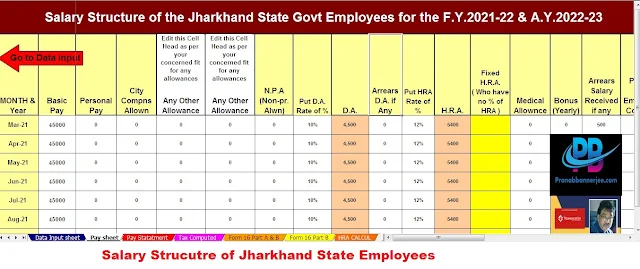

You may also, like- Automated Income Tax Preparation Software in Excel for the Jharkhand State Employees forthe F.Y.2021-22

This discount is available regardless of the amount spent for treatment or nursing.

(Section 2 (i) of section 2 of the Persons with Disabilities (Equal Opportunity, Protection of Rights and Full Participation) Act, 1995 (1 of 1996) shall define disability [4] [and include autism, cerebral autism, cerebral palsy, mental Sections (a), (c) and (h) of the National Trust for the Welfare of Persons with Persons with Disabilities and Sections (a), (c) and (h) of the Disability and Multiple Disabilities Act, 1999 (44 of 1999) refer to palsy and multiple disabilities.

. Eligible persons with at least 40% disability or 80% or more will be classified as severely disabled.

A certificate issued by a medical authority is required as a documentary proof. This exemption is only available up to the validity of such certificate after which the same renewal is required.

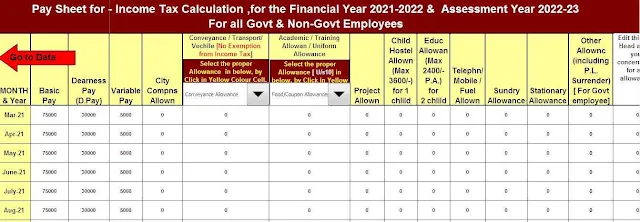

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employee’s Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2021-22